Market Data

June 3, 2022

Persistent Inflation Erodes May Consumer Confidence

Written by David Schollaert

US consumer confidence edged lower in May as Americans’ view of their present and future prospects dimmed in the midst of persistent inflation, The Conference Board reported.

Confidence could stumble further as stubborn inflation may be around for a bit. Inflation soared over the past year at its fastest pace in more than 40 years. The Federal Reserve raised its main borrowing rate by a half-point in early May, with the possibility of more half-point increases this year.

This dynamic together with current business and labor market conditions seem to be impacting overall sentiment. Consumers were again slightly less optimistic about the labor market, even as US employers have added at least 400,000 jobs for 12 straight months, and the unemployment rate is down to 3.6%. That is the lowest rate since the pandemic erupted two years ago and just above the half-century low of 3.5% that was reached two years ago.

“Consumer confidence dipped slightly in May, after rising modestly in April,” said Lynn Franco, senior director of economic indicators at The Conference Board. “The decline in the Present Situation Index was driven solely by a perceived softening in labor market conditions. By contrast, views of current business conditions – which tend to move ahead of trends in jobs – improved. Overall, the Present Situation Index remains at strong levels, suggesting growth did not contract further in Q2. That said, with the Expectations Index weakening further, consumers also do not foresee the economy picking up steam in the months ahead. They do expect labor market conditions to remain relatively strong, which should continue to support confidence in the short run.”

“Meanwhile, purchasing intentions for cars, homes, major appliances, and more all cooled – likely a reflection of rising interest rates and consumers pivoting from big-ticket items to spending on services,” Franco said. “Vacation plans have also softened due to rising prices. Indeed, inflation remains top of mind for consumers, with their inflation expectations in May virtually unchanged from April’s elevated levels. Looking ahead, expect surging prices and additional interest rate hikes to pose continued downside risks to consumer spending this year.”

The Headline Index ticked down by 2.2 points in May to 106.4, following an upward revision in April from 107.3 to 108.6. The seesaw trend still puts May’s total 13.6 points below the same year-ago total when the index measured 120.

May’s Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, slipped 3.3 points after a 0.9-point loss in April. The reading for that index stands at 149.6 in May. The Expectations Index, which is based on consumers’ short-term outlook for income, business, and the labor market, slipped 1.5 points to 77.5 in April, its lowest total since February 2014.

Calculated as a three-month moving average (3MMA) to smooth out the volatility, The Conference Board’s Composite Index was 107.5 in May versus 107.3 in April – rebounding for the first time in six months, but still well below the pre-pandemic high of 130.4 seen in February 2020.

