Market Segment

December 16, 2022

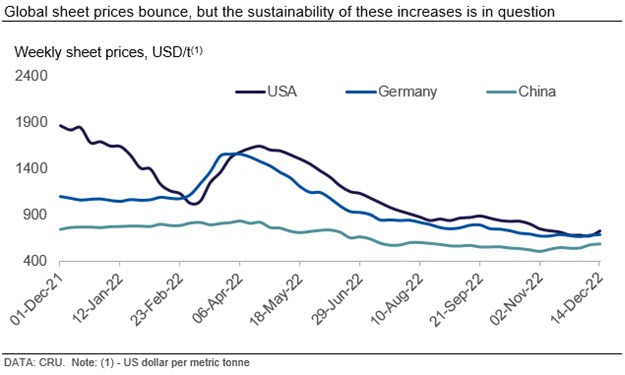

CRU: Global Sheet Prices Find Floor, Upward Pressure Limited

Written by Ryan McKinley

Sheet markets in most areas of the world have established a price floor within the last week. Still, in all markets we cover, demand weakness persists and threatens to either cap potential price increases or even reverse them.

The CRUspi was little changed month-on-month (MoM) in December at 190.8 after nearly all markets reached a bottom—many prices have even risen in recent weeks. This market floor was mostly established by changes in Chinese Covid policies and large, low-priced orders in the US. However, demand is still weak in most regions, and the sustainability of further upward price movements is in question.

Sheet markets in most areas of the world have established a price floor within the last week. A large contributor to upward price momentum was the substantial easing of Covid-19 restrictions in China, and the resulting bullishness in that market shifted general sentiment in greater Asia and echoed as far as Europe. In Southeast Asia, prices were up substantially in many markets after Chinese exporters raised their offers following ascending price movements within that country. Likewise, Japanese exporters increased their offers, but it remains to be seen if demand in the region will be strong enough to sustain these levels. Rising export offers in Asia carried over into Europe, where prices bottomed and have risen over the past two weeks. While only tangentially related to price movements in Asia, prices in the US also rose this week after mills managed to enforce price hikes announced in late November. Although prices are moving up nearly everywhere, it remains to be seen if demand is high enough to sustain them.

Fewer restrictions on travel, quarantining, and a general sense that the government could nearly eliminate all Covid restrictions supported a rally in Chinese domestic sheet prices. Meanwhile, the domestic market has also tightened due to maintenance outages and shipment delays. Against the background of these developments, Chinese exporters increased their offer prices, as did most others in Asia. While buying in Southeast Asia was subdued due to low demand, news from China did boost local and import prices, at least temporarily. Exporters from Japan also increased their offers, but so far have not had much interest. Domestic prices there were mostly stable MoM.

Diverging from the upward price trend in Asia was India, where prices have fallen despite the relaxation of export tariffs as inventories continue to build due to subdued sales both in the domestic and the export markets. Local sales are still impacted by buyers limiting themselves to need-based purchases, while discounted import offers from Southeast Asia and Russia continue to be available. While gradually raising their import bookings, several buyers are consistently negotiating lower prices with mills and their distributors, which has forced mills to reduce their price offers for December output.

Still, the change in Chinese Covid policies has had an impact on markets further afield. In Europe, sheet prices have bottomed over the past couple of weeks and begun to move higher. While the upward moves are so far modest, they represent a marked change from a long and almost unbroken downward trend that has been in place since the Spring. Italian spot prices were the first and furthest to move given that market’s exposure to international trade. These changes in Italian prices eventually carried over into Europe more broadly.

Prices also rose in the US, but this was driven more by the fact that mills were able to push through price increases after lead times extended following a flurry of low-priced, high-volume deals. After some mills announced price hikes of $60/net ton in late November, just this week yet more announced an additional $50/ton hike. So far, the first series of hikes have stuck in the market, but the staying power of these increases may be challenged by low demand.

Outlook: Recent Upside Pressure to Face Resistance

In all markets we cover, demand weakness persists and threatens to either cap potential price increases or even reverse them. This is evident in some areas of Asia where, despite rising offers, many buyers have yet to respond and make deals. Seasonally weak demand in China may also weigh on further potential increases (and by extension elsewhere), while elevated service center inventory levels in the US may put downside pressure on demand.

This article was originally published on Dec. 14 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor