Prices

August 25, 2022

HRC Futures: Market Quietly Digesting Latest Price Increase

Written by David Feldstein

Editor’s note: SMU Contributor David Feldstein is president of Rock Trading Advisors. Rock provides customers attached to the steel industry with commodity price risk management services and market intelligence. RTA is registered with the National Futures Association as a Commodity Trade Advisor. David has over 20 years of professional trading experience and has been active in the ferrous derivatives space since 2012.

How about that SMU Steel Summit, huh!?!? I can’t tell you where the HRC prices will be in January ‘23, but I know where I’ll be next August!

In one conversation I had at the Summit, someone said something like “It’s not like HRC prices are going to go to zero or back above $1,000.” And I thought to myself, still? Still after all of what we have seen in the past few years – after Covid, 2021’s record-high prices, and the Russia-Ukraine war! How is it that this certainty about where prices are headed remains?

To say that there is a cap at the very round number of $1,000 per ton makes it even more amusing. I’m not saying that person was wrong or right. I just continue to believe that you need to keep an open mind about Midwest HRC pricing, my friends!

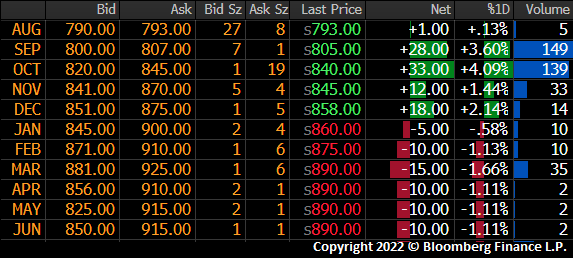

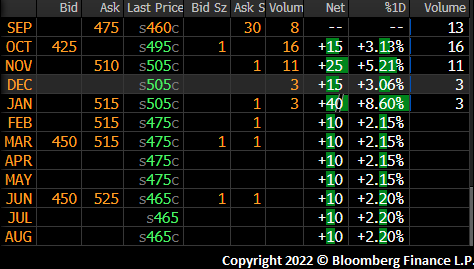

What has two thumbs and thought trading was going to be dead quiet the first three days of this week? This guy! Now, trading in CME Midwest HRC futures got off to a light start on Monday with only 2,620 tons trading. But then it really opened up on Tuesday with 36,640 tons trading and 26,360 tons trading on Wednesday. Clearly the unexpected increase in volume was initiated by the sell-side with Oct. and Nov. declining $22 while Dec. and Jan. fell $40 and $35, respectively, over the two-day period.

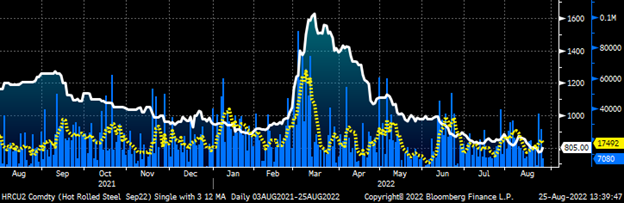

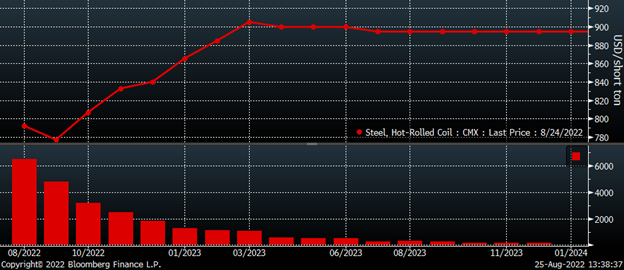

September CME HRC Future $/st w Aggregate Curve Volume & 5-Day Avg

As the ~1,300 Steel Summit goers shuffled off to the airport or were already arriving back home Wednesday afternoon, they were greated with a $75-per-ton price hike announcement from Cleveland-Cliffs.

There was somewhat of a response today, but on only 14,540 tons of relatively light volume versus the previous couple days. The market was quiet with offers to sell futures few and far between.

Cliff’s price increase follows Nucor’s $50-per-ton increase announced on August 8. For some time, I have been flagging the upside risk in Midwest HRC due to a “sneaky tight” physical market and a potential build-up of new orders. On the futures front, the decline in open interest from a peak of 900k tons in January to about 510k tons as of yesterday implies a relatively low level of liquidity in the futures market, leaving it akin to a “dry forest floor.” If given a spark by perhaps a sudden surge of OEM forward buying, it could develop into another “squeeze” higher as was seen in March.

