Prices

December 3, 2022

HRC Report: Market Reacts to Mill Price Increases

Written by David Schollaert

US hot-rolled coil (HRC) prices edged up slightly last week on a wave of $60-per-ton sheet price hikes announced by domestic mills. The move appears to have at least temporarily stopped the bleeding seen over the last two months. Time will tell if the price hike attempt finds support.

Just about everyone announced an increase of at least $60 per ton ($3 per cwt). Cleveland-Cliffs was first out of the gate on Monday morning. Others followed, including Nucor, US Steel, and ArcelorMittal US. The latter announced new base prices: $700 per ton for hot-rolled and $950 per ton for cold-rolled and coated.

With some mills nearing breakeven costs, an industry-wide price hike was not unexpected. Yet, it was still notable to see such a coordinated effort. Such events were common in the years before the pandemic. But the historic price rally of 2021 didn’t require any price hikes to get HR to nearly $2,000 per ton.

The price announcements, and the end of pre-increase discounting for larger buyers, saw the bottom end of SMU’s sheet price range firm up. It remains to be seen if the increases will stick or whether we will see a “dead-cat bounce” like the one we saw in September following a somewhat less-coordinated round of price hikes in August.

SMU’s most recent check of the market on Tuesday, Nov. 29, placed our HRC price range at $600–650 per ton with an average of $625 per ton FOB mill, east of the Rockies.

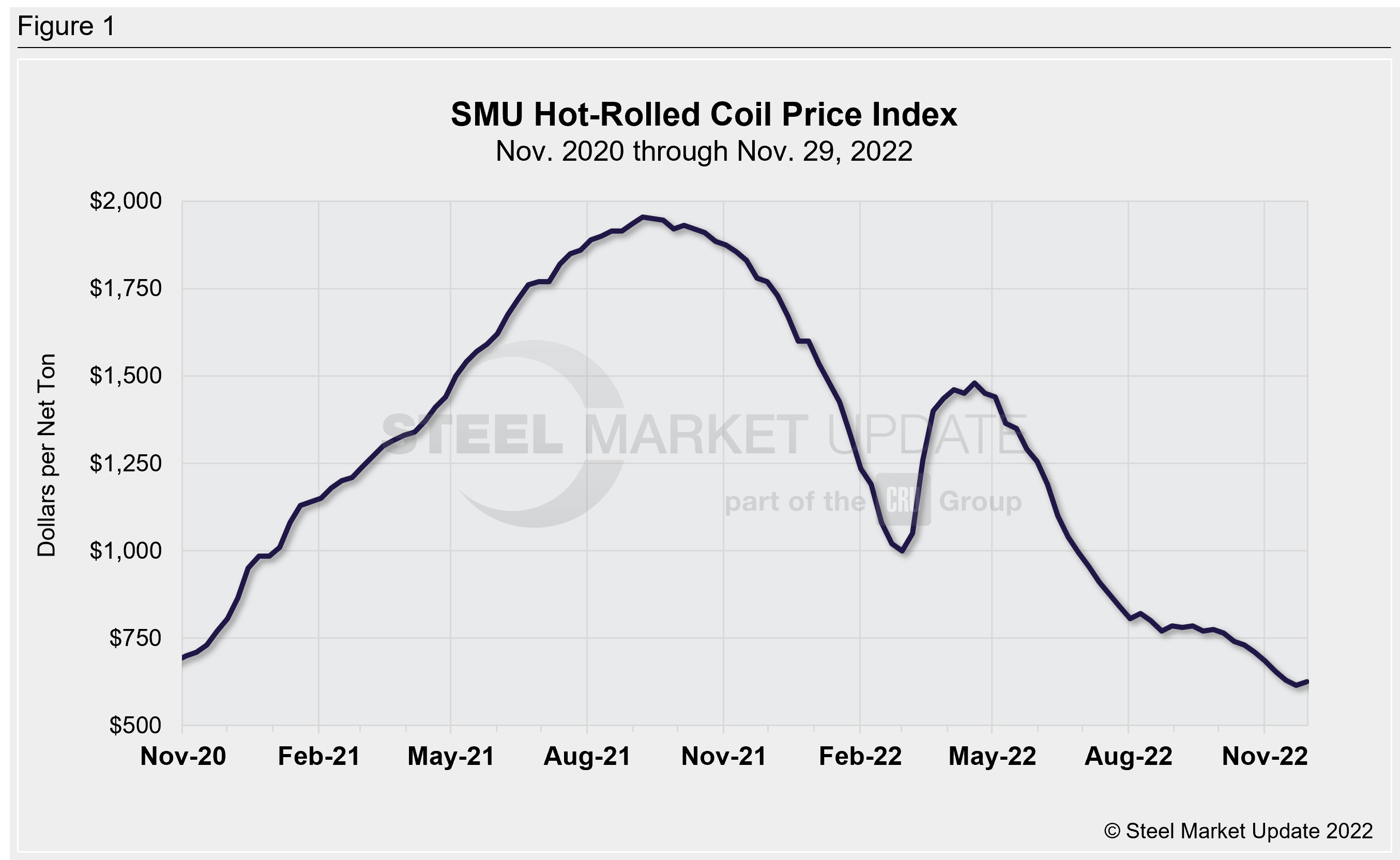

The lower end of our range was up $20 per ton compared to a week prior while the upper end remained unchanged. Our overall average was up $10 per ton (WoW), according to our interactive pricing tool (Figure 1).

Noted in industry analyst Timna Tanners, a managing director at Wolfe Research, was bullish in a Community Chat about HRC prices going well above $700 per ton in the first quarter. HRC futures are significantly above $700 per ton for Q1 too. But many of our contacts in the market remain skeptical that the hikes will stick.

“Mills are trying to find a bottom. I do not feel the increases will stick. But they might create a bottom by year-end and might get some buyers off the sidelines if they need product in next few months,” said one source.

“Hot-rolled up $60 per ton. … It’s probably not going to be collected but it might have stopped further erosion,” said another source. “It’s hard to predict exactly what 2023 will look like. But one thing is a given – it won’t be boring!”

“I think it really doesn’t move the needle either way,” said a third source. “I doubt it will generate more orders.”

“I think it will pause HRC, but I don’t see it making a big bump,” said a fourth. “I think people are largely stocked up and can sit on the sidelines a bit on HRC.”

Also worth watching are blast furnace outages, lead times, and capacity utilization.

US Steel’s No. 3 blast furnace at its Mon Valley Works near Pittsburgh has been idled since a month-long planned maintenance outage began Aug. 30. The steelmaker told SMU this week that the furnace will remain idled until market dynamics improve.

Cleveland-Cliffs is in the process of restarting the No. 7 blast furnace at its Indiana Harbor steel mill in East Chicago, Ind., following a planned outage and a small fire. Market participants have told SMU that it could restart as soon as Monday. Cliffs did not provide us with a specific date.

Our HRC lead time ranges from three to six weeks and averages 3.9 weeks. That’s a relatively typical lead time for hot band. But mill run rates are nowhere near the 90% utilization was saw in 2021. That underscores uncertainty around demand heading into 2023.

By David Schollaert, David@SteelMarketUpdate.com