Prices

July 27, 2023

HRC Futures Continue on Roller Coaster

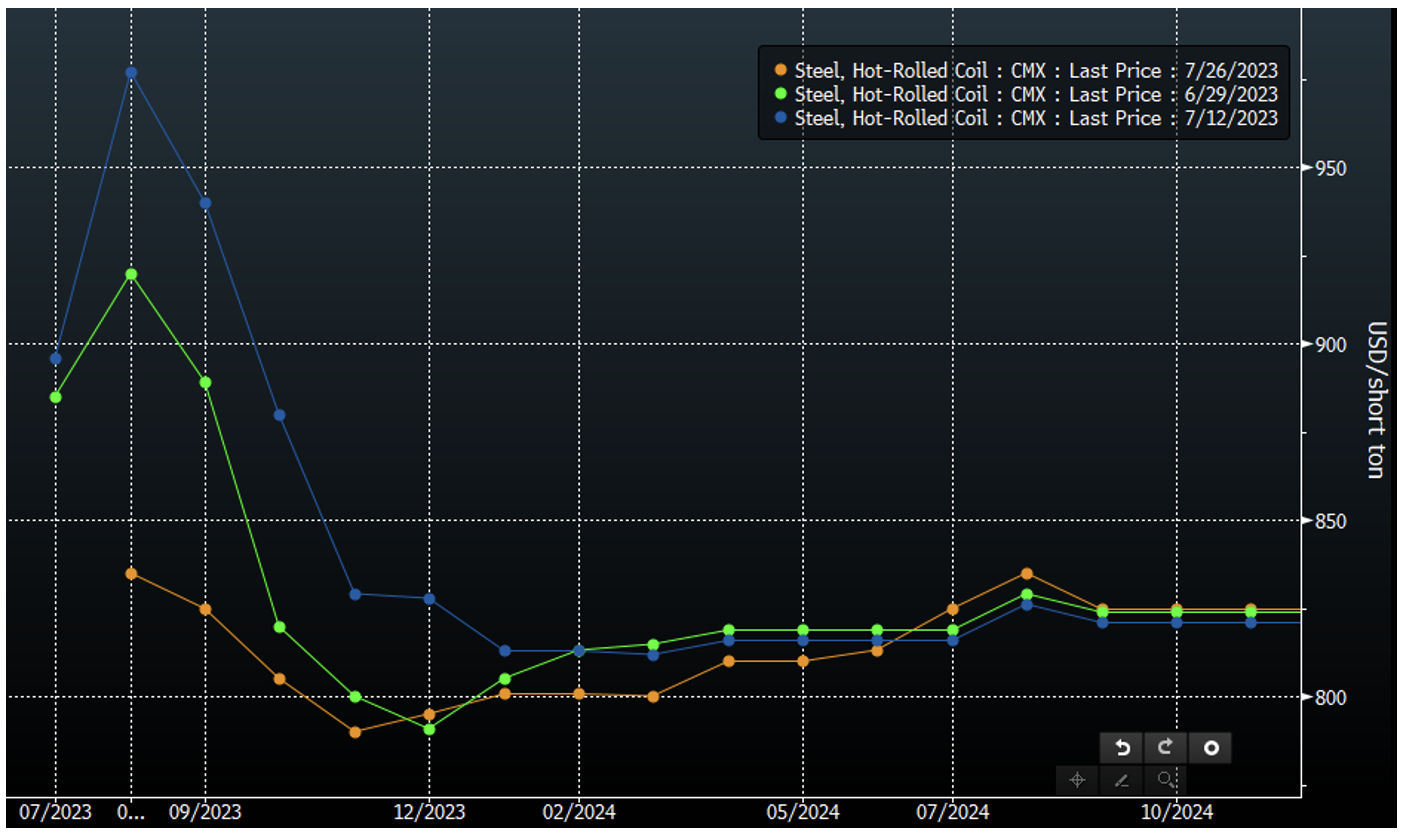

The US HRC Futures market has been on a roller coaster ride since our last update (green). In early July, the front month futures contracts surged significantly as news of Steel Dynamics Inc.’s (SDI’s) Sinton, Texas, mill outage trickled through the market (blue). However, the futures quickly reversed course and experienced a sharp decline, following sustained downward pressure on spot pricing and capitulation by domestic producers once it became clear they would not achieve their announced targets of $950-900. This resulted in the first four monthly contracts reaching the lowest levels in nearly seven weeks (orange). These fluctuations have been notable, reflecting the volatility in the steel market.

The large spot market swings of the past few weeks indicate that the physical market is uncertain and lacking conviction, which has created a choppy futures market environment. The current historically low inventory levels have certainly contributed to the volatility, making physical market participants more sensitive to sudden changes in spot prices and slight fluctuations in lead times.

