Plate

March 12, 2023

Plate Report: More Price Gains Expected, Demand Steady

Written by David Schollaert

US plate prices have steadily increased over the past two weeks, largely in response to repeated mill price hikes.

The most recent increase came from Cleveland-Cliffs when the steelmaker aimed to increase base prices for steel plate by at least $60 per ton ($3 per cwt).

It was Cliffs’ first official plate price notice in over two years, but the third market increase since mid-January. Recall that SSAB Americas, another leading US plate producer, has hiked its plate price by $120 per ton thus far this quarter.

Nucor, often the plate market price-setter, has been surprisingly quiet regarding plate pricing announcements. But that might not last much longer, market sources say.

It’s important to note that Nucor has essentially been the unofficial top end of the range for domestic plate prices, but its base price currently serves as the bottom end of our range, a territory largely unfamiliar to the Charlotte, N.C.-based steelmaker.

Nucor’s last notice was back on Jan. 24, when it notified customers that it would prices unchanged. At the time plate prices were $1,430 per ton on average, according to our interactive pricing tool, and have increased by roughly $80 per ton since.

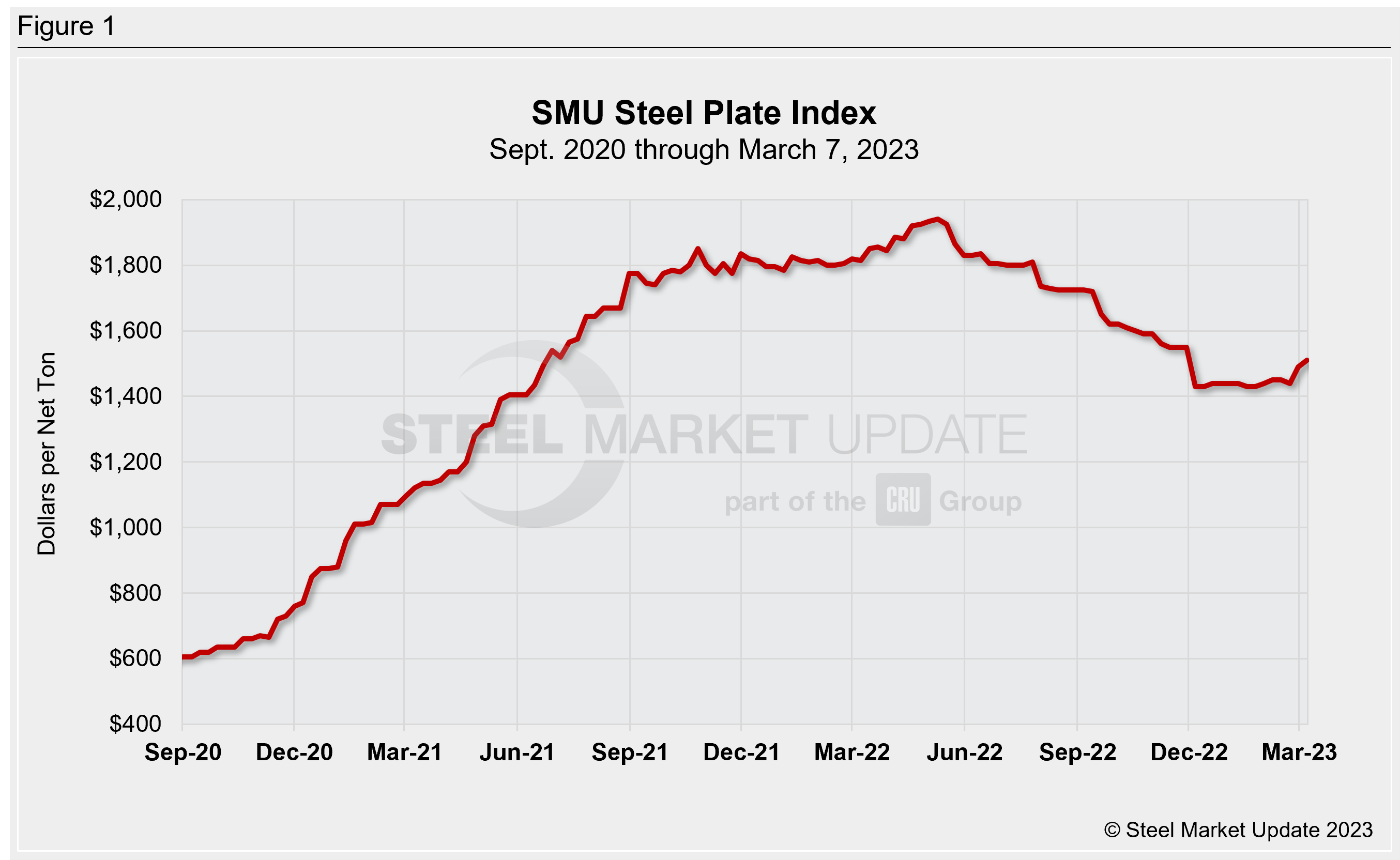

SMU’s most recent check of the market on Tuesday, March 7, placed plate prices between $1,480-$1,540 per ton, with an average of $1,510 per ton FOB mill east of the Rockies – up $20 per ton week-on-week (WoW).

The latest plate market pricing dynamics are displayed below in Figure 1.

Plate sources have told SMU that they expect Nucor’s next plate price announcement to be an increase. Most suggest it could be anywhere between $100-$140 per ton.

“Everyone’s just waiting for Nucor’s price increase announcement,” said a source. “Mills are trying to get the plate price into the $80-per-cwt range.”

“We expect them to increase the price for May, just not sure how much,” said another source. “They will open and close May on the same day and customers won’t get everything they requested.”

“Nucor hasn’t moved from their Feb. 23 price letter, but I expect them to be out with new pricing in the next week or so,” said a third source.

Don’t forget that Nucor has been very vocal about decoupling discrete plate from hot band. It has separated coil and cut-to-length plate from discrete plate to ensure that the latter collects a premium over other products more easily influenced by hot band pricing.

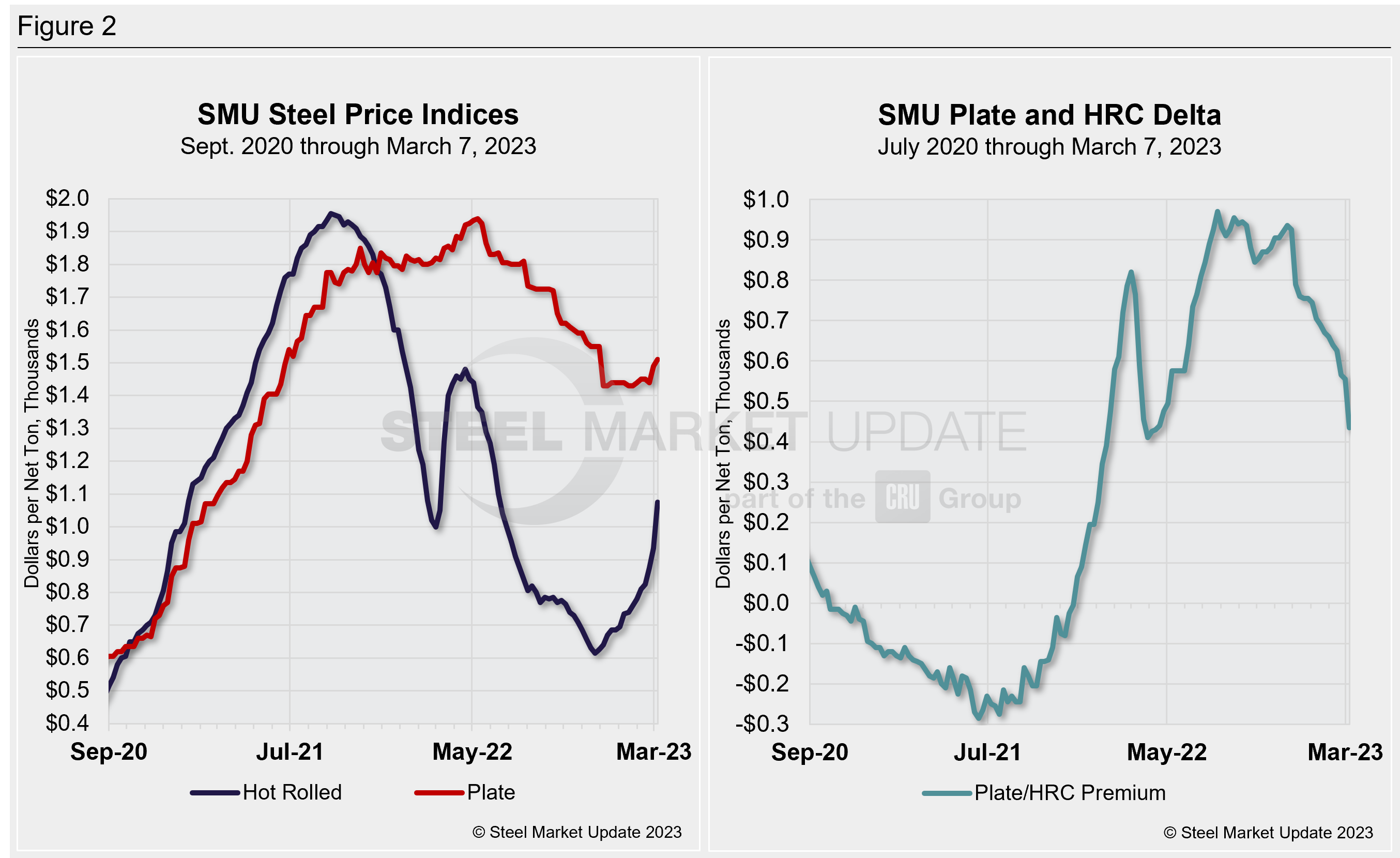

That has been the case until hot-rolled coil prices began to surge with a string of mill price hikes since the new year. We’ve seen the spread (Figure 2) between plate and hot-rolled coil (HRC) reach as high as $970 per ton last summer, though it currently sits at $435 per ton – the tightest spread between HRC and plate in over a year.

Don’t expect that to last much longer.

Steel Market Update’s hot-rolled coil price stands at $1,075 per ton on average as of March 7, up $140 per ton from the week prior and up $390 per ton since the beginning of the year. The latest round of sheet price increases, $150 per ton announced on Friday, March 3, quickly made its way into the market, and further increases are expected.

Hot-rolled coil lead times now stand at 5.95 weeks as of March 2—at their highest point since November 2021— and up from 5.41 weeks in our prior survey. (Results of our next lead time review will be posted on March 16.)

And while demand for plate remains steady, most sources continue to note that mills are focused on controlling order books, likely in a desire to drive prices higher and maintain a premium over HRC.

Discrete plate lead times are also starting to push out. They stand presently on average at 5.67 weeks as of March 2, up from 5.23 weeks in mid-February.

By David Schollaert, david@steelmarketupdate.com