Distributors/Service Centers

February 24, 2022

Ryerson Posts Record '21 Earnings, Notes 'Geo-Political Wildcards' in '22

Written by Tim Triplett

Ryerson, the Chicago-based steel processor and distributor, reported record annual results for 2021 highlighted by capital investment in two new service centers and significant debt reduction that positions the company well for what management expects to be a strong 2022.

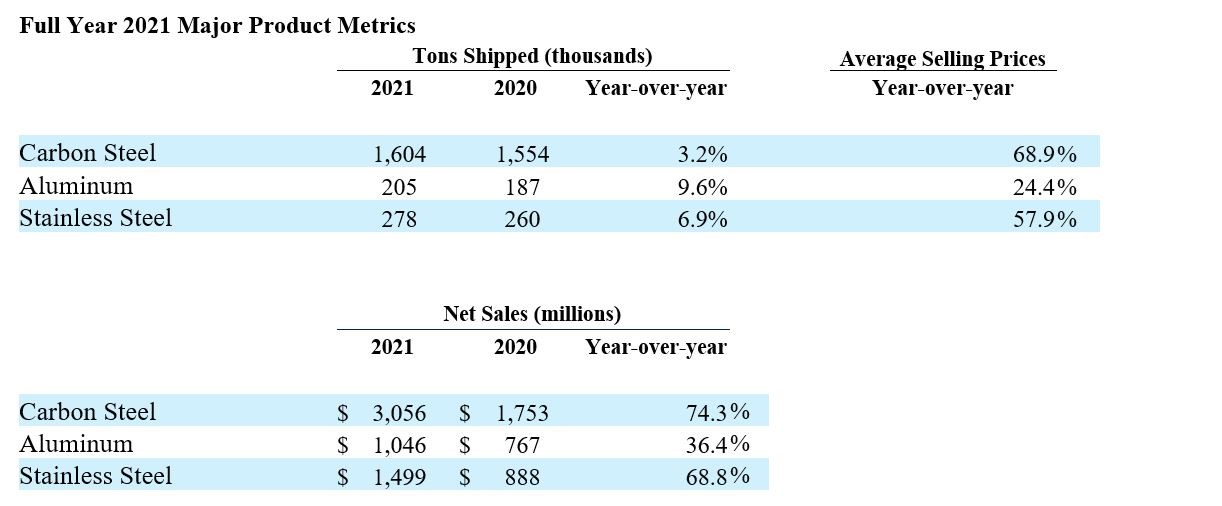

Ryerson reported net income of $294.3 million on revenues of $5.68 billion in 2021. That’s a big improvement from the loss last year of $65.8 million on sales of $3.47 billion. The company finished the year strong with fourth-quarter earnings that doubled the prior quarter at $106.4 million on sales of $1.53 billion.

In his earnings call earlier today, Ryerson President and CEO Eddie Lehner described 2021 as “a consequential year in all its dimensions,” but also “an extraordinary grind for all involved requiring true grit.” He thanked his Ryerson teammates for delivering a year of record financial performance against the backdrop of repeated disruptions caused by the second year of the COVID-19 pandemic and its manyfold knock-on impacts, including severe global supply-chain paralyses. Their efforts have “set Ryerson on a path for new, better and accelerated possibilities for the business,” he said.

During 2021, Ryerson realized over $100 million on sales and leasebacks of industrial facilities, $45 million of which will be reinvested this year into two new service centers in Centralia, Wash., and University Park, Ill. The Centralia facility will serve as a regional hub for the U.S. Pacific Northwest, and the University Park campus will serve as a regional long products hub for the U.S. Midwest market and as a future operational hub of Central Steel & Wire Co. The Centralia facility is expected to be fully operational in early 2023 and the University Park plant a year later in early 2024. Ryerson has committed $100 million for capital expenditures in 2022 to modernize its service center network.

In market commentary, Ryerson executives said U.S. commodity markets experienced a pricing dichotomy in the fourth quarter, with flat carbon steel products declining while prices for aluminum and stainless steel remained elevated. “At this point, given underlying supportive demand conditions and gradually improving metals availability, Ryerson anticipates that carbon prices will gradually decline in the first quarter of 2022 while aluminum and nickel maintain relative strength compared to their historical averages,” the company said. The company’s diversified product mix now includes approximately 50% bright metals.

Demand in the fourth quarter was affected not only by normal seasonal softness but also by two additional factors, the company said: 1) end-customers’ production downtimes were exacerbated by impacts of the Omicron variant, straining available labor and parts, leading to delays in demand; and 2) due to the rapid decline in hot-rolled coil prices, some customers deferred spot purchases in anticipation of lower pricing in the new year. As a result, Ryerson noted shipment declines in most of its end-markets in the fourth quarter. Bucking the seasonal softness trend was Ryerson’s oil-and-gas segment, which again posted quarter-over-quarter improvement in North American shipments due to recovering exploration activity driven by surging energy prices. Ryerson’s HVAC segment also saw positive growth due to increased demand from the construction and home building sectors.

“While near-term production bottlenecks and COVID-related issues persisted into the fourth quarter of 2021, the outlook for 2022 remains optimistic,” the company stated. “Our base case is a lessening of supply-chain disruptions and accelerating demand realization as the year unfolds against a backdrop of price bellwethers holding above their 10-year averages. We acknowledge the potential of inflation, policy, public health and geo-political wildcards.”

By Tim Triplett, Tim@SteelMarketUpdate.com