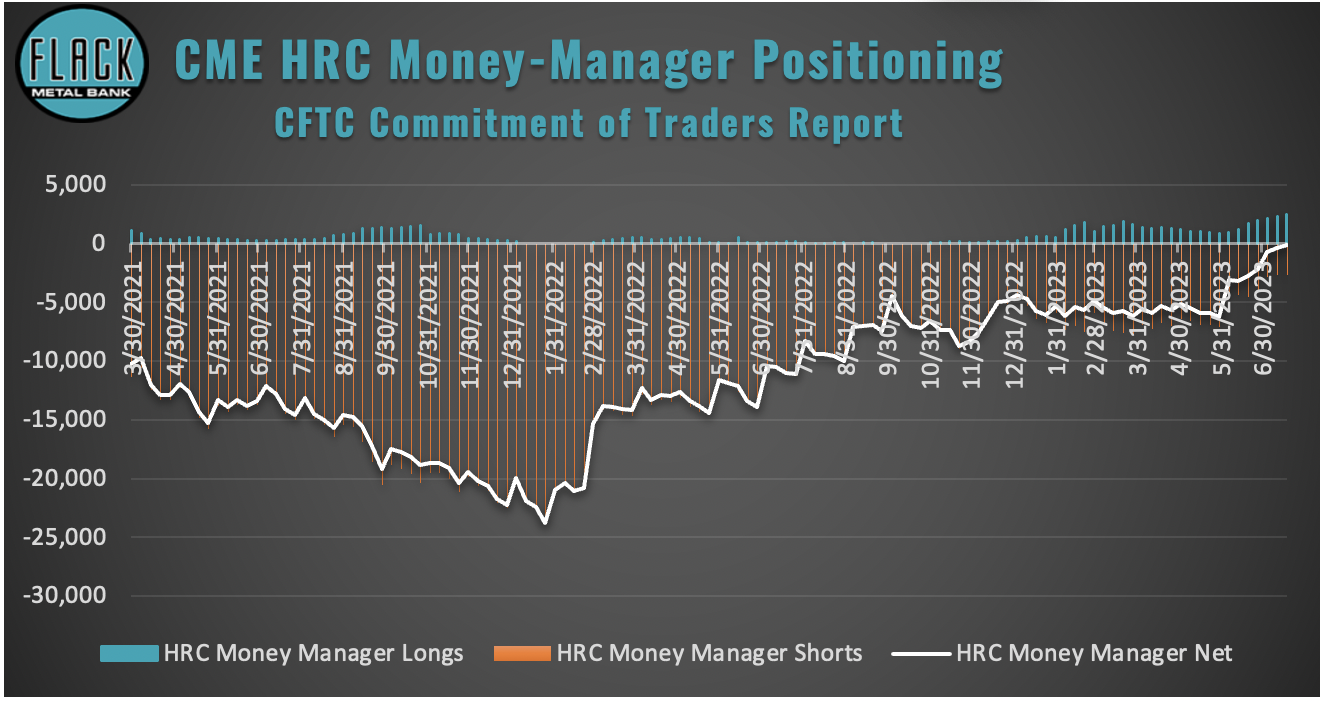

On the paper side, the market is currently experiencing another constraint in liquidity and participation. As a percentage of total open interest in US HRC futures, recent CFTC filings show that speculative traders have reduced their participation to the low single-digits, indicating that money managers have either moved to the sidelines or reallocated capital to other commodity products. While reduced participation by speculative traders could present challenges for hedgers to source sufficient liquidity for risk mitigation, overall open interest in HRC futures contracts remains healthy compared to the five-year trend. This indicates that other market players have stepped up their activity to offset the impact left by money managers.

