Prices

April 5, 2022

CRU: Iron Ore Returns to $160 Per DMT

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor, April 5.

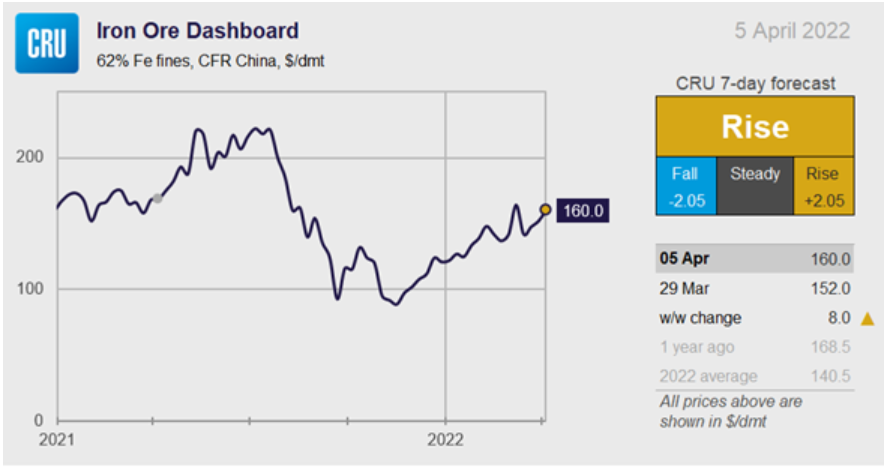

Iron ore has risen again in the past week as lockdowns in China have fuelled hopes of new stimulus measures, resulting in an overall bullish sentiment last week, ahead of the Chinese Qingming holiday (Sunday–Tuesday). Iron ore has now returned to $160/dmt – a near $20/dmt rise in the past three weeks.

