Market Data

March 3, 2023

SMU Steel Demand Index Slips, Supply Squeeze Driving Prices?

Written by David Schollaert

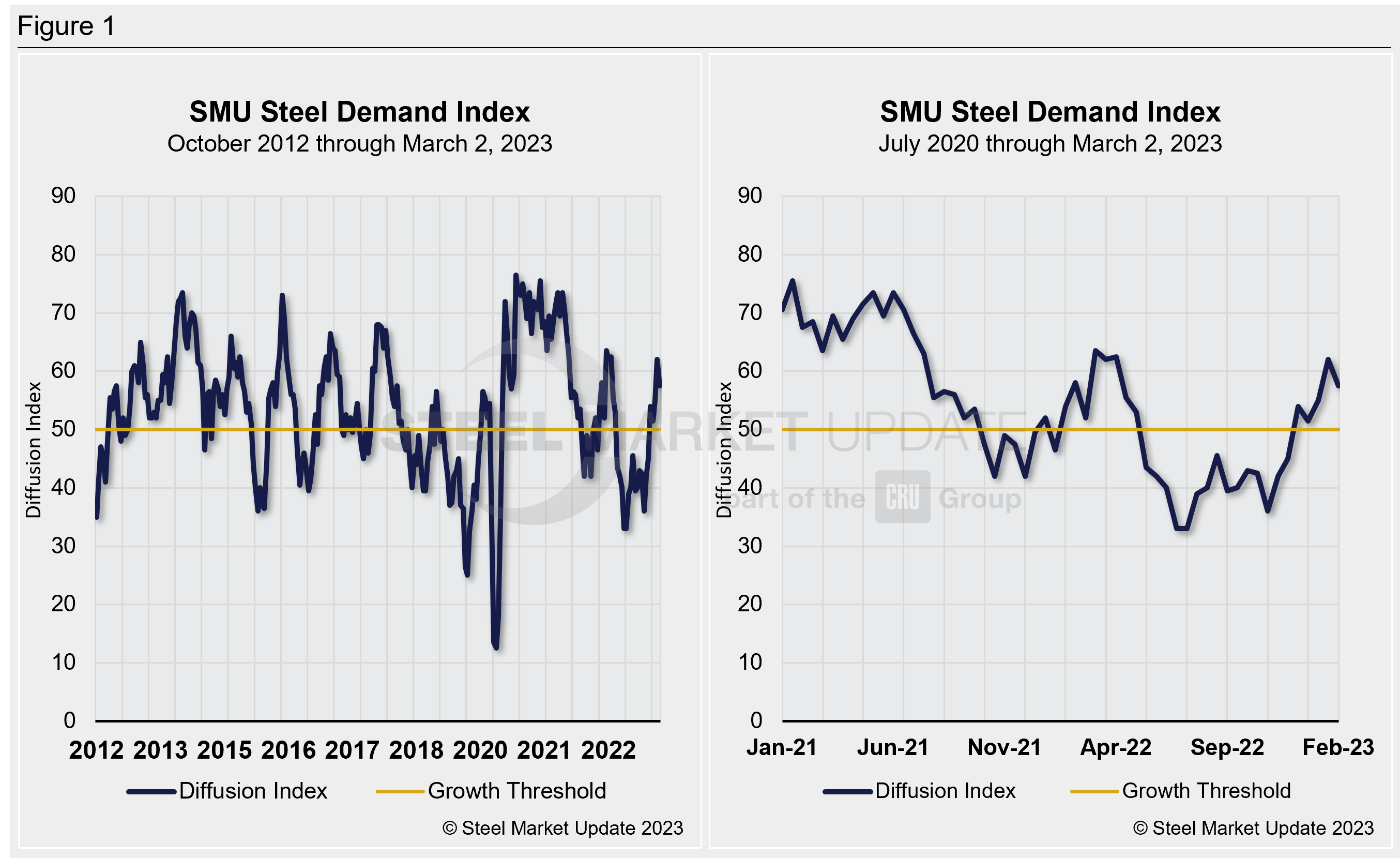

SMU’s Steel Demand Index indicates that the pace of growth has slowed down when it comes to apparent demand for flat-rolled steel in the US.

The index is still above 50, which indicates improving demand. But it is down 6.4 points, following a similar weakening seen in the prior reading in mid-February.

The back-to-back declines follow an uninterrupted string of gains dating back to Thanksgiving.

