Market Data

December 22, 2021

SMU Survey: Little Agreement on What Q1 '22 Holds for Steel Prices

Written by Michael Cowden

There’s surprisingly little consensus among market participants about where steel prices will be next year, even though 2022 is just around the corner.

That’s a big departure from the last 12 months, when respondents to Steel Market Update surveys were roughly in agreement on where prices would be in the future – or at the very least on their general direction.

The ’22 Consensus: There is None

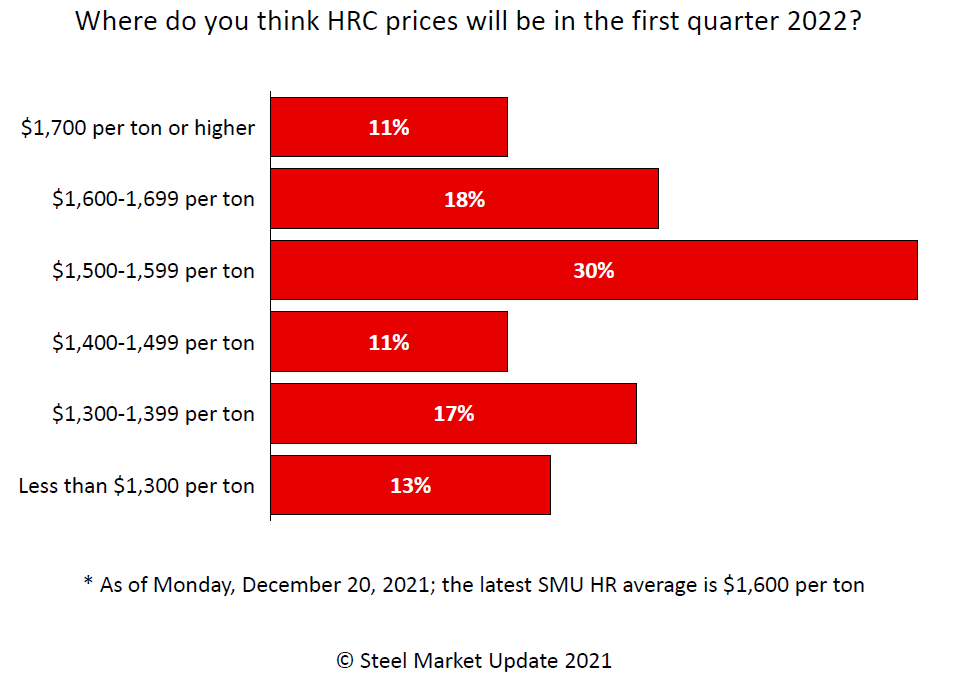

SMU asked steel buyers this week where they think hot-rolled coil prices will be in the first quarter. Here are the results:

About 11% predicted $1,700 per ton or higher, or above our current range.

Nearly half, approximately 48%, said prices would be roughly within our current range at $1,500-1,700 per ton – although most clustered toward the lower end of that range.

A combined 41% said prices would be below our current range. And of that group, approximately 30% said they would be substantially lower: $1,399 per ton or less.

That kind of diversity of opinion might at first glance appear normal. But it’s a significant departure from as recently as early December.

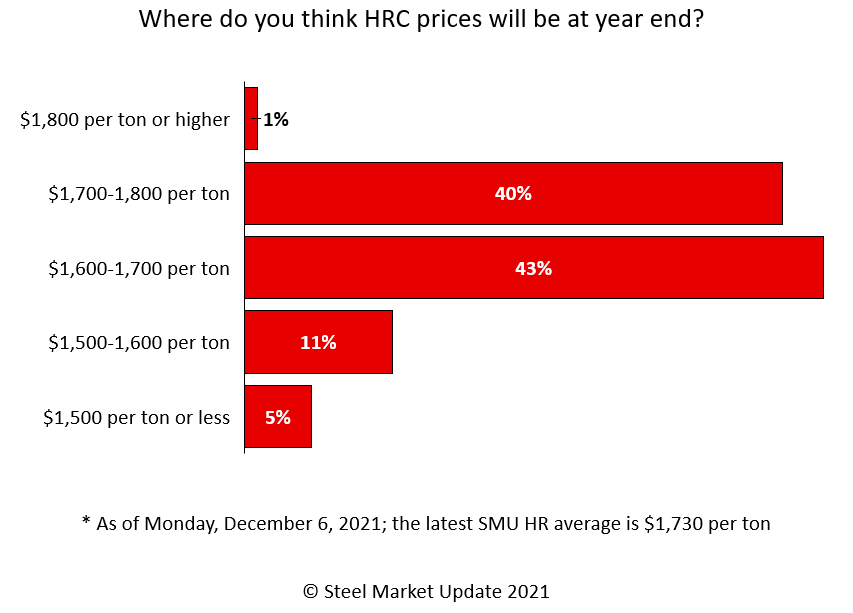

Here’s what respondents to our last survey said when asked where HRC prices would end the year:

In other words, there was a consensus just a couple of weeks ago (83% of respondents) that prices would hold in a range of $1,600-1,800 per ton. That consensus fell apart in just two short weeks.

