Analysis

February 21, 2023

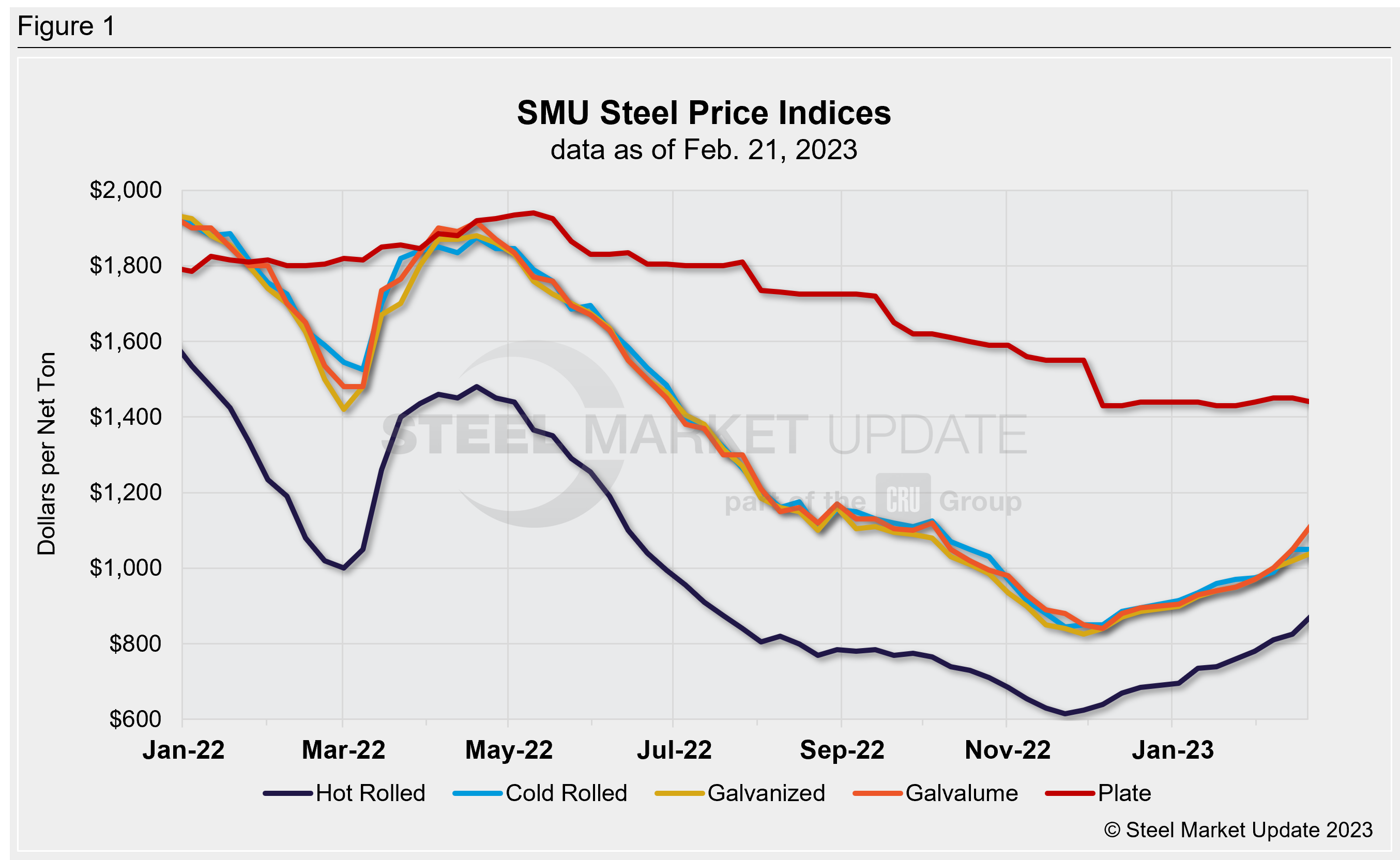

SMU Price Ranges: Sheet Climbs Further, Price Hikes Continue

Written by David Schollaert

Sheet prices increased this week as another blitz of price hikes – this time $100 per ton ($5/cwt) – spurred the market higher.

The latest announcements from the likes of Nucor, Cliffs, US Steel, and ArcelorMittal, all setting a new base price for hot band of $1,000 per ton, are yet to be reflected in today’s pricing. Could we see that level in the not-very-distant future?

Steel Market Update’s hot-rolled coil price now stands at $875 per ton on average, up $50 per ton from last week, eclipsing the $900-per-ton barrier on the top end for the first time since late July.

The difference: HRC prices were roughly halfway through a 24-week pricing collapse, on their way to the mid-$600s per ton by Thanksgiving. The question now is how high they’ll rise. Could they reach or surpass the most recent high of $1,480 per ton set back late last April?!

Mills have now announced increases of $200 per ton since Feb. 2 and $310 per ton since Thanksgiving. That’s more than the $275-per-ton announced in response to the invasion of Ukraine.

Cold-rolled was sideways vs. last week, galvanized is up $20 per ton, while Galvalume is up $65 per ton. Plate prices, though, were down $10 per ton – largely unchanged week on week (WoW).

Most of the sources we contacted don’t expect the price gains to stop anytime soon. They are seeing stronger demand, new capacity being slow to ramp up—and supply perhaps not able to keep up.

All our sheet momentum indicators continue to point upward. Our plate momentum indicator remains at neutral.

Hot-Rolled Coil: The SMU price range is $830–920 per net ton ($41.50–46.00/cwt), with an average of $875 per ton ($43.75/cwt) FOB mill, east of the Rockies. The bottom end of our range increased by $40 per ton, while the top end rose $60 per ton vs. one week ago. Our overall average is up $50 per ton week on week (WoW). Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,000–1,100 per net ton ($50.00–55.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies.Both the lower end of the range and the top end of our range were unchanged compared to one week ago. Our overall average was sideways WoW. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,000–1,080 per net ton ($50.00–54.00/cwt) with an average of $1,040 per ton ($52.00/cwt) FOB mill, east of the Rockies. The lower end of the range rose by $20 per ton WoW, while the top end of our range increased $20 per ton vs. one week ago. Our overall average is up $20 per ton WoW. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,097–1,177 per ton with an average of $1,137 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6–9 weeks

Galvalume Coil: The SMU price range is $1,080–1,150 per net ton ($54.00-57.50/cwt) with an average of $1,115 per ton ($55.75/cwt) FOB mill, east of the Rockies. The lower end of the range rose $80 per ton vs. the week prior, while the top end of our range was up $50 per ton compared to one week ago. Our overall average is up $65 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,374–1,444 per ton with an average of $1,409 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–9 weeks

Plate: The SMU price range is $1,400–1,480 per net ton ($70.00–74.00/cwt), with an average of $1,440 per ton ($72.00/cwt) FOB mill. The lower end of the range was down $10 per ton WoW, while the top end of our range was unchanged compared to one week ago. Our overall average was down $10 per ton, largely sideways WoW. Our price momentum indicator on steel plate is Neutral, meaning we are still unsure whether prices will remain stable, or move up or down over the next 30 days.

Plate Lead Times: 5–8 weeks

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com