Analysis

May 1, 2022

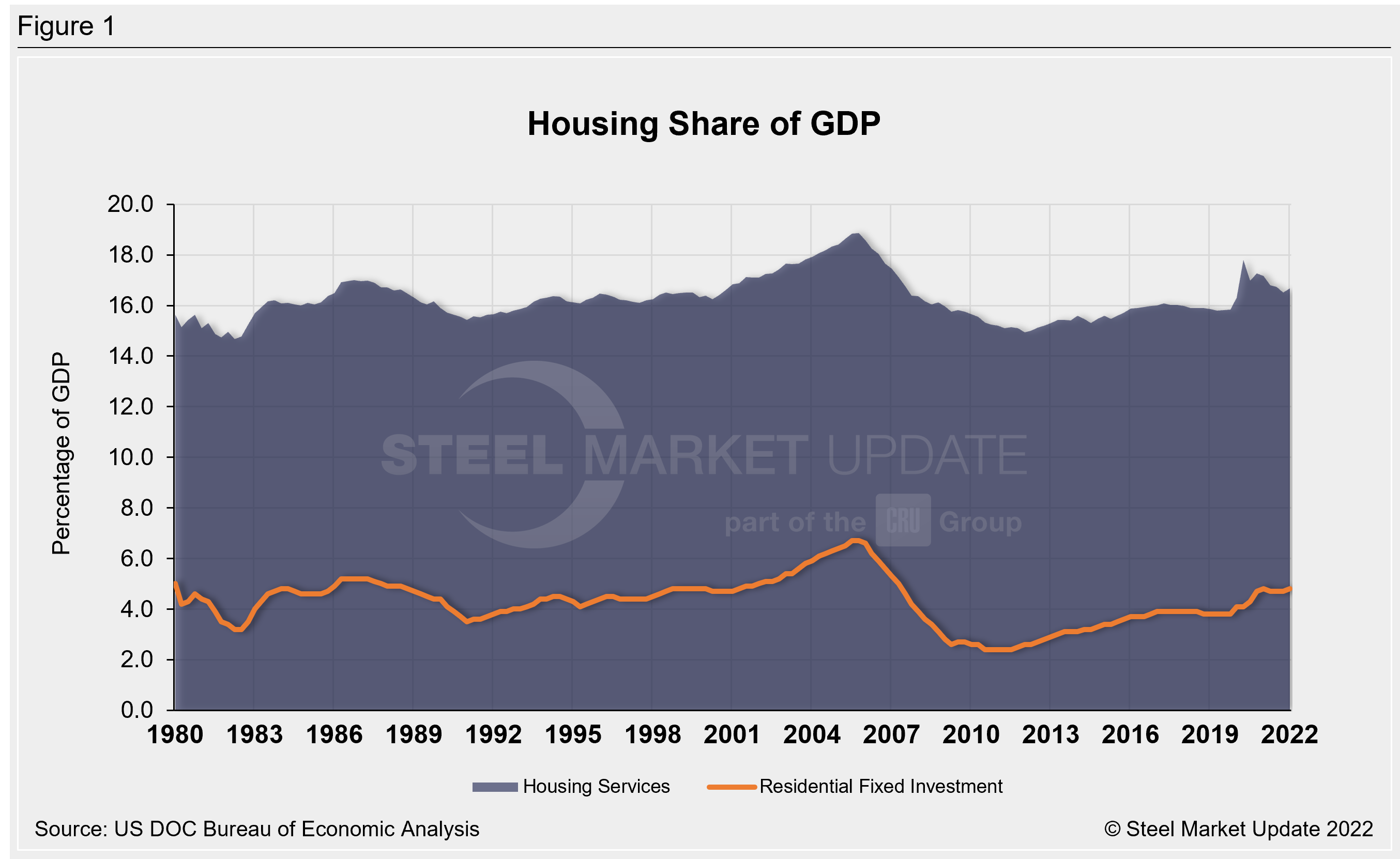

NAHB: Housing Share of GDP Edges Higher at Start of 2022

Written by David Schollaert

Housing’s share of the economy edged higher at the start of 2022 due in part to a surprise drop in GDP growth. For the first quarter of 2022, overall GDP growth declined at a 1.4% annual rate, driven by increased inventories and a jump in imports, according to the National Association of Home Builders’ analysis of US Commerce Department’s data.

In the first quarter of 2022, the decrease in real GDP reflected a deceleration in private inventory investment, led by decreases in wholesale trade and retail trade. The drop also reflected decreases in both federal and state and local government spending as well as in and exports. Imports, which are a subtraction in the calculation of GDP, increased, NAHB chief economist Rob Dietz said.

Housing’s share of GDP increased to 16.7%, just behind the 14-year high of 17.8% set during the second quarter of 2020.

“For the first quarter, the more cyclical home building and remodeling component – residential fixed investment – increased to 4.8% of GDP,” Dietz said. “Home construction will face growing challenges as higher interest rates due to tightening monetary policy increase housing affordability challenges. RFI added 10 basis points to the headline GDP growth rate at the start of 2022.”

Housing-related activities contribute to GDP in two basic ways.

The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building, multifamily development, and remodeling contributions to GDP. It includes the construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees, the report said.

For the first quarter, RFI was 4.8% of the economy, recording a $1.18 trillion seasonally adjusted annual pace.

The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. According to Dietz, the inclusion of owners’ imputed rent is necessary from a national income accounting approach. That’s because without this measure, increases in home ownership would result in declines for GDP.

For the first quarter, housing services represented 11.9% of the economy, or $2.9 trillion on seasonally adjusted annual basis. Taken together, housing’s share of GDP was 16.7% for the quarter.

Historically, RFI has averaged roughly 5% of GDP while housing services have averaged between 12% and 13%, for a combined 17% to 18% of GDP. These shares tend to vary over the business cycle. However, the housing share of GDP lagged during the post-Great Recession period due to underbuilding, particularly for the single-family sector. The recent expansion in housing activity has increased these shares to near historic norms.

By David Schollaert, David@SteelMarketUpdate.com