CRU

January 16, 2024

CRU: Turkish scrap prices rise driven by restocking as sellers return

Written by Rosy Finlayson

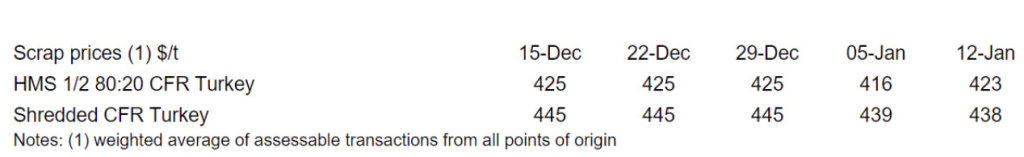

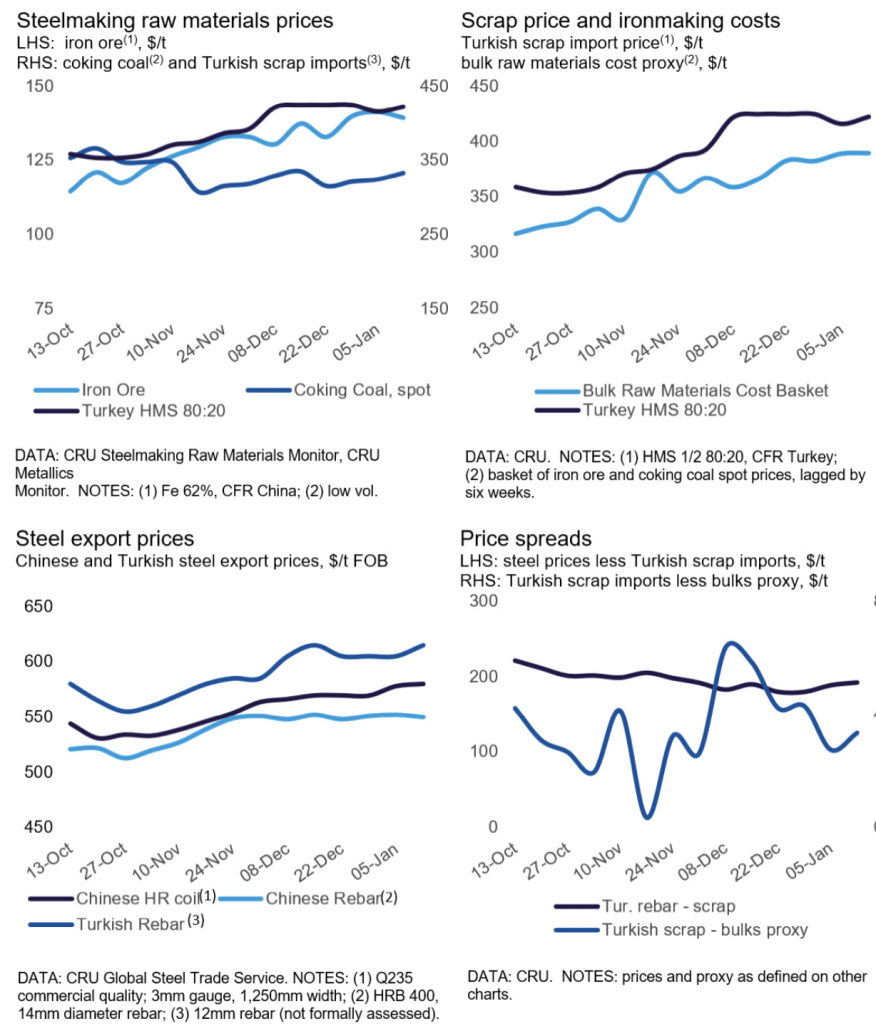

Turkish scrap import prices increased last week with CRU’s assessment for HMS1/2 80:20 at $423 per metric ton (t) CFR, up by $7/t week over week (w/w) but down $2/t month over month (m/m). This was driven by a pickup in buying activity.

The increase in Turkish scrap prices was driven by buyers actively purchasing scrap last week from sellers in Europe and the US who returned from the holiday period. For similar reasons, Turkish finished steel prices rose by $10/t for rebar, and by $5/t for hot-rolled (HR) coil, to $615/t FOB and $695/t FOB, respectively. This was partly due to a mild demand recovery after the holiday period. However, market participants remain cautious and await further clarity on price developments as demand has not shown significant signs of improvement.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.