Analysis

July 30, 2021

Final Thoughts

Written by Michael Cowden

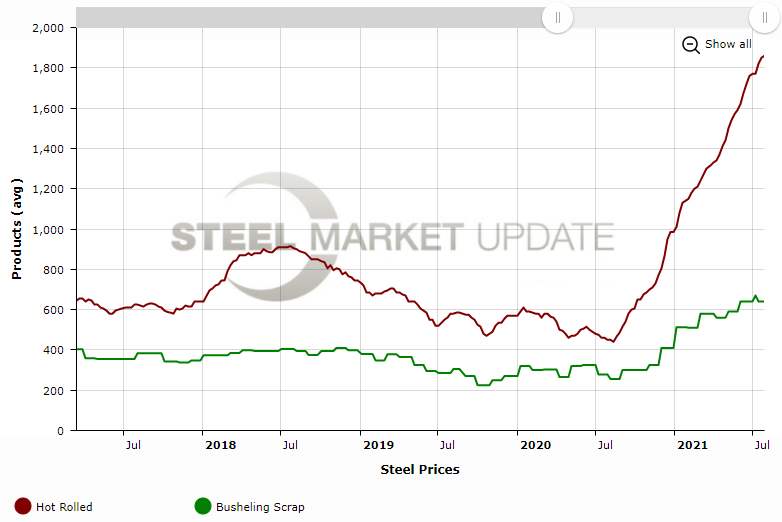

We talk a lot about the price of steel going up. We don’t talk as much about spreads between hot-rolled coil and prime scrap – which are going up just as fast if not faster.

And if you’ve listened to earnings calls over the last two weeks, you know that steel mills and industry analysts are paying very close attention to steel-scrap spreads too.

![]()

Take the U.S. Steel second-quarter earnings call, which happened on Friday. U.S. Steel executives were asked whether they would consider restarting an idled blast furnace to make pig iron.

Our ears perked up because we’d heard rumors that U.S. Steel might restart the ‘A’ blast furnace at Granite City to do just that. Company President and CEO David Burritt poured cold water on that idea. He said the ‘A’ furnace would remain “indefinitely idled.” (It has been indefinitely idled since April 2020, according to SMU’s blast furnace status table.)

Another remark by Burritt also caught our attention: “Let’s face it. The thing that keeps minimills up at night is their metallic strategy and where they are going to get the scrap and the iron ore longer term.”

You would think those worries might translate into higher prime scrap prices. And yet look at the chart below:

Prime scrap prices held steady in 2018 even as steel prices shot upward on the implementation of Section 232 tariffs and quotas. A similar phenomenon has happened over the last year. But on steroids.

So let’s review for the numbers. Note: Scrap is usually listed in dollars per gross ton. I’ve converting everything to dollars per short ton in the text below (in other words dividing by 1.12) for the sake of comparison.

• Hot-rolled coil prices were $905 per ton ($45.25 per cwt) in early August 2018, a good time for steel. Prime scrap prices were $361 per ton – so a spread of $544 per ton, a very healthy profit margin by any normal standard.

• HRC prices were $450 per ton in early August of 2020, a bad time for steel. Prime scrap prices were $248 per ton – a spread of only $202 per ton, or barely enough to cover conversion costs of approximately $150-200 per ton.

• Hot band prices now are $1,860 per ton, the highest in at least the last half century. Prime scrap prices are $571 per ton – a spread of $1,289 per ton, obscene by historical standards.

In short, steel prices have quadrupled from last year’s lows, scrap prices have merely doubled, and spreads are up more than sixfold. On the face of it, this is extraordinarily unfair to anyone selling scrap.

Steel took a megayacht to a private resort in French Polynesia. Scrap had a pleasant drive to the Indiana Dunes.

That and a nickel will get you a cup off coffee. (Actually, it won’t even do that. A cup of coffee hasn’t cost a nickel since the 1940s. So more that and $3. But we digress.)

We can talk about prices, what things are worth, and what’s fair and not fair all day long. That won’t get us anywhere. What’s needed is a look at the structural reasons why these prices are the way they are.

In a word, consolidation. Let’s consider deals over the last year or so. Cleveland-Cliffs in 2020 acquired ArcelorMittal USA and AK Steel. U.S. Steel acquired all of Big River Steel in January 2021. And if we cast a wider net, going back to 2014, we’d also include Steel Dynamics Inc. (SDI) buying Severstal North America’s electric-arc furnace (EAF) sheet mill in Columbus, Miss., and Nucor buying Gallatin Steel in Ghent, Ky.

In other words, there are fewer and fewer buyers on the mill side. In fact, there are so few sheet producers left in the United States that you could count them on two hands. You can’t talk about M&A trends at the mill level, only about specific deals that might happen.

Yes, the scrap industry has consolidated, but not to anywhere near the same extent. And if scrap were to consolidate, who would do it? We could see mills buying more scrap operations. That was certainly a trend in 2007-08, another bull market for steel, and one that saw Nucor buy The David J. Joseph Co. and SDI buy OmniSource. And that trend continues, albeit on a smaller scale, with SDI, for example, in 2020 buying Mexican recycler Zimmer SA de CV to secure scrap for its new EAF mill in Sinton, Texas.

That catch: A new mill like Sinton costs nearly $2 billion. It costs a lot less to get into the scrap business. Can you really consolidate in an industry with few barriers to entry? Hard assets are a good hedge against inflation. So maybe private equity will figure out a way to do it. Or maybe we’ll see antitrust regulators turn their attention to steel – which might return a little leverage to scrap sellers.

Cleveland-Cliffs Chairman, President and CEO Lourenco Goncalves said during his company’s earnings call last month that prime scrap will in the years ahead come to be seen as a “precious metal” as more EAF capacity starts up in the U.S. and abroad. That might be the case one day. But it sure isn’t yet. Steel might not have as much shine as gold just yet but, fair or not, it still has a lot more sparkle than scrap.

By Michael Cowden, Michael@SteelMarketUpdate.com