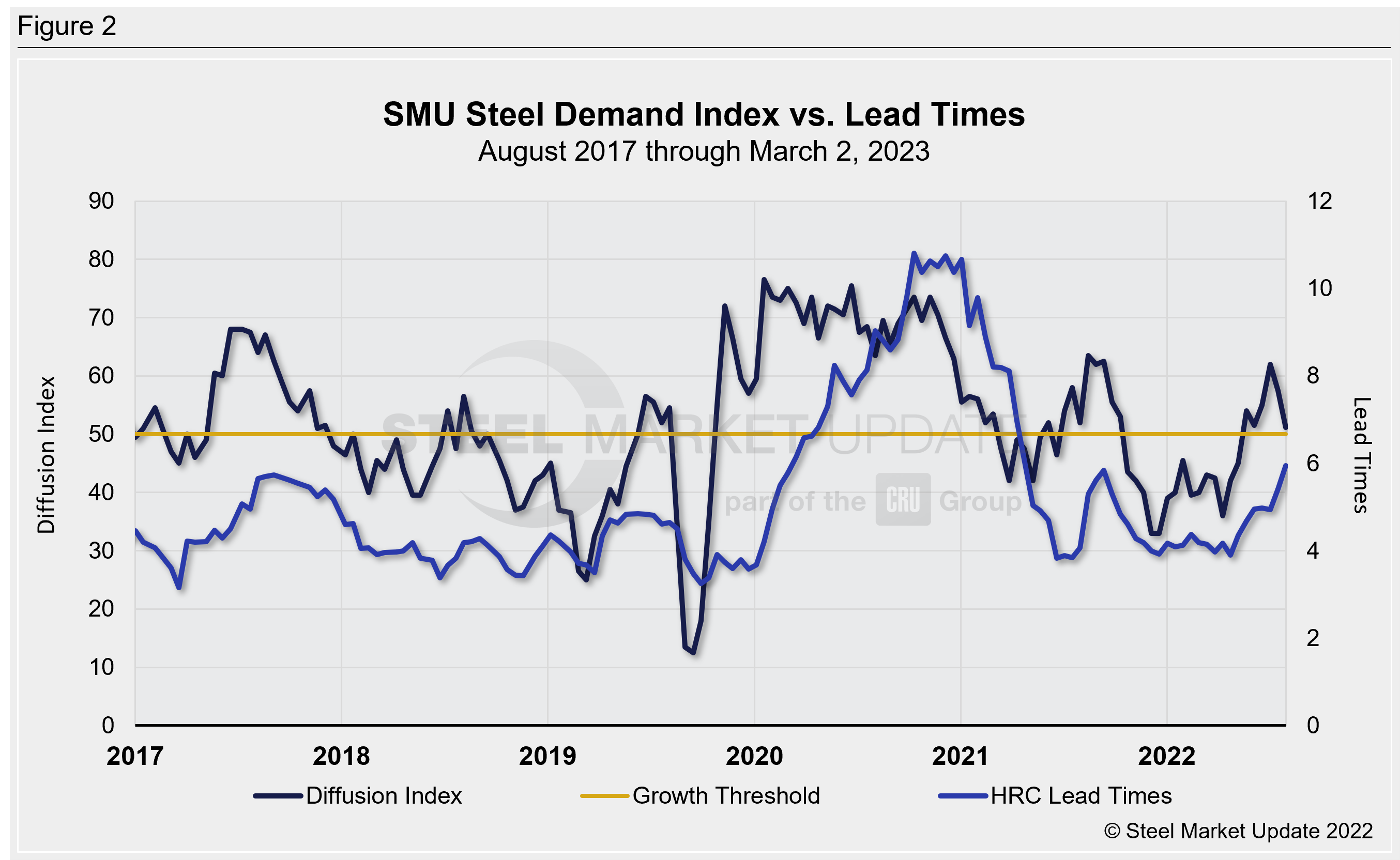

SMU’s Steel Demand Index, which compares lead times and demand, is a diffusion index derived from our bi-weekly market surveys. This index has historically preceded lead times, which is notable given that lead times are often a leading indicator of steel price moves.