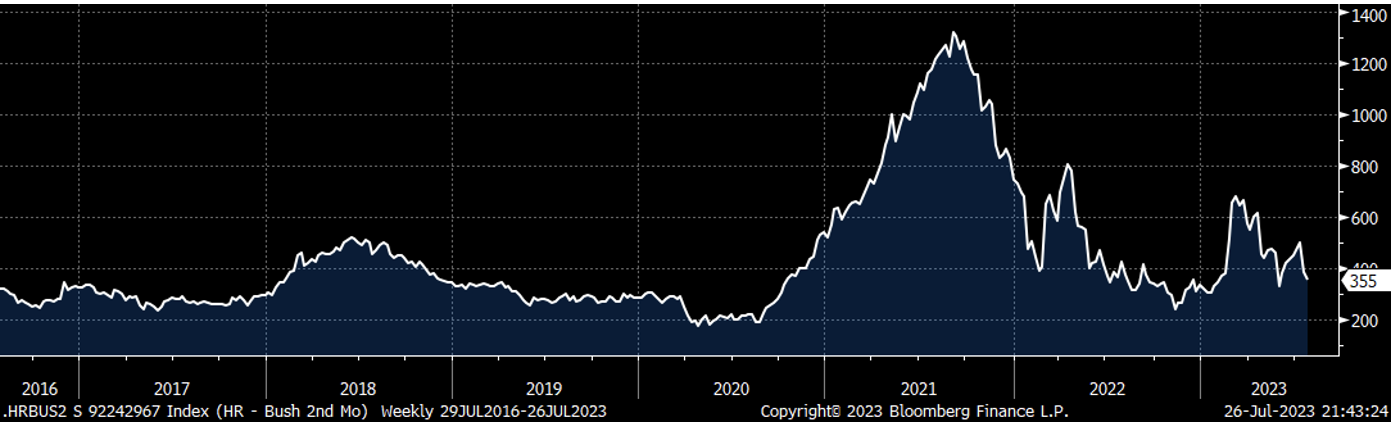

Recent price movements suggest that mills might have encountered difficulties in reaching their price-hike targets as patient buyers have opted to wait and procure steel as necessary, leading to a decline in US HRC prices and putting pressure on the EAF Mill margin. While mill margins have fallen from peak levels, the current mill margin is healthy compared to the long-term average and even showed improvement earlier this month when scrap prices settled at the lowest level in five months.

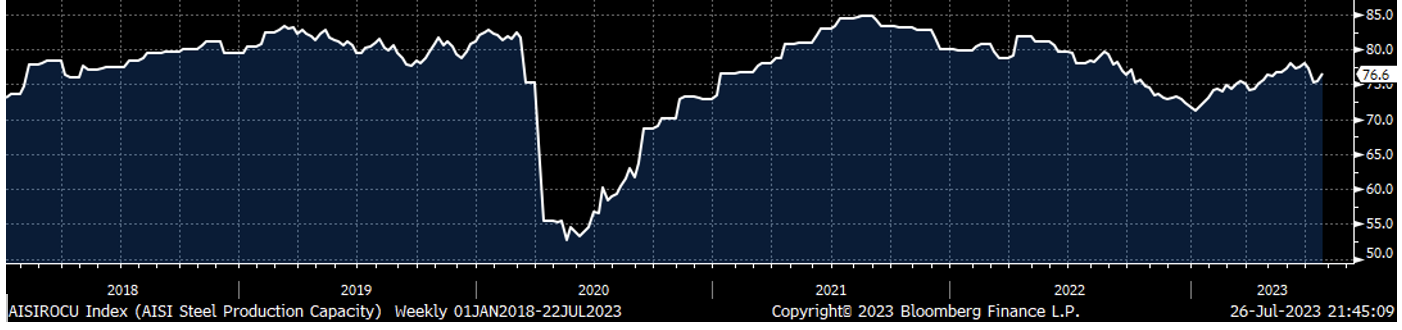

In response, domestic producers have taken action by adjusting production levels, resulting in a capacity utilization rate of 76.6%. This figure is seen as neutral, giving mills the flexibility to adjust their output as needed, either increasing or decreasing production accordingly.

EAF Mill Margin:

AISI Capacity Utilization Rate:

Some industry participants believe spot prices will be supported by low inventory levels that will trigger restocking, while others would argue that restocking is not necessary with reasonable lead times at the domestic mills. Furthermore, the domestic-global price differential continues to make cheaper imports available. However, recent data indicates that domestic availability has discouraged consumers from taking the added risks associated with importing foreign material.

Moreover, recent price hikes may have led to a pull-forward of demand, meaning that some buyers who would have made purchases during this upcoming period have already done so. As a result, there could be gaps in demand over the coming weeks as those buyers might not be active in the market during this period.

In conclusion, the US HRC Futures market has been a wild ride of ups and downs, reflecting the volatility in the steel market. The physical market’s uncertainty and historically low inventory levels have contributed to the choppy futures market environment, with spot market swings underscoring the need for robust risk management strategies. The evolving dynamics in the steel market warrant careful observation and strategic decision-making for all participants involved.

By Sean Kessler

About Flack Global Metals

In 2010, Flack Global Metals (FGM) was founded with the mission to reinvent how metal is bought and sold. Over 13 years later, the company has evolved into a hybrid organization combining an innovative domestic flat-rolled metals distributor and supply chain manager, a hedging and risk management group supported by the most sophisticated ferrous trading desk in the industry known as Flack Metal Bank (FMB), and an investment platform focused on steel-consuming OEMs called Flack Manufacturing Investments (FMI). Together, these entities deliver certainty and provide optionality to control commodity price risk in the volatile steel industry.