Market Segment

April 4, 2023

SMU Price Ranges: Sheet Up Only Modestly for a Second Week

Written by Michael Cowden

Sheet prices moved slightly higher as domestic steelmakers held to previously announced price increases and as Cleveland-Cliffs rolled out another round of price hikes.

Cliffs had been inching prices above $1,200 per ton ($60 per cwt) before the price hike was announced, some sources noted. It’s not clear whether other producers will follow Cliffs’ move.

Recall that Cliffs rolled out a sheet price hike of $100 per ton on Monday, bringing its target base price for hot-rolled coil to $1,300 per ton from $1,200 per ton previously.

The increase did not inspire the same frenzy that similar price hikes did in the first quarter. Sources noted that the spot market has remained relatively quiet despite the price increase.

SMU’s hot-rolled coil price stands at $1,155 per ton, up $10 per ton from a week ago. It’s the second consecutive week of modest gains. In early March, in contrast, we saw HR prices increase $140 per ton in a single week.

Prices for valued-added sheet products also rose modestly, with cold-rolled up $10 per ton, galvanized base prices up $25 per ton, and Galvalume up $10 per ton. Our plate price was unchanged.

Our price momentum indicator continues to point higher for all products.

Hot-Rolled Coil: The SMU price range is $1,100–1,210 per net ton ($55.00–60.50/cwt), with an average of $1,155 per ton ($57.75/cwt) FOB mill, east of the Rockies. The bottom and top end of our range increased by $10 per ton vs. one week ago. Our overall average is also up $10 per ton week on week (WoW). Our price momentum indicator for hot-rolled coil points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,300–1,400 per net ton ($65.00–70.00/cwt) with an average of $1,340 per ton ($67.00/cwt) FOB mill, east of the Rockies. The lower end of our range was up by $20 per ton, while the top end was flat compared to a week ago. Our overall average is up $10 per ton WoW. Our price momentum indicator on cold-rolled coil points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,300–1,400 per net ton ($65.00–70.00/cwt) with an average of $1,350 per ton ($67.50/cwt) FOB mill, east of the Rockies. The lower end of our range was up $50 per ton. The top end was unchanged WoW. Our overall average is up $25 per ton vs. the prior week. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,397–1,497 per ton with an average of $1,447 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5–10 weeks

Galvalume Coil: The SMU price range is $1,340–1,440 per net ton ($67.00-72.00/cwt) with an average of $1,390 per ton ($69.50/cwt) FOB mill, east of the Rockies. The lower end of the range was unchanged vs. the week prior, while the top end of our range increased by $20 per ton compared to one week ago. Our overall average is up $10 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,634–1,734 per ton with an average of $1,684 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8–10 weeks

Plate: The SMU price range is $1,520–1,590 per net ton ($76.00–79.50/cwt), with an average of $1,555 per ton ($77.75/cwt) FOB mill. Both the lower end and the top end of the range were unchanged WoW. Our overall average was flat WoW. Our price momentum indicator on steel plate is pointing Higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 5–10 weeks

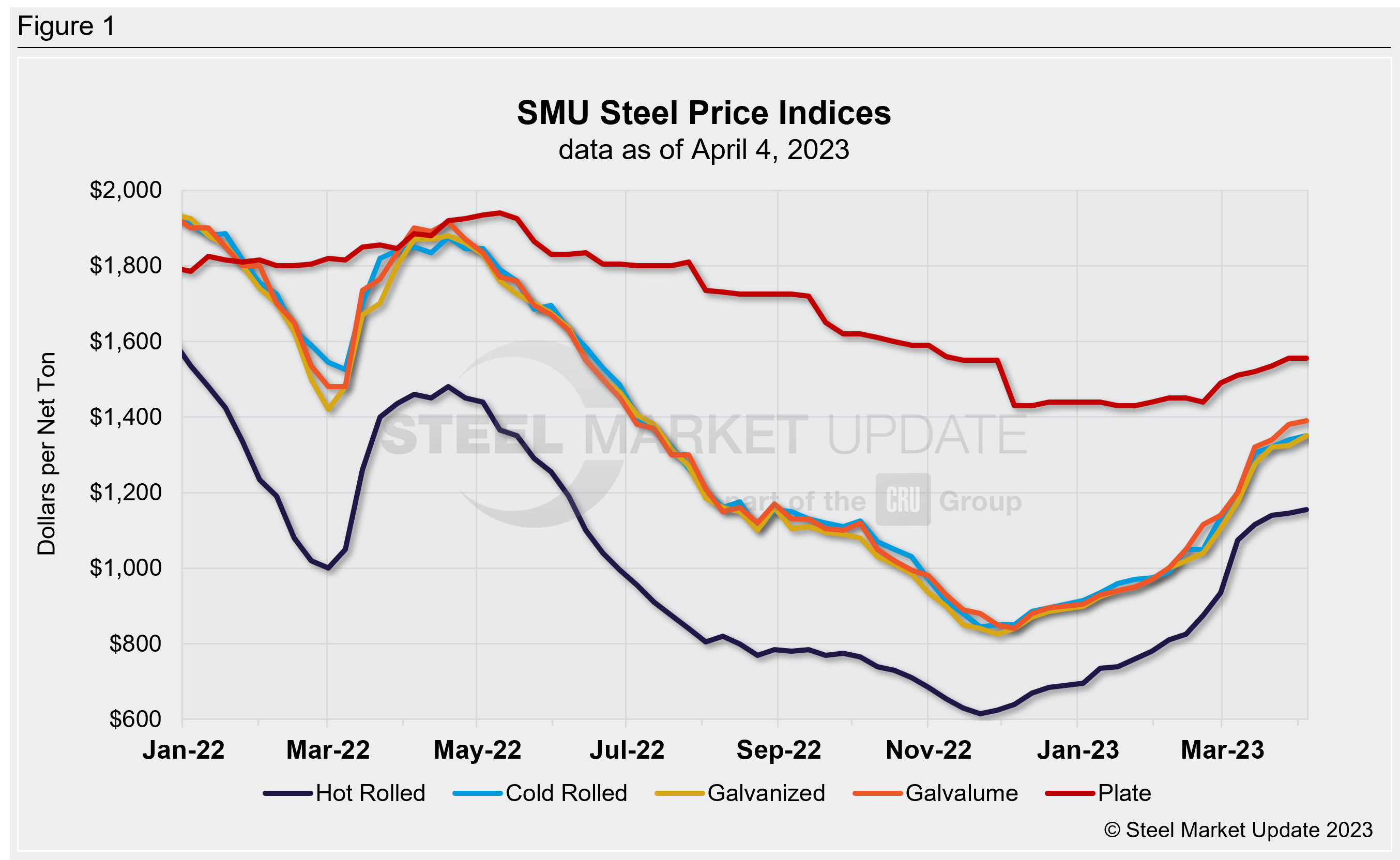

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Editor’s note: The initial version of this article, published on Tuesday, March 28, did not include updated plate prices. It was subsequently updated to reflect the correct prices shown above. Prices on our website and in our interactive pricing tool were updated correctly and on time.

By Michael Cowden, michael@steelmarketupdate.com