Analysis

August 29, 2023

Final Thoughts

Written by David Schollaert

We’re roughly a week removed from the 2023 Steel Summit and some of the discussions, both on stage and the the sidelines of the event, remain of critical importance to many in the industry.

Between some of my weekly calls and early survey results, the possible United Auto Workers (UAW) union strike and what the domestic steel landscape may look like with the potential sale of U.S. Steel are still hot topics.

I also had the privilege today to join in on HARDI’s monthly call. The expiration of the current UAW labor contract with Ford, General Motors, and Stellantis on Thursday, Sept. 14, at 11:59 p.m. ET, again controlled a solid portion of the discussion.

It’s still early, and we have more data coming in as we speak in this week’s survey, but some early indications from the market that might be compelling to look at considering the UAW situation.

Seventy-seven percent of survey participants – namely survey center and OEM executives – believe a strike is imminent. A week ago we kicked off the Summit with a snap poll, and revealed that 67% of the 1,400-plus in the room thought a strike would happen. But what hasn’t changed, is the sentiment that most believe it will not last that long.

Here’s what some of those who replied had to say:

“There will be a strike, but it will be short-lived.”

“The strike seems to be imminent.”

“Maybe a new deal as a strike would be bad for all.”

“40% wage increase and 32-hour work week? Get real.”

“The two sides are far apart on wages.”

“UAW has an $800,000,000 strike fund, according to my sources. They have time/money to hold out.”

“A strike against one but not all three.”

“If a strike happens, it will be very short – possibly two weeks.”

“I’m going to say, “New Deal,” just because I hope so. In reality, there probably will be a small stoppage, though.”

“Unlikely to be an extended strike. It’s not in the union’s interest or the automakers’ interest.”

“Duration remains to be seen.”

“The wage levels requested are very high.”

Are Prices Near a Bottom?

It’s not much of a surprise that we’ve seen a bit of a shift from survey participants when it comes to prices, and when they expect them to bottom. This is especially true given the sentiment expressed above.

Just two weeks ago, 20% of respondents believed sheet prices had already bottomed, and that has shifted to just about 7%. And now 84% believe tags will likely bottom in either September or October, a boost from just two weeks ago when 60% believed that to be the case (Figure 1).

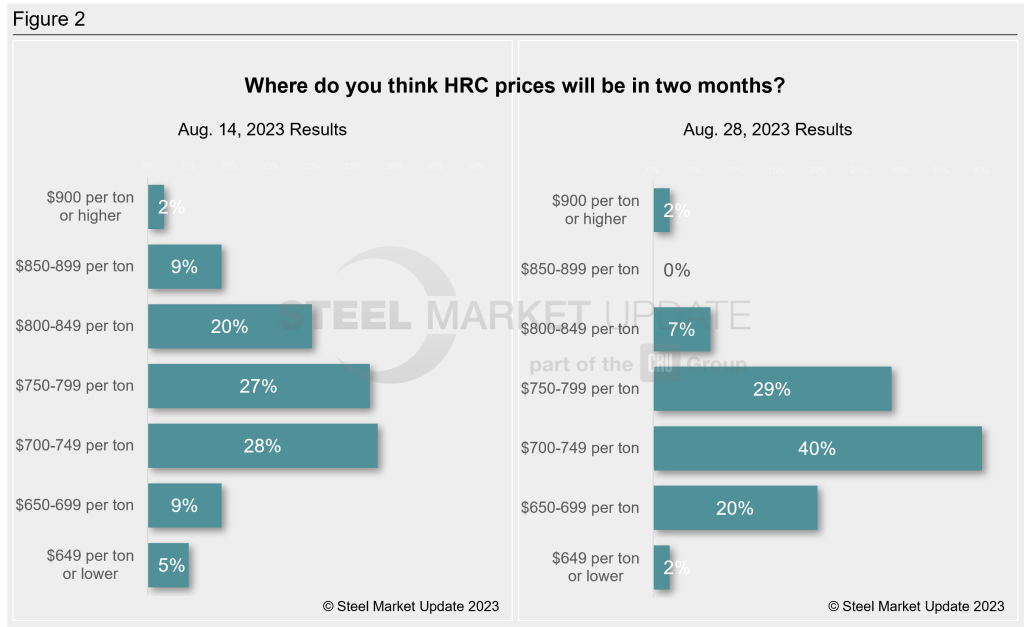

But it’s not just when prices will bottom but where they’re expected to be two months from now, early in the fourth quarter (Figure 2).

Just two weeks ago, sentiment was a bit mixed. A solid 28% believed prices would be roughly where they are now, between $700-749 per ton ($35.00-37.45 per cwt) halfway through October. And just about 14% expected tags to be in the $600s or lower. In total, just about 40% expected hot band tags to be sideways-to-down from where they presently are.

As of now, more than 60% of those polled in this week’s SMU survey anticipate hot-rolled coil prices to be where they currently are or lower come late October. The major shift is where less than 10% expect prices to be at or above the $800-per-ton mark.

The results support the idea that many, if not most, in the market believe the UAW will strike against at least one of Detroit’s Big Three, but that the downtime will not be an extended one. The current deal expires halfway through September, and by this simple measure, most suspect a deal will be in place by the time September ends, or at the latest sometime in October.

I recall Timna Tanners, managing director of Wolfe Research, stating during the Steel Forecast Panel on the first day of the Summit that roughly 90,000 tons of steel would find its way into the spot market every month if the UAW went on strike vs. Stellantis.

In Sunday’s Final Thoughts, managing editor Michael Cowden took us down memory lane and looked at some lessons learned from the last time the UAW negotiated a new labor deal back in 2019. I encourage you to give it a read if you haven’t already.

The precedent is helpful as we work through the ramp-up in anticipation of the next couple of weeks leading up to the expiration of the current deal. But one thing to keep in mind is that back in 2019, auto inventories were much higher than they are now.

According to a recent report by Cox Automotive, inventory supply was nearly 4 million vehicles for a 95-day supply back in June 2019. Presently, based on July’s data, the total US supply of available unsold new vehicles is about half that at 1.96 million.

Ultimately, SMU doesn’t predict or forecast, and I’m not going to shift away from that, but it’s fair to argue that if a strike does indeed take place – between the UAW and at least one of the automakers – not only could the price decline drastically outpace the ~20% fall seen in 2019’s strike when the union held a six-week work stoppage at GM, but it would be fair to reason that the ~30% snapback could also be considerably outdone as automakers rally to build back potentially historically low inventories.

The next couple of weeks will be closely monitored, and there will be no shortage of talk about the potential work stoppage by UAW members and Detroit’s Big Three.

Steel 101 Workshop

We are less than two months away from our LIVE Steel 101 Workshop: An Introduction to Steelmaking and Market Fundamentals training course. It will be held in Charleston, S.C., on Oct. 24-25. The workshop will include a tour of Nucor’s Berkeley steel mill. Click here to register.

From all of us at SMU, we’d like to thank you for your business.