Product

January 26, 2023

HR Futures: Waiting for Clearer Signals of a Pickup in Demand

Written by Jack Marshall

Healthy hot-rolled (HR) futures activity year to date has been spurred by a pickup in physical sales as the market breaks into the first quarter of 2023.

Open interest climbed from roughly 440,000 ST a side to about 520,000 ST a side before the January contract rolled off, and daily trading volume averaged north of 28,000 ST. Since year-end, some mills have announced an additional HR price increase to $800/ST, which has led the HR spot indexes to run up $84/ST (12/28/22 $664/ST to 1/25/2023 $748/ST).

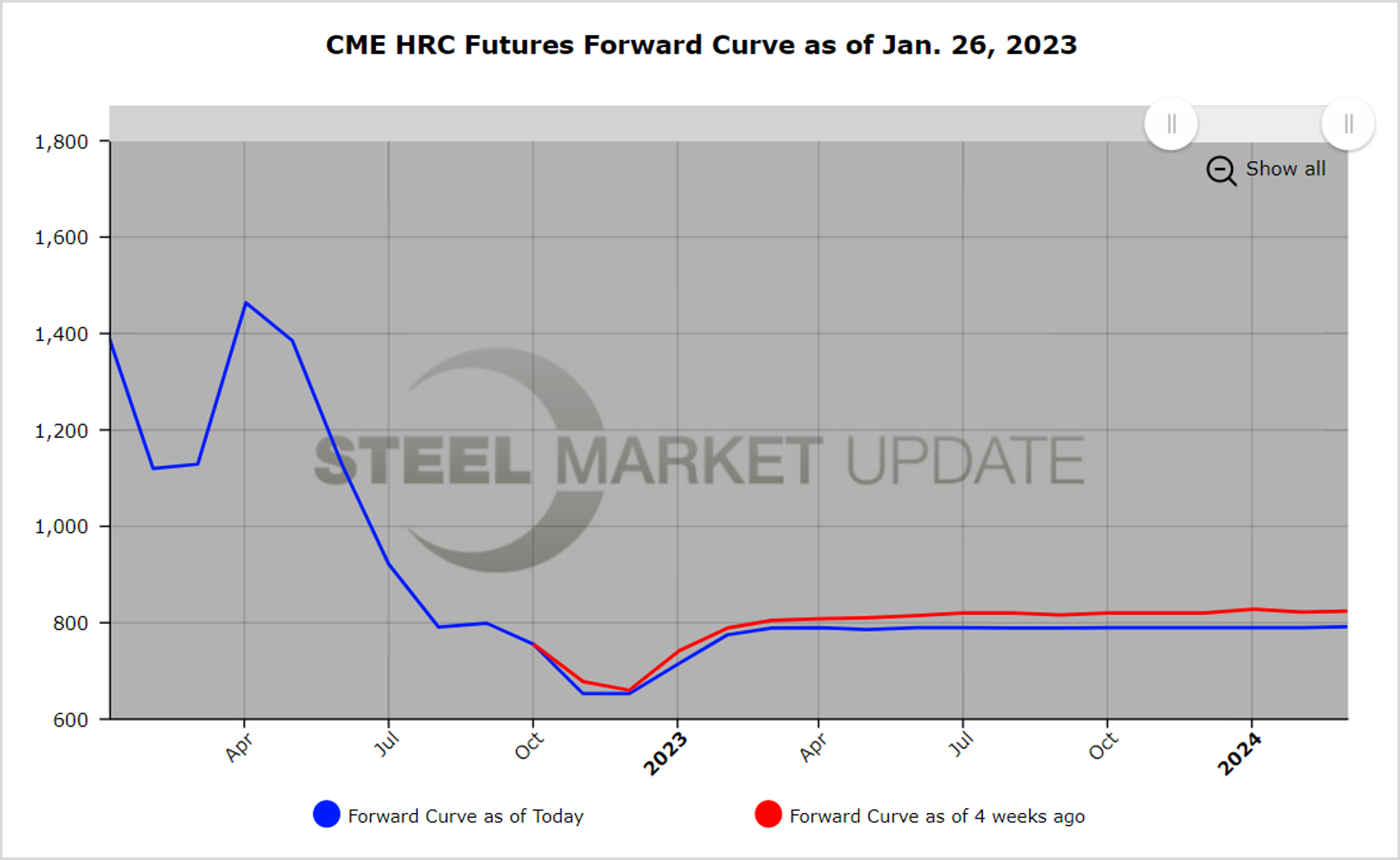

Interestingly, while spot edges higher on the back of mill price increases, the forward curve settlement prices have shifted lower.

