Market Segment

August 4, 2023

July Import Licenses Decline Dramatically

Written by Laura Miller

US steel imports look to have fallen significantly during the month of July, according to license data from the US Department of Commerce collected through July 31.

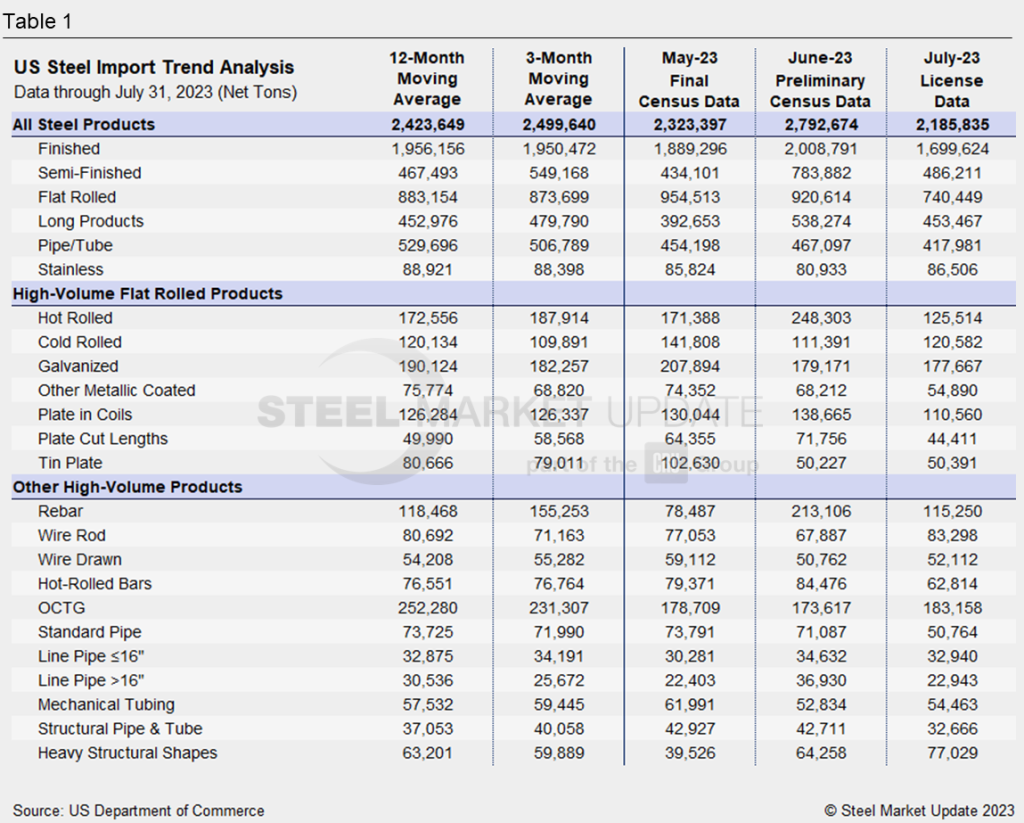

Commerce counted 2,185,835 net tons of licenses to import steel for July. Compared to June’s preliminary import count, this is a 22% month-on-month (MoM) decline. July’s count is the lowest in eight months and is down 18% from July 2022 (see Fig. 1)

Recall that license counts can differ from preliminary and final figures, as licenses are required to be obtained before actual importation.

All major product categories saw double-digit declines, except for stainless steel, which saw a 7% MoM rise (see Table 1).

Compared to June’s preliminary figures, semi-finished steel import licenses were down 38% and finished steel licenses were down 15%. Declines of 20% were seen in flat rolled licenses, of 16% for long products, and of 11% for pipe and tube.

Licenses to import slab, at 335,547 tons in July, were down 34% from June’s count. As you may recall, China, while not typically a supplier of slab to the US, sent 55,115 tons in June, but made no shipments in July, according to the license count. Slab shipments from Mexico were down by nearly half from the month prior, with 52,537 tons of licenses in July.

On the flat rolled side, licenses to import hot rolled were down by almost half from the month prior. Shipments from Canada fell to a recent low of 74,636 tons, down from 110,503 tons in June.

Coiled plate and cut-to-length plate licenses were down 20% and 38%, respectively, from June. Coiled plate shipments from Canada declined by 25% MoM. Cut plate shipments from South Korea slowed considerably, with 10,258 tons of July licenses down from June’s recent high of 39,673 tons.

We’ll take a deeper look at July imports when preliminary figures are released later this month.