Prices

May 11, 2023

Futures: The Slow Erosion of HR Prices

Written by Jack Marshall

After surprising the market watchers of HR futures in the first week of May, the index finally gave back $40 per short ton (ST) in the second week, coming in just shy of $1,130/ST.

Interestingly, the May futures settlement was almost unchanged from April 10 . While the market may be in a hurry for price corrections, the indexes prove they tend to lag.

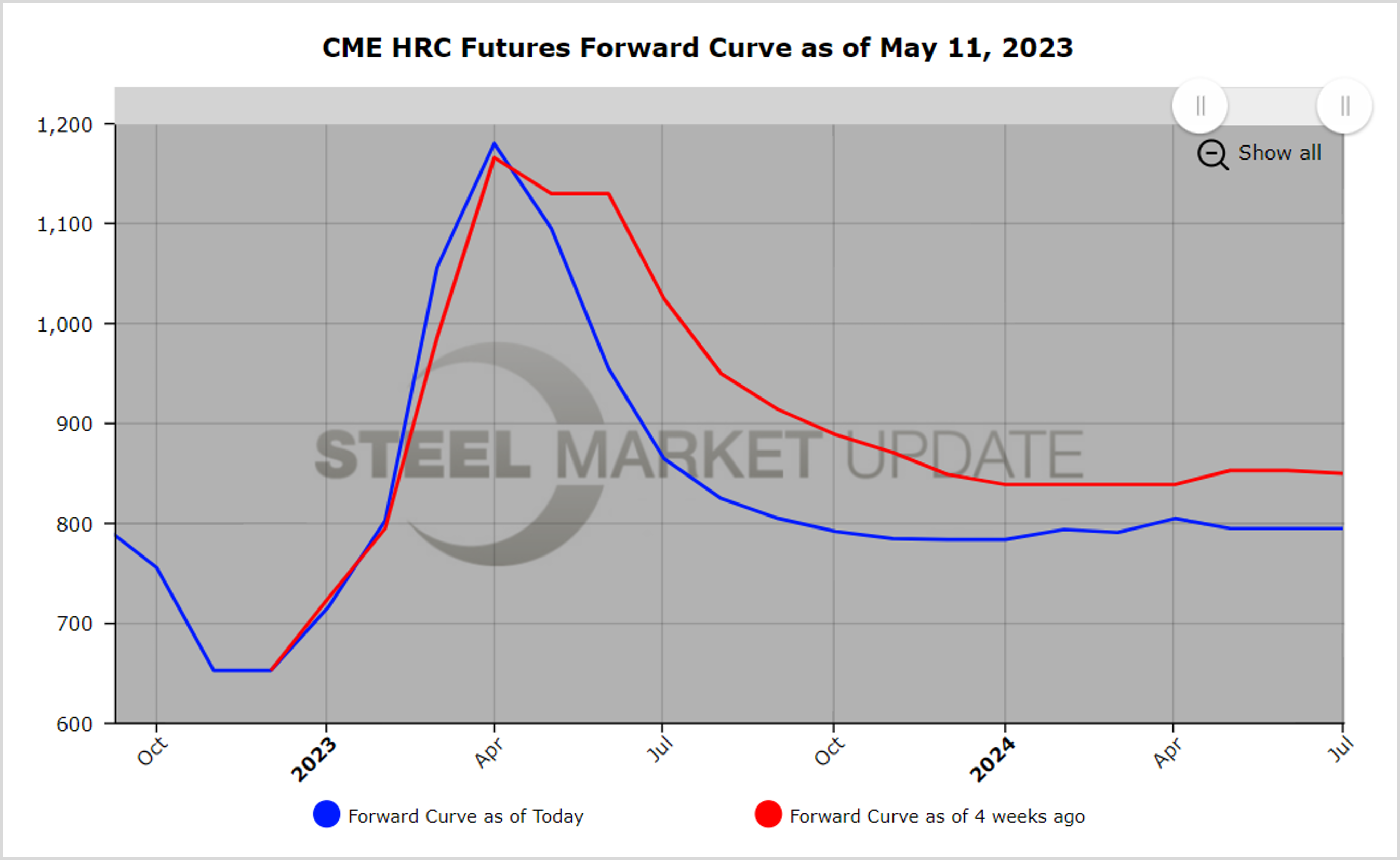

Reports of scarce physical activity, along with declining lead time deliveries from mills, seem to have increased bearish sentiment. Softness in global steel demand, as well as increasing imports, have only added to concerns that prices could slide further. In spite of the steeply backwardated futures curve, hedging participants are still wary that prices could slide even further, which appears to be muting volumes. In addition, the steep decline in prices between futures months is adding to concerns for service centers of being stuck with expensive contract tons should the velocity of the price decline increase. Lower spot volumes tend to slow the index prices declines.