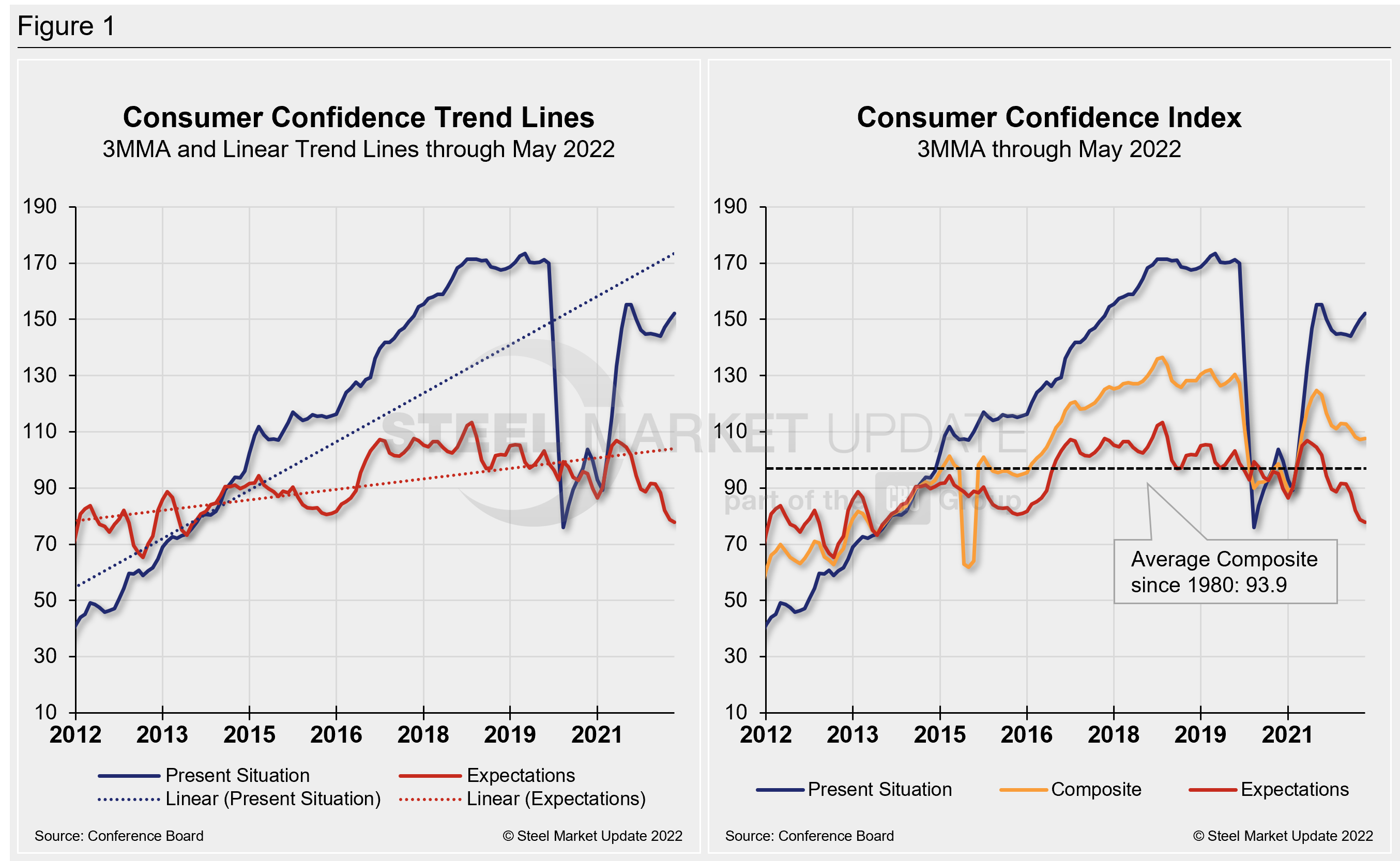

The Composite Index is made up of two sub-indexes: consumers’ view of the present situation and their expectations for the future. Figure 1 below notes the 3MMA linear trend lines from January 2012 through May 2022 versus the trend lines of all three subcomponents of the index: Present Situation, Composite and Future Expectations. All three were above the average composite line prior to the pandemic before falling consecutively through last February. The surge from March through June of 2021 pulled all three indexes above the composite line once again. But economic uncertainty has since eroded confidence.

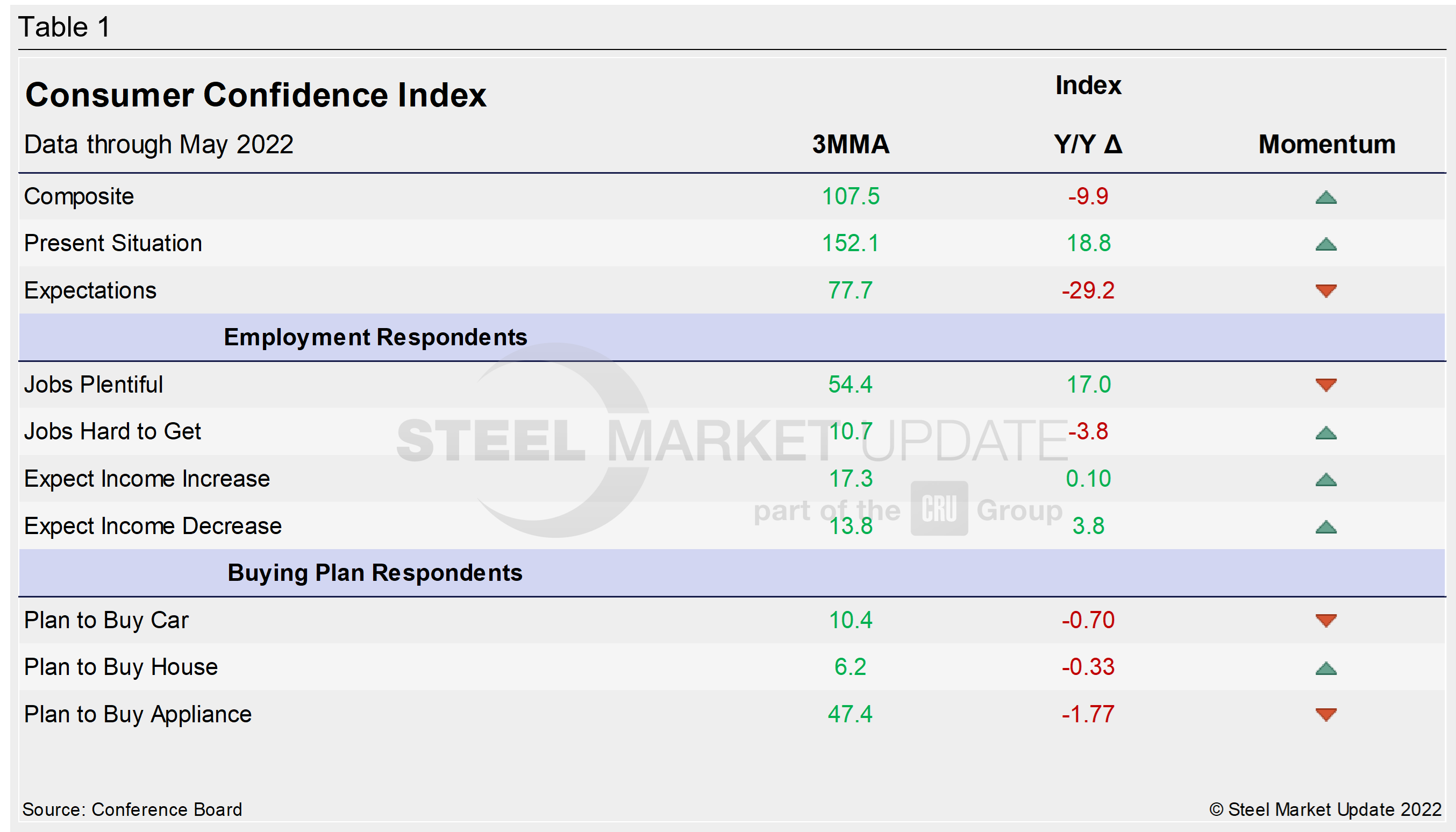

The table below compares May 2022 with May 2021 on a 3MMA basis. The present situation index reading is the only one showing YoY gains, though momentum for the Headline and Present Situation Indexes are trending up of late on the 3MMA basis. Expectations is showing the most volatility, down YoY as well as a declining momentum through May.

The Composite is down 20.7 points when comparing current 3MMA totals to the same 2019 pre-pandemic period. The Present Situation is down 15.5 points, while the Expectations reading is down 24.3 points in May when compared to the same period in 2019. The consumer confidence report includes employment data and purchase plans. These are summarized in the table below.