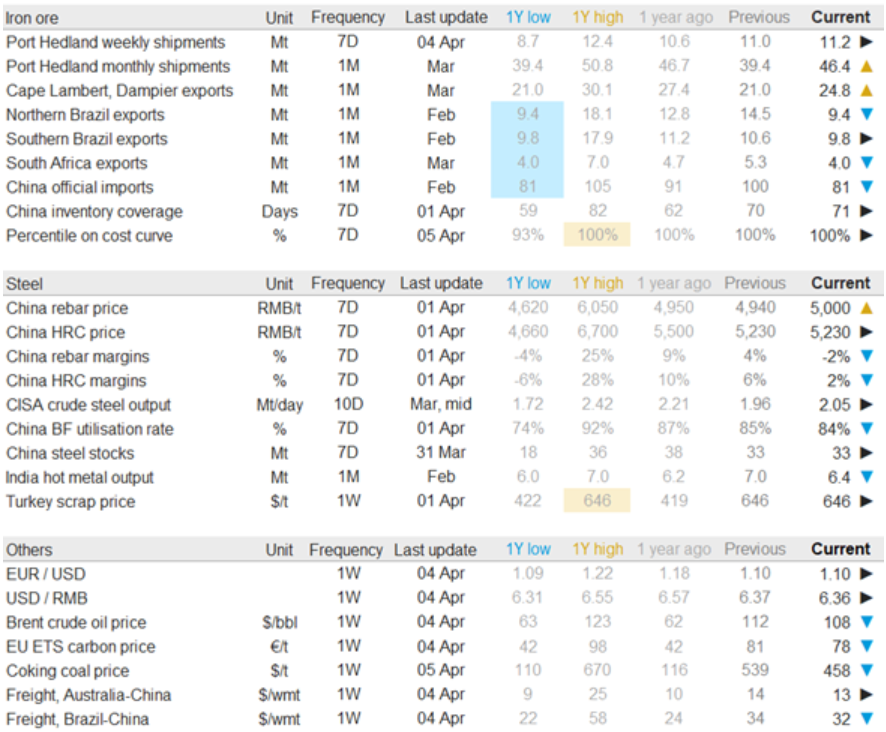

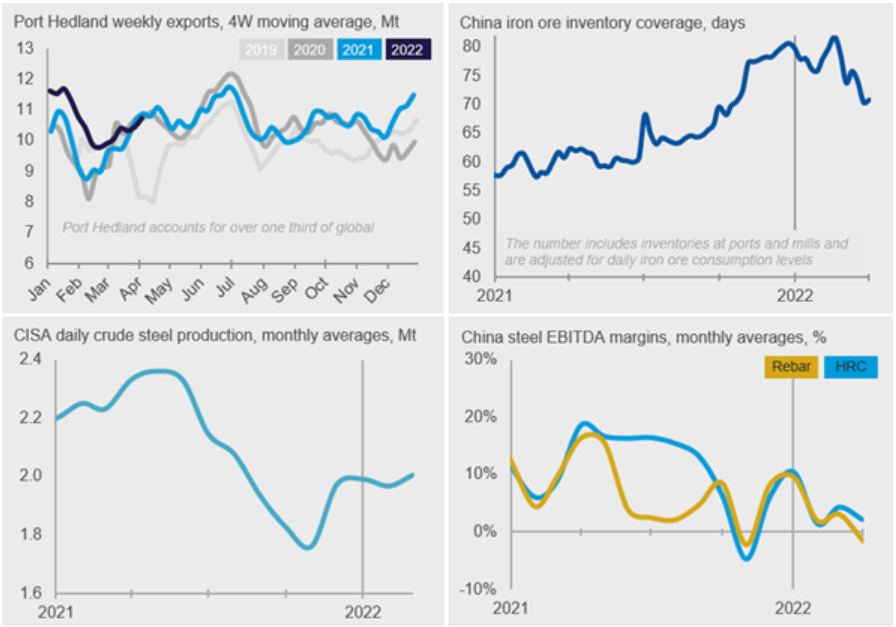

On the demand side, Omicron has continued to spread in Shanghai and Jilin province but was better contained in other regions. With improved weather conditions, construction activity was boosted, pushing up steel long products demand. Meanwhile, BOF-based steelmakers reduced long products production to maintain the output of flat products, which have higher prices and margins. EAF-based steelmakers also reduced their production due to high scrap prices partly resulting from less scrap collection activity in cities facing lockdowns. These combined factors pushed up long products prices, with our assessed rebar price rising by RMB60/t (from March 28 to April 1).

In contrast, the steel flat products market was more stable, seeing prices largely unchanged week-on-week. Our sources in China have mentioned that steelmakers have begun to reduce BF productivity. Capacity utilization has edged down week-on-week primarily due to raw materials supply disruptions restricting mill operations. This has helped to prompt a shift over to lower-grade ore, which has increased demand for products such as SP10 and SSF. Transportation restrictions have eased in the last days before the holiday, and steelmakers were more active in restocking iron ore. Medium- and low-grade fines have been preferred while demand for lump and pellets has slowed as steelmakers have increased sinter production.

Seaborne supply remained strong at the end of March with the usual push to close out Q1. Port Hedland ended up shipping ~46 million tons in March – up ~7 million tons from February but slightly lower than in March last year. Rio Tinto’s shipments (Dampier and Cape Lambert) also fell short of March last year as the company continues to struggle with its heritage management. Year to date, the company’s shipments are down 8% from last year.

In Ukraine, rail exports to steel mills have reportedly increased since the war started. Both Ferrexpo and Metinvest are railing volumes across the country to steel mills located mainly in Slovakia and Czechia. They are currently investigating other export routes as the Black Sea and the Danube River export routes remain closed. CRU estimates that 32 million tons of the country’s total exports of 44 million tons were exported through these two routes in 2021. In Russia, the railway connecting Severstal’s pellet operations to the port of Kokkola in Finland has reopened, allowing the company to resume shipments to the seaborne market. However, the EU has indicated that new sanctions are to come, and Russia’s commodity sector is likely to be targeted.

We expect iron ore prices to increase in the coming week. Sentiment remains bullish and steelmakers will be in need of restocking after the extended holiday, while transportation is expected to improve due to further easing of lockdowns. In the coming week, the market will be watching the trajectory of Chinese steel prices closely. Margins are already low and if they do not rise in line with market expectations, iron ore prices could go south quickly.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com