At the end of Dec.’22 the forward curve had over $40/ST of contango. As spot has pushed up the front of the curve, the back end has dipped, leaving the curve pretty flat currently. Latest settlement values have the curve at $790 from March ’23 through Q1’24. Since year-end 2022, HR futures prices for quarterly average prices for Q2’23 through Q2’24 have dropped about $35/ST. So, while HR spot is supported, the HR futures market participants are less sure about the next year starting in the second quarter.

Caution remains as market signals remain mixed, evidenced by capacity utilization, which hovers just below 73% as compared to improving business signal surveys.

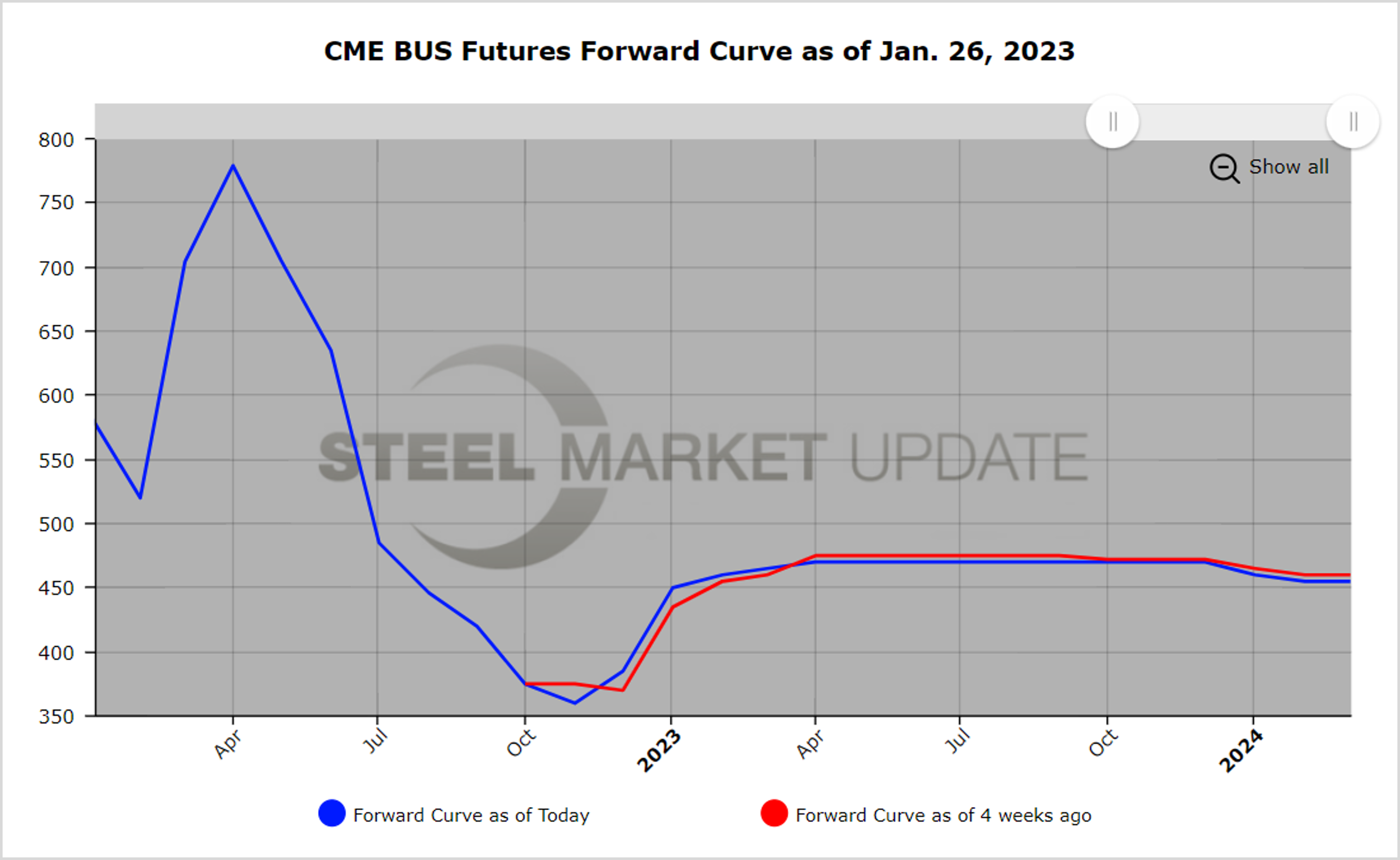

BUS futures had a strong surge coming into January 2023 as the turn of the year cyclical flows helped push prices higher. Near-date BUS futures months have pushed up to the $475/GT level.

Some selling interest has come in and temporarily slowed the price appreciation. Early chatter is mixed for February expectations.

The latest settle for Feb.’23 futures is $460/GT, up slightly from the Jan.’23 settle at $449/GT. Mild winter weather and Federal Reserve moves have kept a lid on prices. However, increased demand could follow if China’s return from the Lunar New Year break has any legs.

By Jack Marshall of Crunch Risk LLC