Rolling 2nd Month CME Hot Rolled Coil Future $/st & Open Interest

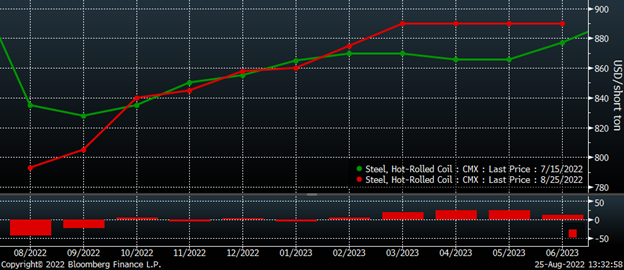

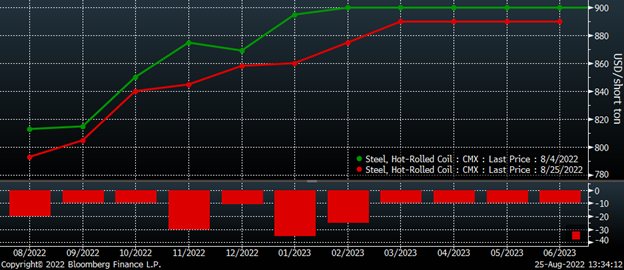

For a couple of weeks in late July, it appeared the futures curve had put in a bottom around July 15. But then the selling returned in earnest the week after Nucor’s $50/ton price increase announcement. Since July 15, the front months have declined, while the months of March ’23 forward have seen some gains. While none of the moves have been large, it has steepened the futures curve. But all-in-all, not much has actually happened over the past six weeks.

CME Hot Rolled Coil Futures Curve $/st

Since my last article on Aug. 4, every month on the curve has declined with January ‘23’s $35 decline being the largest. But, again, that’s nothing compared to the massive declines seen in April and May.

CME Hot Rolled Coil Futures Curve $/st

One interesting tidbit has been the steady buying throughout 2023. Open interest is shown in the panel at the bottom of the chart below in futures contracts (i.e., 20 tons per lot). Q1 is already above 20k short tons per month, Q2 is above 10k, Q3 is above 5k tons, and Q4 is above 3k tons.

CME Hot Rolled Coil Futures Curve $/st & Monthly Open Interest

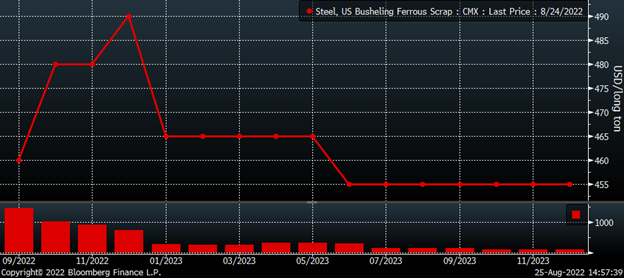

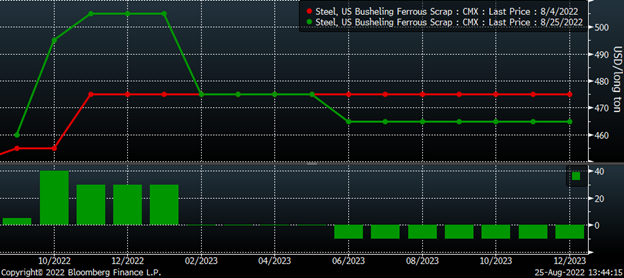

The busheling futures curve has also seen open interest extending out through calendar ’23. Whether it be a commercial or financial interest taking on these positions, it is a welcome site as liquidity works both in terms of volume as well as duration.

CME Busheling Futures Curve $/st & Monthly Open Interest

Speaking of busheling, the futures curve reacted with relatively more enthusiasm today, albeit on light volume.

The rolling 2nd month future, now October, is shown below with open interest across the curve rebounding back toward March’s all-time highs due to the trading in the months throughout 2023.

Rolling 2nd Month CME Busheling Future $/lt & Open Interest (red)

Over the past three weeks, busheling has seen decent gains through January, with Oct. up $40 and Nov.-Jan. each up $30/lt.

CME Busheling Futures Curve $/lt

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.

By David Feldstein, Rock Trading Advisors