Analysis

January 26, 2023

ABI Down Again in December

Written by David Schollaert

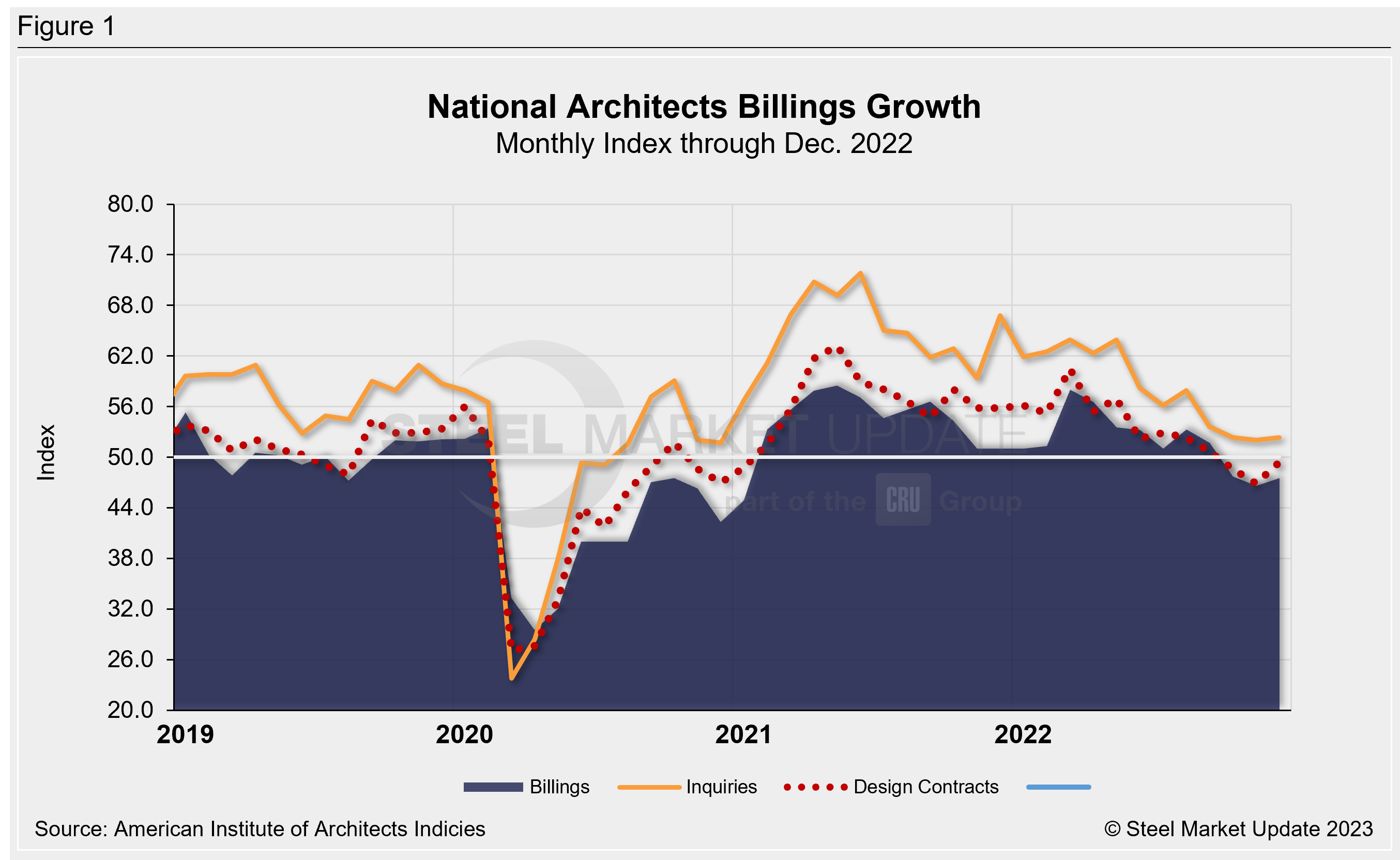

Business conditions continued to contract at architecture firms in December, though slightly fewer firms reported a decline in billings, according to a report from The American Institute of Architects (AIA).

AIA said the pace of decline during December slowed from November, with an Architecture Billings Index (ABI) score of 46.5 vs. 46.6, respectively.

The ABI is an important advance indicator of construction activity, and the sector is a key end-market for steel.

Any score above 50 indicates increased billings, and any score below 50 indicates a decline, AIA noted.

Last month’s results highlight an ongoing softness in business conditions to close out 2022, as firm billings declined for the third consecutive month in December.

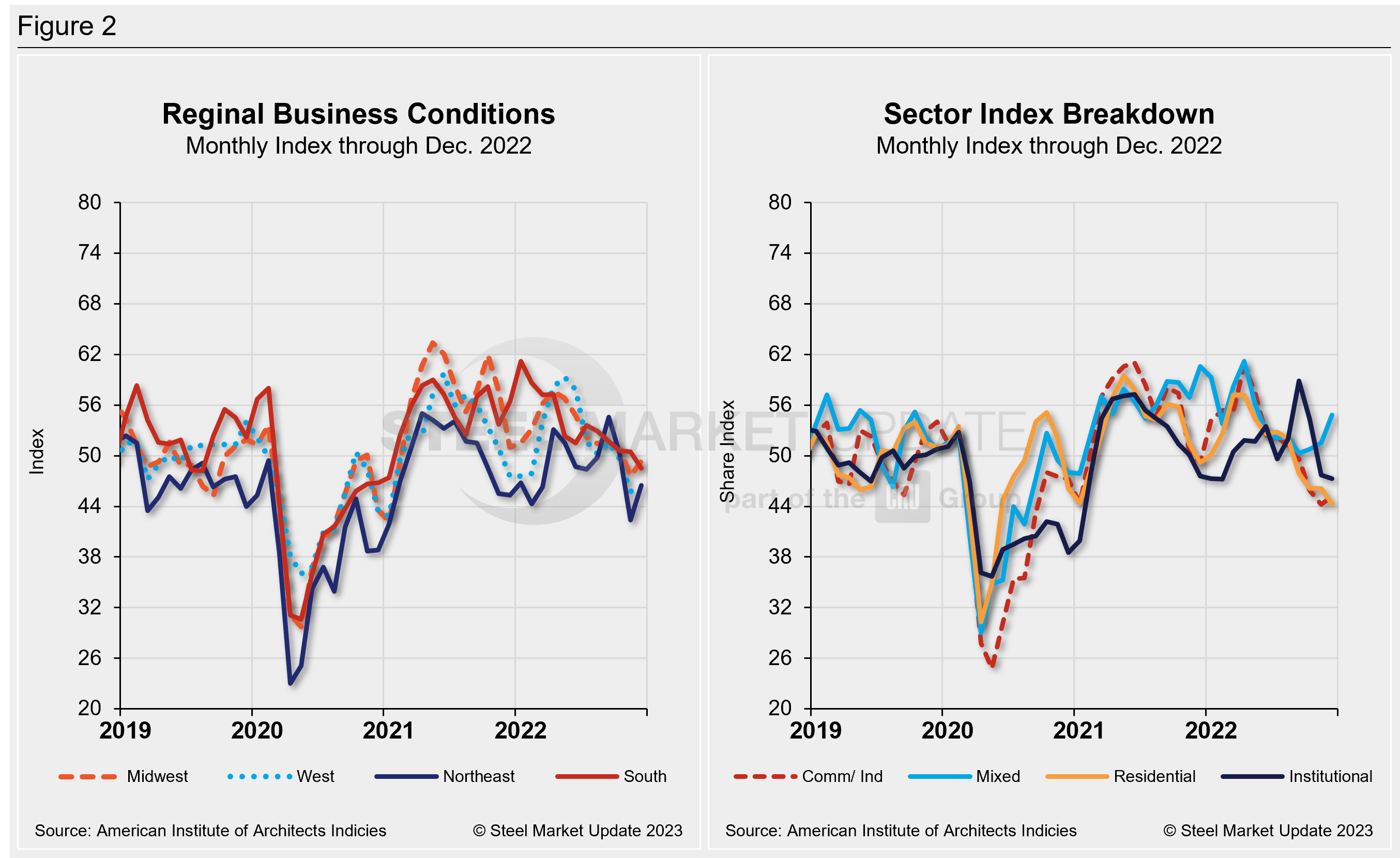

Regionally, billings were all contracting as well last month, though the Midwest posted the best reading at 49.4. The South was 48.5, the Northeast 46.5, and the West stood at 45.5 for the month.

In its sector breakdown, mixed practice, at 54.8, rose again from the previous month, as did commercial/industrial (45.2). Institutional (47.3) and multi-family residential (44.3) both showed decreases.

AIA notes that the regional and sector categories are calculated as a three-month moving average, while the national index, design contracts, and inquiries are monthly numbers.

Design contracts also recovered in December, accelerating to 49.4 last month from 46.9 in November.

“Despite strong revenue growth last year, architecture firms have modest expectations regarding business conditions this coming year,” AIA chief economist Kermit Baker said in a statement. “With ABI scores for the entire fourth quarter of 2022 in negative territory, a slowdown in construction activity is expected later this year, though the depth of the downturn remains unclear.”

By David Schollaert, david@steelmarketupdate.com