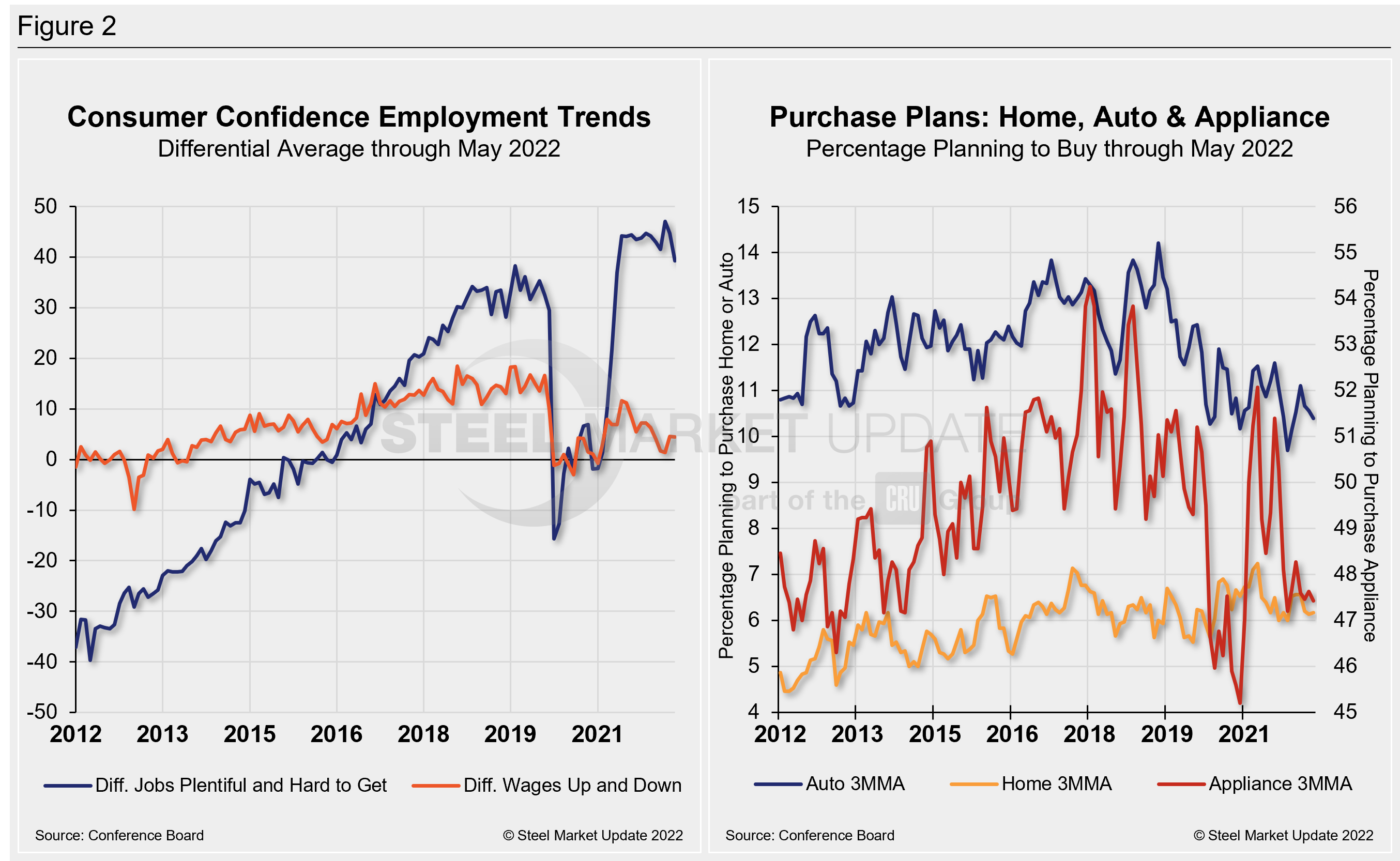

People found jobs less plentiful in May but were a bit more optimistic about wage increases compared to the month prior. The differential between those finding jobs plentiful and those having difficulty was 39.3 in May, down from 44.7 in April. The measure, despite recent fluctuation, remains well above the most recent pre-pandemic high and is well above 21.6 a year ago. The difference between those expecting wages to rise versus those expecting wages to fall is 4.5, down 0.1 points MoM, and down from the recent high of 11.6 last June.

Buying intentions for big-ticket items – cars, homes, and major appliances – all cooled slightly, the report said. Rising costs remain the top concern for consumers, as their inflation expectations were mostly unchanged from April’s elevated levels. Home buying saw the largest percentage fall in May, down 13.2%, followed by major appliances (-9,1%) and autos (-8.9%). These recent dynamics and historical movements are illustrated below in Figure 2.

Note: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.

By David Schollaert, David@SteelMarketUpdate.com