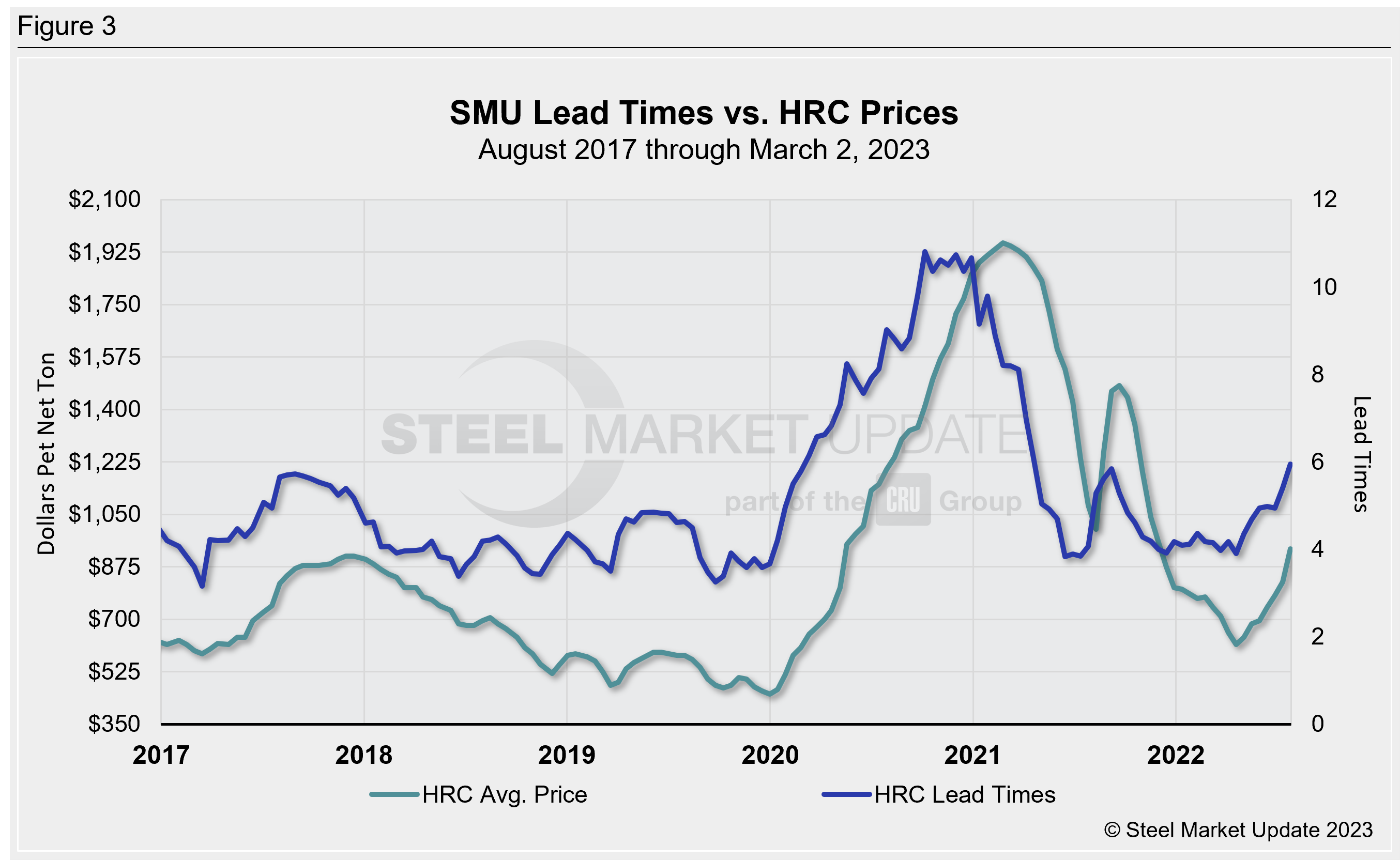

The latest readings were not expected given lead times and prices continue to move upward in tandem. The pricing rally over that last month has been driven by repeated mill price. (Nucor, for example, is up $350 per ton, or $17.50 per cwt, over that period.) Also, lead times are currently at their highest levels since November 2021.

The Steel Demand Index raises an important question: Are prices rising and lead times extending because of improving demand? Or is it predominantly a supply-side squeeze driven by a host of factors including a slower-than-expected ramp-up of new US capacity, production issues at AHMSA, and low import volumes?

Consider the data below. As noted above, an index score higher than 50 indicates an increase in demand and a score below 50 indicates a decrease. Detailed side-by-side in Figure 1 are both the historical views and the latest Steel Demand Index.

The latest demand index registered 51.1 through March 2, down from a reading of 57.5 on Feb. 16, and down from a recent high of 62 at the start of February. (SMU sends out full surveys to the market every two weeks.) The index had been rising since bottoming out at 36 in early November.

In other words, demand, while strong, is no longer improving as quickly as it was earlier this year and in late Q4. And we have no seen the sharpest month-on-month decline since mid-November, before mills began rolling out waves of price increases.

In our prior survey, in mid-February, 24% of respondents said demand was improving vs. just 11% in our early March survey. The declining measure has been roughly steady since mid/late December. And more than 80% of respondents reported that demand was stable in our latest survey results, up from 67% and 60% in our prior two surveys. The big difference: fewer people are reporting that demand is improving.

SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times. (Figure 2 shows the past five years.) Historically, SMU’s lead times have also been a leading indicator for flat-rolled steel prices, and HRC prices in particular. (Figure 3 features the past five years.)

Our hot rolled lead times average at approximately six weeks. Recall that lead times had been steady just below five weeks in January, and marginally lower for much of December before rising sharply in February. They are currently on the higher end of a “normal” range but well below a recent high of 10.74 weeks in July 2021.

The takeaway: While mills continue to drive prices higher, supported by extending lead times, our survey respondents, steel buyers—mainly OEMs and service centers—report steady demand. It appears that supply is not able to keep up with that demand. It’s too soon to say whether this is an early indicator of a potentially shift in pricing or lead times trends. It does, however, indicate that the current pricing surge is not fundamentally demand-driven but rather a supply squeeze.

Note: Demand, lead times and prices are based on the average data from manufacturers and steel service centers who participate in SMU market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.

By David Schollaert, david@steelmarketupdate.com