Resale Prices

I addressed some of the reasons why prices were in a broader range compared to prior weeks in Final Thoughts on Tuesday. Another reason for more bearish outlooks can be found in lead times returning to historic norms, which has made mills more willing to negotiate lower prices. Does that mean prices will revert to historic norms too? We’ll see.

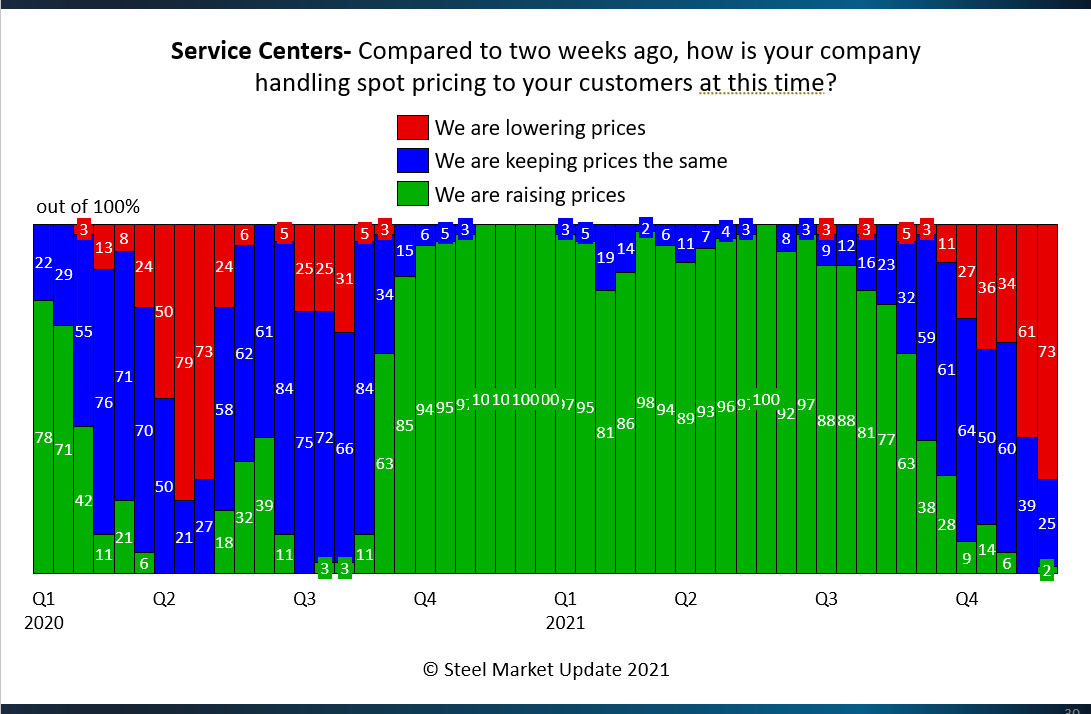

Also worth noting in our latest survey data is that more service centers report lowering resale prices now than at any time since the early days of the pandemic:

SMU does not officially track service center resale prices. But we have anecdotally heard stories of galvanized material, for example, being sold by service centers – slit and delivered – at hundreds of dollars per ton below already lower fob mill pricing.

There might be any number of reasons for that: year-end deals, excess prime or secondary substrate, or service centers blending import and domestic pricing. The point is, those numbers are well below replacement costs – which is not something you see in a normal market.

Market Reaction

Comments submitted by survey respondents are as mixed as their predictions for next year. If there is a unifying thread, it is that demand (except from distribution) is mostly firm even as prices continue to fall:

“Throughout the entire saga, demand has been strong. We are expecting to see more tons fly out the door in ’22.”

“Demand for manufacturers is strong. Distribution has stopped buying due to price decreases. But overall demand is good.”

“Seeing auto recovery.”

“Pricing is still sliding, but it should find a bit more solid footing in the new year.”

“Demand is the only thing that could stop the free fall. The mill CEOs are very quiet as the price collapses.”

“The market is good and strong. Some stupid mills are making some bad decisions.”

“Midwest mills seem more hesitant to sink prices. (But) there are better prices coming through import, which probably will continue to pull the Midwest number down.”

“Contractual tons are being booked. Passing on spot offers.”

“Our inventory position is still pretty solid, so we don’t need to be an active buyer…especially when pricing continues to slide every week.”

“Our customers are not interested in buying just yet, so we are not in a hurry.”

“Inventory is in solid shape. Dramatically lower prices are likely in the coming weeks.”

By Michael Cowden, Michael@SteelMarketUpdate.com