Market Data

September 1, 2021

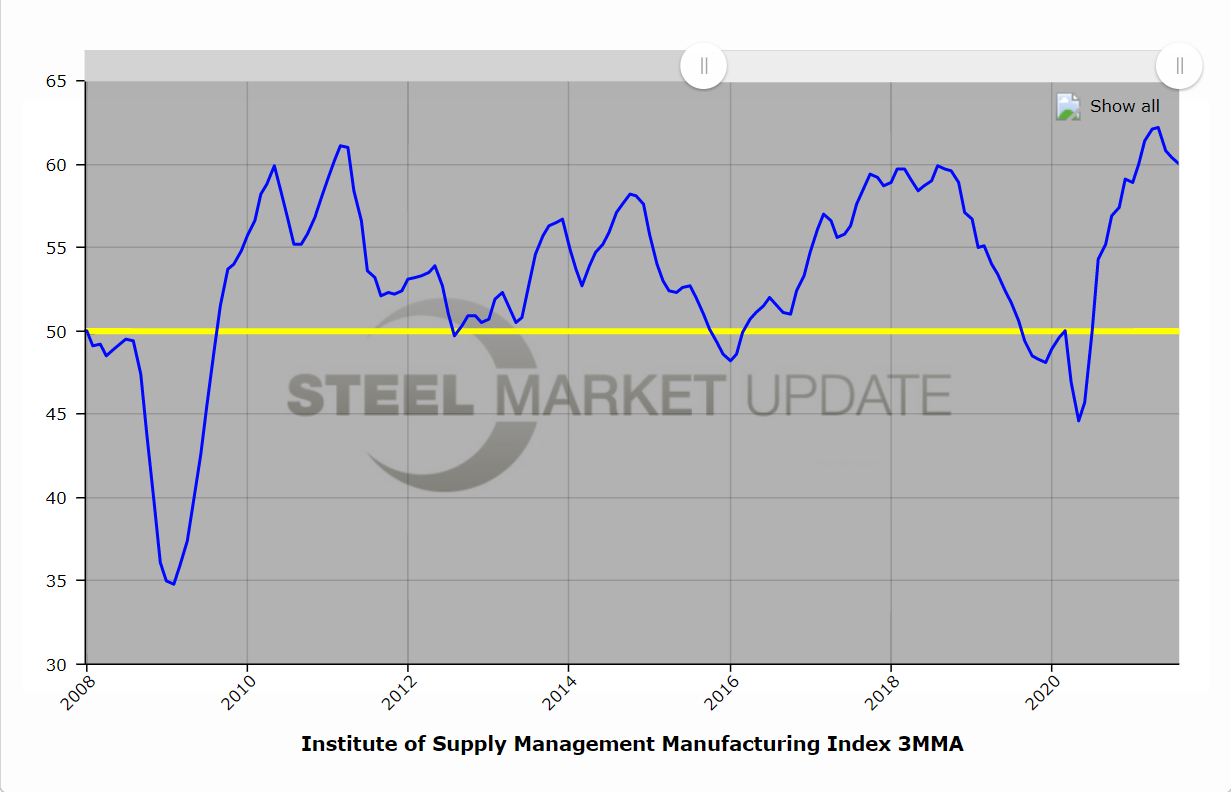

ISM Report on Business: Delivery Backlogs Grow on Expanding Orders

Written by David Schollaert

New orders, production and prices grew in August, while employment contracted and supply backlogs expanded, said the Institute for Supply Management in its August 2021 Manufacturing ISM Report on Business.

The Manufacturing PMI rose 0.4 percentage point in August to 59.9%, edging higher and indicating expansion in the overall economy for the 15th consecutive month since contracting in April 2020. Companies and suppliers continued to struggle, at unprecedented levels, to meet the increasing demand that is pushing prices upward.

“Manufacturing performed well for the 15th straight month, with demand, consumption and inputs registering month-over-month growth in spite of unprecedented obstacles,” said Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee. “Panelists’ companies and their supply chains continue to struggle to respond to strong demand due to difficulties in hiring and a clear cycle of labor turnover as workers opt for more attractive job conditions. Disruptions from COVID-19, primarily in Southeast Asia, are having dramatic impacts on many industry sectors. Ports congestion in China continues to be a headwind as transportation networks remain stressed. Demand remains at strong levels, despite increased prices for nearly everything,”

New orders rose 1.1% from the month prior to 64.9% in July. Production rose 1.6 points to 60.0% as backlogs were 3.2 percentage points higher last month at a reading of 68.2%.

Employment narrowed by 3.9% compared to the month prior, registering 49.0% in August. “The Employment Index returned to contraction after one month of expansion; hiring difficulties at panelists’ companies were the most significant hurdle to further output in August, as validated by the growth in inventory accounts,” said Fiore.

Supplier deliveries retracted in August, down 3.0 points to a reading of 69.5%. Customer inventories rose in August by 5.2 points to 30.2%, but remain at historically low levels for the 13th consecutive month, according to Fiore.

The prices index registered 79.4%, down 6.3% versus July, and falling for the second consecutive month after reaching 92.1% in June – the index’s highest reading since July 1979. “Aluminum, electrical and electronic components, energy, some plastics and plastic products, freight, and steels continue to remain at elevated prices due to product scarcity, but supply and demand dynamics appear to be moving closer to equilibrium, as stated in recent months,” said Fiore.

Both imports and exports rebounded in August after contracting the month prior. The export orders index was 56.6%, an increase of 0.9 points compared to the month prior, while the imports index was 54.3%, a 0.6 percentage point increase from the July reading.

“All segments of the manufacturing economy are impacted by record-long raw-materials lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products,” noted Fiore. “The new surges of COVID-19 are adding to pandemic-related issues — worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions and overseas supply chain problems — that continue to limit manufacturing growth potential.”

Yet he concluded that “all of the six biggest manufacturing industries — Computer & Electronic Products; Fabricated Metal Products; Chemical Products; Food, Beverage & Tobacco Products; Transportation Equipment; and Petroleum & Coal Products, in that order — registered moderate to strong growth in August.”

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.