CRU

November 9, 2021

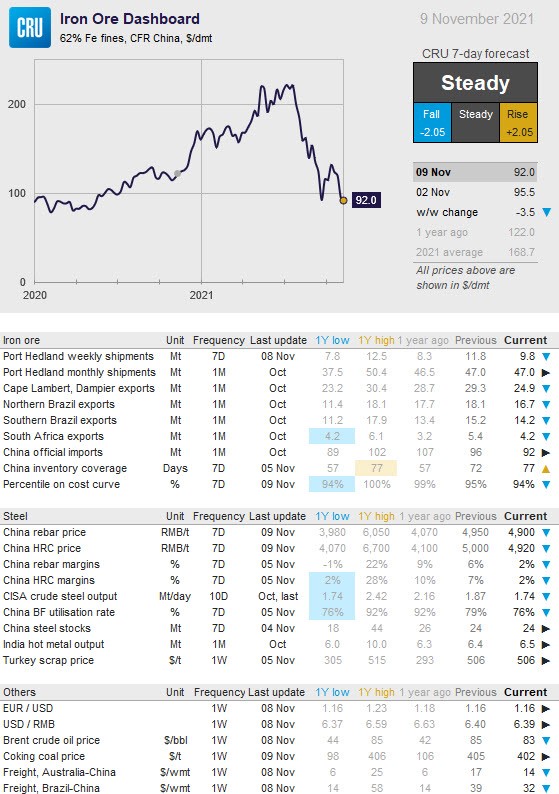

CRU: Iron Ore Falls Again as Inventories Skyrocket

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor, Nov. 9

Iron ore prices remain under pressure as Chinese steel production levels remain low and iron ore inventories continue to pile up, both at ports and at steel mills. A price of $92 /dmt is the lowest seen since May 2020, and the 2021 average has now fallen below $170 /dmt.

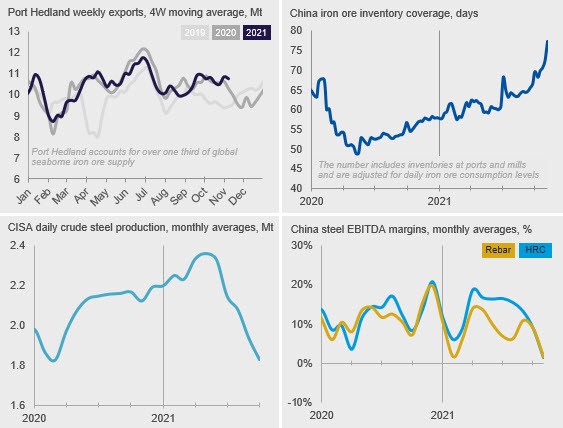

In China, most indicators below are pointing downwards. Steel prices, margins, production levels and BF utilization rates have all been declining in the past week, while iron ore inventories in the supply chain have increased to nearly 80 days, the highest level observed since early 2019. All these factors have contributed to low iron ore demand in the past week. Steel production controls are currently getting stricter, mainly in Tangshan city. Sinter production is particularly affected, which is resulting in strong demand for pellets as well as sinter brought in from other regions. Lump demand has not seen the same increase as pellet and high-grade material due to the elevated coking coal prices continuing to soften demand for this product.

While demand in China remains weak, availability of ore has improved. The offloading rate at ports in China has increased significantly in the past few weeks, which means the vessel queue has been shrinking and port stocks have risen. The reduced port congestion has freed up dry bulk vessels and helped to push freight rates lower in the past weeks. Iron ore supply was somewhat disappointing in October, with exports from most places falling compared to September levels. At the start of November, we have seen slightly weaker supply from both Port Hedland and Brazil, while Rio Tinto has managed to keep shipments elevated

In the coming week, we expect iron ore prices to hold steady. Demand in China is expected to remain weak, but seaborne supply has also been falling and we find it unlikely that iron ore inventories will jump again after recent gains. It also appears that freight rates have stopped falling for now, thus helping to keep the cost of producing and delivering ore to steelmakers elevated.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com