Plate

April 9, 2024

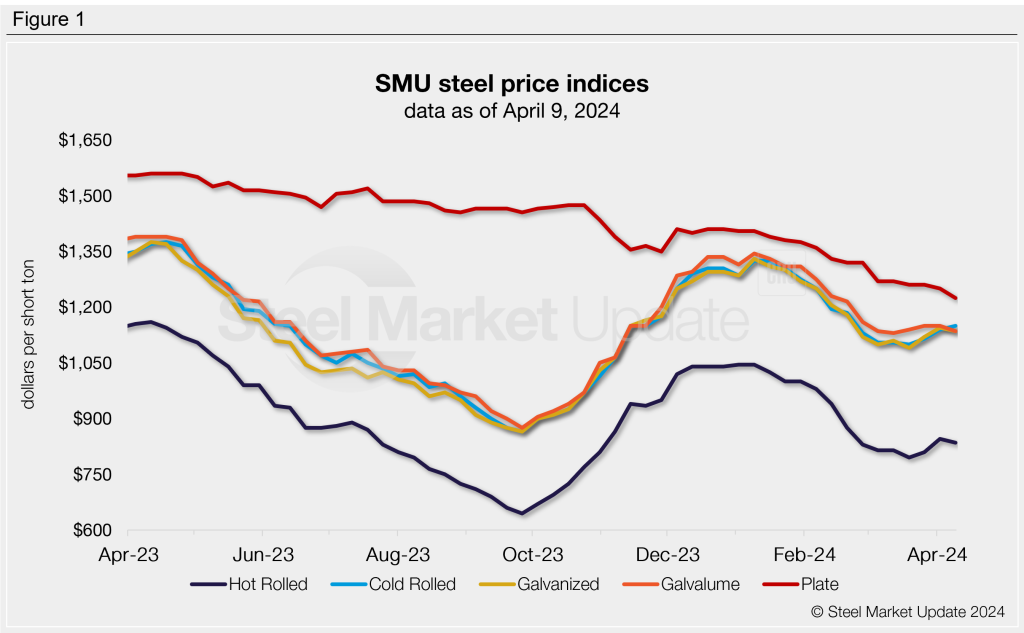

SMU price ranges: Sheet slips, plate lower again

Written by Brett Linton & David Schollaert

Sheet prices saw a slight momentum shift this week after consecutive gains in the prior two weeks. Plate edged lower on greater competition and easing demand, according to our latest check of the steel market.

SMU’s average hot-rolled (HR) coil price ticked down by $10 per short ton (st) from last week to $835/st this week. The shift occurred in part because Nucor’s inaugural HR spot price ($830/st) resulted in a narrowing of our price range.

Reaction to the move was mixed. Most of those surveyed by SMU were indifferent to its impact on the HR market.

Cold-rolled (CR) and coated sheet price trends were mixed. CR inched up $10/st w/w to $1,150/st. Galvanized and Galvalume slipped $10/st and $15/st, respectively, falling to $1,135/st. Some market participants said CR prices have remained higher in part because of production issues at a mill that has also seen an influx of automotive business.

Plate prices fell, losing $25/st w/w to settle at $1,225/st this week. Sources have told SMU that sellers are undercutting published mill prices to win sparse spot business.

SMU changed its sheet price momentum indicators from higher to neutral this week. The adjustment in part reflects Nucor’s surprise announcement, which has made the near-term direction of sheet prices less certain. We changed our plate price momentum indicator from neutral to lower.

Hot-rolled coil

The SMU price range is $810-860/st, with an average of $835/st FOB mill, east of the Rockies. The lower end of our range increased $20/st w/w and the top end declined $40/st. Our overall average is down $10/st compared to last week. Our price momentum indicator for HR is now at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-9 weeks, averaging 5.36 weeks as of our March 28 market survey.

Cold-rolled coil

The SMU price range is $1,100–1,200/st, with an average of $1,150/st FOB mill, east of the Rockies. The lower end of our range remained unchanged w/w, while the top end increased $20/st. Our overall average is up $10/st from the previous week. Our price momentum indicator for CR is now at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 6-12 weeks, averaging 7.84 weeks through our latest survey.

Galvanized coil

The SMU price range is $1,100–1,170/st, with an average of $1,135/st FOB mill, east of the Rockies. The lower end of our range is $10/st higher w/w, while the top of our range declined $30/st. Our overall average is $10/st lower than last week. Our price momentum indicator for galvanized is now at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,197–1,267/st with an average of $1,232/st FOB mill, east of the Rockies.

Galvanized lead times range from 6-11 weeks, averaging 7.63 weeks through our latest survey.

Galvalume coil

The SMU price range is $1,090–1,180/st, with an average of $1,135/st FOB mill, east of the Rockies. The lower end of our range declined $10/st w/w, while the top end decreased $20/st. Our overall average is down $15/st compared to the previous week. Our price momentum indicator for Galvalume is now at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,384–1,474/st with an average of $1,429/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-12 weeks, averaging 8.25 weeks through our latest survey.

Plate

The SMU price range is $1,160–1,290/st, with an average of $1,225/st FOB mill. The lower end of our range declined $40/st w/w, while the top end fell $10/st. Our overall average declined $25/st compared to the previous week. Our price momentum indicator for plate is now at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 4-7 weeks, averaging 5.67 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton