Market Data

May 23, 2024

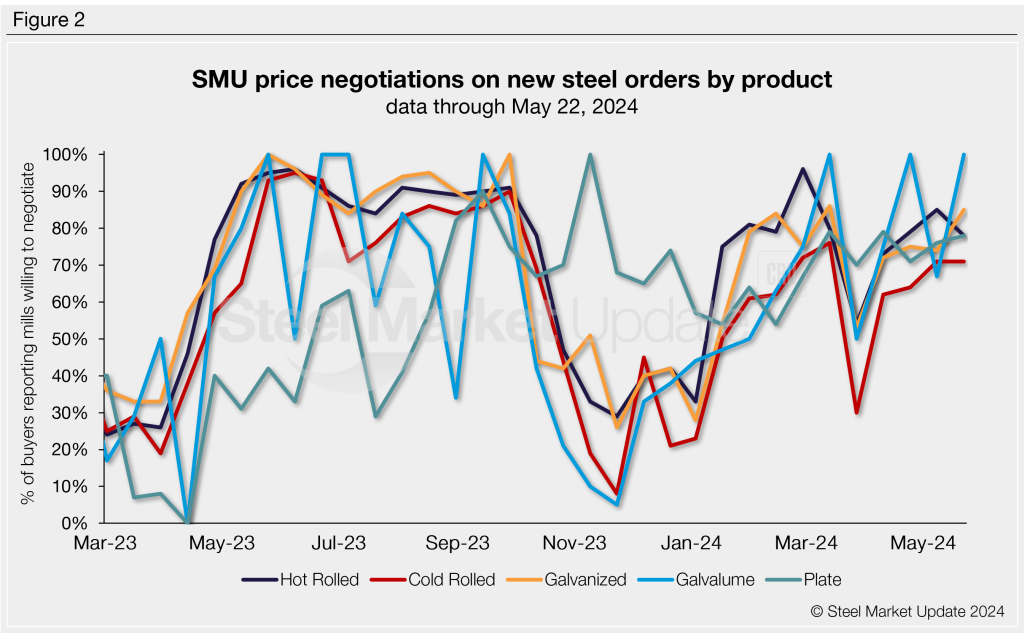

SMU survey: Mills less willing to talk price on HRC, other products mixed

Written by Ethan Bernard

Hot rolled buyers found mills less willing to negotiate spot pricing this week, while other products SMU tracks were mixed, according to our most recent survey data.

For HRC buyers, 78% of respondents reported mills were flexible on price, down seven percentage points from two weeks earlier. However, galvanized’s rate rose 11 percentage points to 85% in the same comparison.

Every other week, SMU polls steel buyers asking if domestic mills are willing to negotiate lower spot pricing on new orders.

This week, 80% of participants surveyed by SMU reported mills were willing to negotiate prices on new spot orders, up five percentage points from our last market check. This is the first time the reading has touched 80% since the middle of March (Figure 1).

Figure 2 below shows negotiation rates by product. The rate for cold-rolled coil was flat at 71% this week. Meanwhile, the rate for Galvalume shot up to 100% (+33), and plate stood at 78% (+2).

Here’s what some survey respondents had to say:

“They (mills) seek volume and will negotiate to get it (on hot rolled).”

“Depending on who and the size of the buy, there are deals to be had (on hot rolled).”

“Negotiations are good if deemed appropriate (on cold rolled).”

“Most mills are active bidders and can still deliver (galvanized) in June last week.”

“Depends on the mill (on galvanized).”

“Somewhat (on plate).”

Note: SMU surveys active steel buyers every two weeks to gauge their steel suppliers’ willingness to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our steel mill negotiations data, visit our website.