Market Data

June 1, 2021

ISM Report on Business: Orders Improve Despite Supply Challenges

Written by Sandy Williams

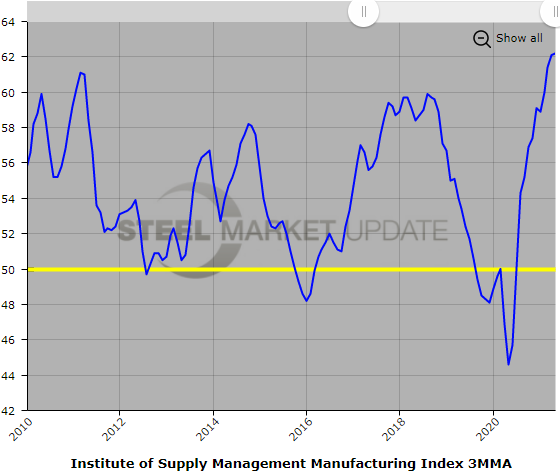

New orders, production and employment picked up in May despite slower supplier deliveries and lengthening backlogs, said the Institute for Supply Management in the May 2021 Manufacturing ISM Report on Business. The Manufacturing PMI rose 0.5 percentage point to 61.2 after contracting in April and indicates expansion for the overall economy.

“Manufacturing performed well for the 12th straight month, with demand, consumption and inputs registering strong growth compared to April. Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to the difficulty in hiring and retaining direct labor. Record backlogs, customer inventories and raw material lead times are being reported. The manufacturing recovery has transitioned from first addressing demand headwinds to now overcoming labor obstacles across the entire value chain,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee.

New orders gained 2.7 points to register 67%. Production slipped four points to 58.5% as backlogs increased 2.4 points to 70.6%. Backlogs expanded at a faster rate in May, increasing 2.4 points to a reading of 70.6% and the highest level ever reported by ISM.

Supplier deliveries continued to lengthen in May, up 3.8 points to 78.8. Inventories were still too low last month, climbing 4.3 points to 50.8%. “Inventories remain unstable due to ongoing supplier constraints. In May, supplier delivery rates were not able to keep up with new-order and production levels, causing a lack of expansion of the Inventories Index and a constraint on companies’ production levels,” said Fiore.

Customer inventories remained too low at a reading of 28%, staying at historically low levels for 10 straight months.

The prices index registered 88%, continuing five months at readings over 80% and indicating rising raw material prices. “Virtually all basic and intermediate manufacturing materials are experiencing price increases as a result of product scarcity and the dynamics of supply and demand,” said Fiore.

Both imports and exports expanded for the 11th consecutive month. The imports index rose 1.8 points to 54%. The export orders index added to new order growth with a 0.5-point gain to register 54.9%. Global supply chains continue to be challenged by transportation issues and container shortages that are expected to continue through the third quarter of 2021, said Fiore.

Comments from panel respondents included:

- “Very busy, but still experiencing labor shortages.” [Primary Metals]

- “Ongoing component shortages are driving dual sourcing and longer-term supply plans to be implemented.” [Transportation Equipment]

- “A lack of qualified candidates to fill both open office and shop positions is having a negative impact on production throughput. Challenges are mounting for meeting delivery dates to customers due to material and services shortages and protracted lead times. This situation does not look to improve until possibly the fourth quarter of 2021 or beyond.” [Fabricated Metal Products]

- “Labor shortages are impacting internal and supplier production. Logistics performance is terrible.” [Electrical Equipment, Appliances & Components]

- “The continued global supply chain tightness and raw material shortages from the Gulf (winter storms) make it less likely that any business can recover this year. Demand is strong, but what good is that if you cannot get the materials needed to produce your finished goods?” [Nonmetallic Mineral Products]

- “Supplier performance — deliveries, quality, it’s all suffering. Demand is high, and we are struggling to find employees to help us keep up.” [Computer & Electronic Products]

- “Changes in currency exchange rates favorably contributed to our quarterly performance. Continued strong consumer demand for our high-quality products also provided increased sales.” [Chemical Products]

- “Business is good, but labor and raw materials are becoming very problematic, driving increases in costs.” [Furniture & Related Products]

- “Seeing a high demand and backlog of orders.” [Plastics & Rubber Products]

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.