In the last month, futures volumes have been steady with just under 20,500 lots traded. Open Interest finished April just above 30,200 lots. We have seen a slight erosion in activity as participants remain on the sidelines due to reduced physical activity. Over the last month, settlement prices have eroded somewhat: Q3’23 prices have on average declined by about $55/ST, Q4’23 prices have on average declined by about $45/ST, and 1H’24 quarterly prices have eased roughly $25/ST.

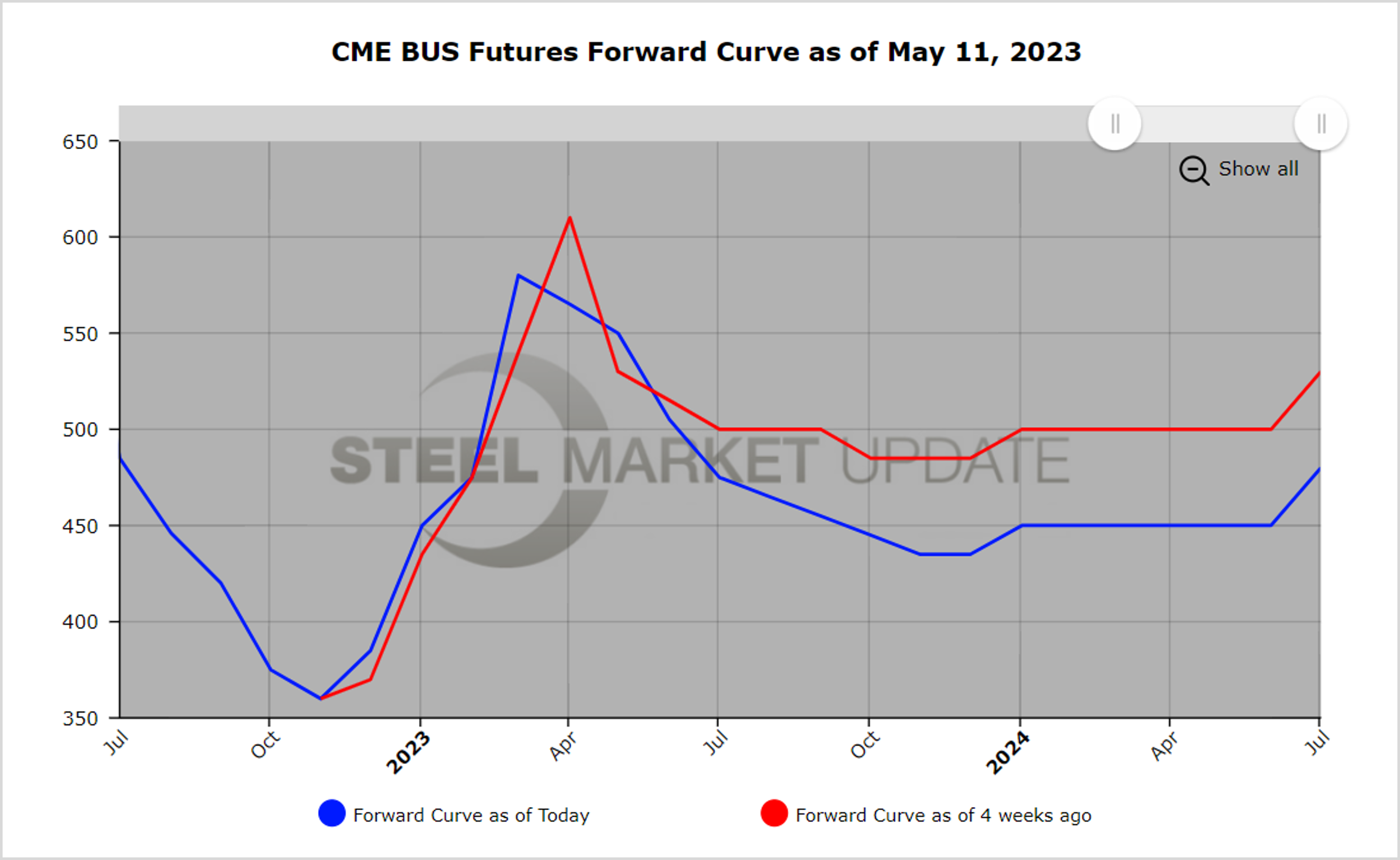

Receding global demand for scrap left export prices considerably lower with 80/20 in the $375/ton range. While the market was anticipating a $25-30 price decline in BUS for May.

The market demand for prime scrap kept BUS above $550/ST for May’23 value, less than a $16/GT decline. Will the scheduled summer model changeovers at the auto manufacturers be enough to offset the increased EAF capacity that is coming on-line? The jury is still out on that. BUS prices have been proving to be very sticky.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop. It will be held on April 26 in Chicago. Learn more and register here.

By Jack Marshall of Crunch Risk LLC