Market Data

June 17, 2022

CRU: China’s Stimulus Package, Will it Work?

Written by Henry Hao

By CRU Senior China Economist Henry Hao, from CRU’s Global Economic Outlook and China Macro Monthly

In May, overall economic activity in China has improved marginally as the relaxation of Covid-19 restrictions led to the resumption of production in late May. Export and infrastructure investment have regained momentum. However, prospects for construction remain weak. While the contraction of real estate investment moderated at the start of the year, it has deepened again due to pandemic-related restrictions and weakening expectations of homebuyers.

To mitigate the impact of the lingering pandemic and worsening terms of trade, we expect fiscal, monetary, and regulatory policies to become increasingly accommodative. In this month’s China Macro Monthly, we will look at how the recent relief and stimulus measures could affect the pace of recovery.

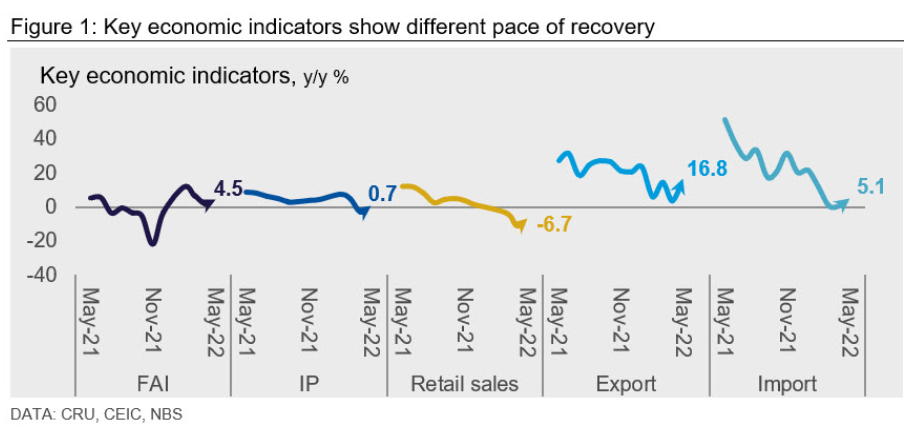

Key Economic Indicators Bottomed Out in May

China’s economic activity improved in May as the relaxation of pandemic restrictions led to the resumption of production in late May. However, the pace of recovery in May varied within different sectors. Fixed-asset investment (FAI) rose to 4.5% year-on-year (YoY) growth in May from 1.8% in April. Industrial production recovered to 0.7% YoY in May from a drop of 2.9% in April. Retail sales, a gauge of private consumption, fell 6.7% YoY in May, improving from a collapse of 11.1% in March. Export growth rebounded to 16.8% YoY in May, while imports increased by 5.1% YoY (Figure 1).

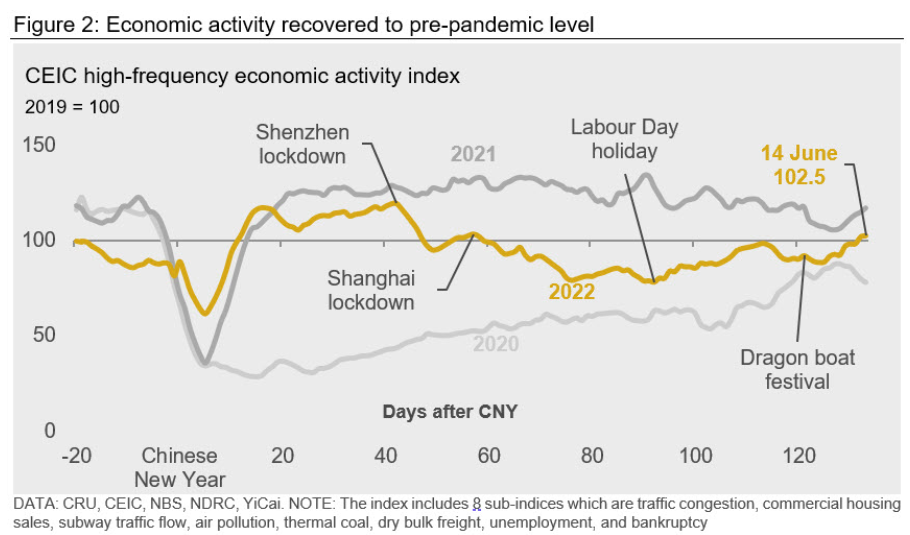

High-Frequency Index Recovers to Pre-Pandemic Level

CEIC’s high-frequency economic activity index shows that economic activity has been improving and stood above its pre-pandemic level days after the Dragon Boat Festival (Figure 2). As Shanghai reopened on June 1, mandatory PCR testing will be conducted regularly in major cities to prevent another citywide lockdown in the future and allow production and spending to get closer to normality. However, the highly transmissible Omicron variant will continue to challenge these measures. Repeated smaller-scale outbreaks and subsequent lockdowns will be the new normal, as seen recently in Beijing and Shanghai.

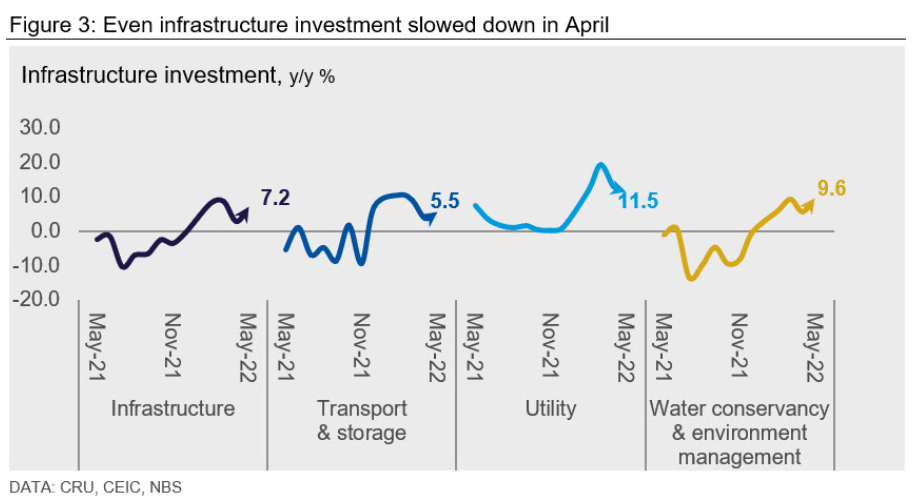

Infrastructure Investment Took the Lead to Regain Its Pace

Infrastructure investment also reaccelerated to 7.2% YoY growth in May from 3.0% in April as local government accelerated the pace of special-purpose bond issuance in the past few weeks (Figure 3). The Chinese government has been ramping up stimulus and relief measures in recent months to mitigate the impact of the economic disruption.

The central government has emphasized with more urgency that special purpose bond quotas should be utilized by August. To help facilitate the stimulus measures, China’s State Council designated policy banks to offer RMB800 billion ($119 billion USD) loans to support infrastructure projects. It has also directed local governments to look for other ways to increase funding for infrastructure, such as selling infrastructure REITs and Public-Private Partnership. These suggest that the major stimulus mechanism in the proposed package is to shore up the economy through increased infrastructure investment.

We had previously expected infrastructure investment to grow by 6% to 8% in 2022. Despite concerns over local governments’ capacity to deliver the project, with the latest developments we now think growth in infrastructure investment this year could be close to 10% or even higher.

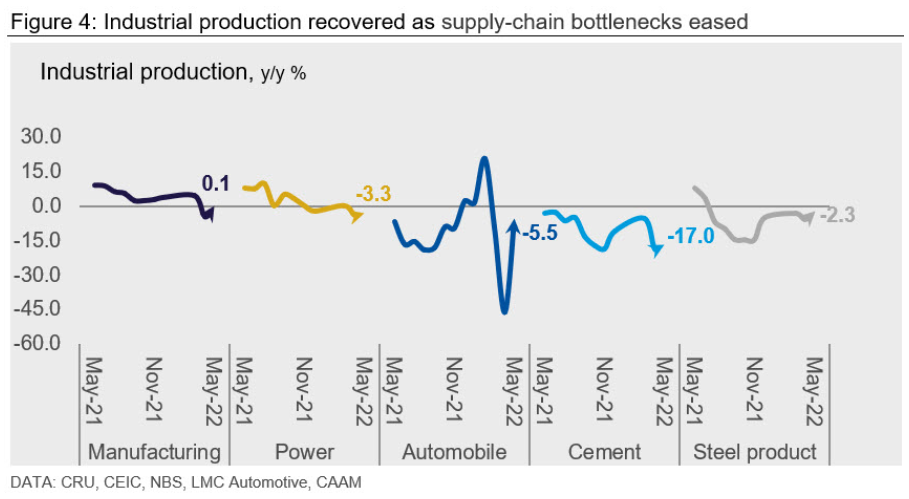

Industrial Production Improved as Logistic Disruptions Eased

Industrial production recovered, helped by easing supply-chain and logistics bottlenecks and rebounding exports. Manufacturing production rose by 0.1% YoY in May, after a 4.6% decline in April. Construction-related production such as cement and steel improved slightly as infrastructure projects resumed whereas the real estate market remained sluggish in May (Figure 4).

The YoY decline in automotive production narrowed to 5.5% from 46.2% in April (Figure 4), reflecting government efforts to remove supply-chain bottlenecks in the automotive sector and help automakers in Shanghai and surrounding areas resume production from mid-May.

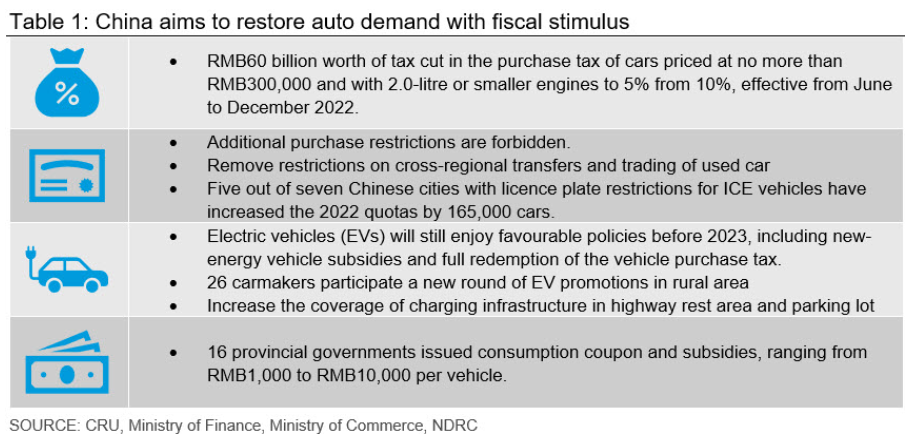

Chinese authorities recently announced a series of auto consumption stimulus packages that could boost automotive demand (Table 1). However, we believe risks remain from production disruptions and supply chain challenges amid China’s ‘dynamic zero-Covid-19’ policy, as the auto industry has a long supply chain.

