Market Data

April 28, 2022

Steel Mill Lead Times Soften for First Time in Three Months

Written by Brett Linton

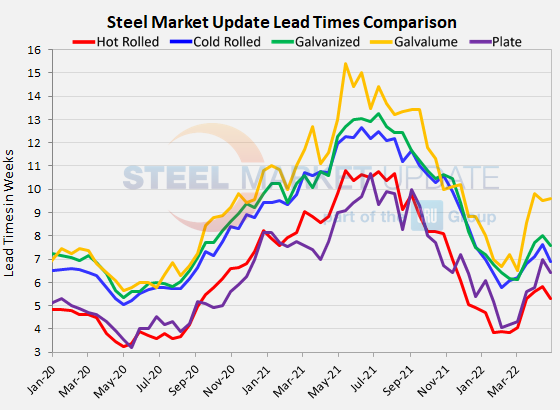

Steel Market Update’s latest check of the market indicates steel mill lead times are sideways to down for sheet and plate products, decreasing by an average of 0.4 weeks compared to two weeks prior. This is the first time lead times have declined on average since late January. Hot rolled, cold rolled, and galvanized lead times have eased to levels seen 4-6 weeks ago. Galvalume lead times are relatively unchanged from mid April, while plate lead times shortened but remain at the second-highest rate of the year.

Buyers surveyed this week reported mill lead times ranging from 4-8 weeks for hot rolled, 5-9 weeks for cold rolled, 5-10 weeks for galvanized, 8-11 weeks for Galvalume, and 5-8 weeks for plate.

Hot rolled lead times declined by 0.6 weeks from mid-April, now averaging 5.3 weeks, territory not seen since mid-March. Cold rolled lead times slipped 0.7 weeks to 6.9 weeks, and galvanized lead times fell 0.4 weeks to 7.6 weeks. The average Galvalume lead time rose by 0.1 weeks to 9.6 weeks. Mill lead times for plate are now at 6.4 weeks, shortening by 0.6 weeks from SMU’s previous market analysis.

70% of the executives responding to this week’s questionnaire told SMU they are seeing stable lead times. 16% said lead times were slipping, while 14% said they were extending. Here’s what a few of them had to say:

“Demand is good, but not like last year. Availability is still fine, not seeing very extended lead times.”

“Depends on the commodity. I don’t see any problem with HRC availability. Some tubing items will continue to have long lead times due their production process.”

“Ordering is stalling, so while [lead times are] stable now they could be slipping in the future.”

“Not much movement on lead times as of late.”

“Lead times are good right now for the steel we buy, and I don’t see much changing.”

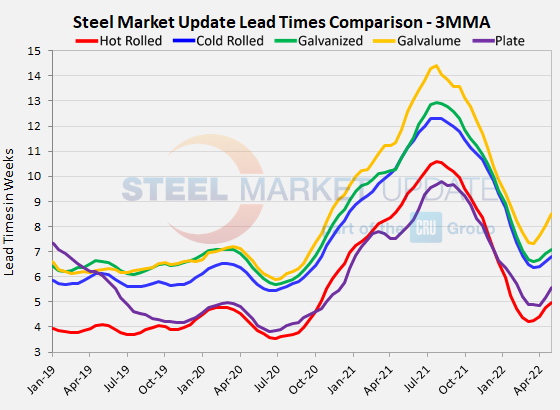

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, all products showed an increase this week, rising an average rate of 0.3 weeks over mid April. The current 3MMA for hot rolled is 5.0 weeks, cold rolled is 6.8 weeks, galvanized is 7.1 weeks, Galvalume is 8.5 weeks, and plate is 5.6 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com