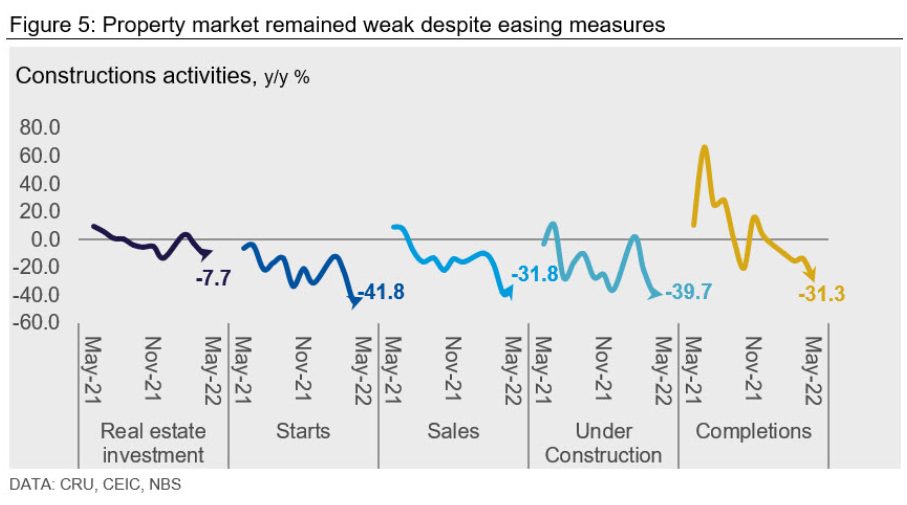

Property Market Remains Weak Despite Easing Measures

Fixed asset investment (FAI) in real estate dropped by 7.7% YoY in May from a 10.1% decline in April. Construction activities remained weak despite a series of easing measures introduced recently, including loosening home-purchase restrictions and lower mortgage rates. Starts declined by 41.8% YoY in floor space terms, sales of properties fell by 31.8% YoY and completions decline by 31.3% YoY (Figure 5).

Renewed stress in the property sector could affect the solvency of developers and local government financing vehicles, and weigh on house prices and consumer spending. Hence, it will take longer to see the effects of these easing measures.

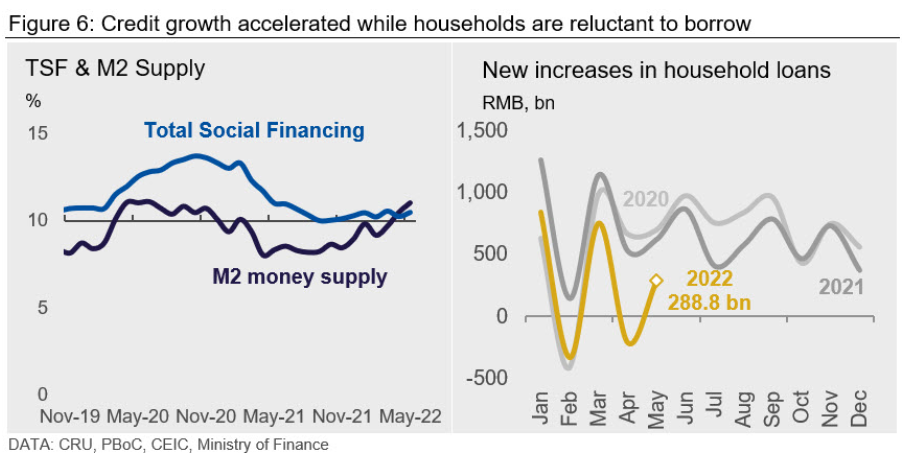

Credit Growth Accelerated While Households Preferred Saving

The growth of total social financing, a broad measure of credit and liquidity, rose to 10.5%, from 10.2% in April. The growth of the broad money supply (M2) accelerated to 11.1% YoY in May, from 10.2% in April (Figure 6, left-hand side).

We expect credit growth to stay above the 10% threshold in the coming months amid declines in borrowing costs and policy support. New long-term household loans (mostly mortgages) increased by RMB288.8 billion ($43 billion USD) in May. This was up on the month, but lower than in 2020 or 2021, reflecting sluggish housing market transactions (Figure 6, right-hand side).

The current policy support for infrastructure investment and consumption demand and an easing of restrictions on the real estate sector is expected to partly offset the slowdown caused by Covid-19 resurgence and continued stress in the real estate sector. We think the pathway to recovery will vary with different sectors: infrastructure investment will take the lead to rebound first between May and August, followed by production activity in late June, sales for home appliances, and auto in the summer. The property sector should rebound in late Q3 and Q4, and finally the service sector in the fourth quarter of 2022 and early 2023.

Still, the outlook is subject to significant risks. Repeated outbreaks and lockdowns across major cities could curtail the recovery of consumption and services activity, disrupt supply chains, and weigh on investor confidence.

Lastly, further stimulus is likely to be revealed in the next few months. We will watch closely two potential boosters:

- Special treasury bond – a fiscal tool that was used in 2020 to shore up the Covid-hit economy.

- Pledged supplementary lending – a monetary tool that was used widely in 2014-2015 to support the shanty town redevelopment.

This article was originally published on June 17 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com