Prices

June 4, 2024

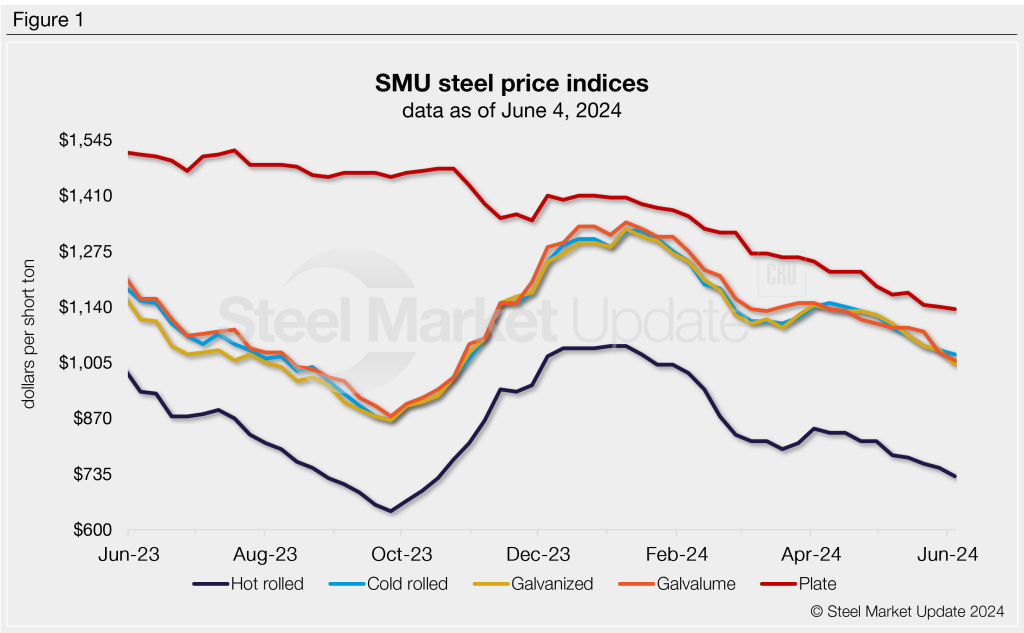

SMU price ranges: Sheet drops as market debates where/when a floor will be found

Written by David Schollaert & Michael Cowden

US sheet prices remained on a downward course again this week amid chatter in some corners about a potential broader slowdown in demand.

SMU’s hot-rolled (HR) coil price now stands at $730 per short ton (st) on average, down $20/st from last week and down $115/st from a recent high of $845/st in early April.

The high end of our range is $780/st, which is also Nucor’s published spot price. The low end of our range dropped into the high $600s on larger buys at those levels.

We heard of even bigger deals in the mid-$600s/st. But we could not confirm whether those deals had happened and/or whether they were tonnages so large as to not be repeatable for all but some of the biggest HR buyers.

While some industry sources said deals in the $600s/st indicated that a bottom was near for HR, others said they expected tags to continue to drift lower on lackluster demand, the summer doldrums, increased output, and import competition.

We observed a similar trend in cold-rolled (CR) and coated products. Our CR price slipped $10/st week-over-week (w/w) to $1,025/st on average. Our galvanized base price dropped $35/st to $1,000/st on average. And our average Galvalume price fell $20/st to $1,010/st.

Market participants said higher imports are more of an issue for galvanized and Galvalume, where lower priced material from Southeast Asia continues to have a significant impact. Some also noted that certain domestic mills had stopped charging a premium for CR-base galvanized. That’s a potential sign of a weak market because mills can charge a significant premium for CR-base galv in a strong market.

Our plate price was little changed this week, perhaps reflecting Nucor’s decision last month to keep plate prices flat.

Our momentum indicators continue to point lower, with concerns about supply outstripping demand weighing on the market.

Hot-rolled coil

The SMU price range is $680–780/st, averaging $730/st FOB mill, east of the Rockies. The lower end of our range is $40/st lower week over week (w/w), while the top end is unchaged. Our overall average is down $20/st w/w. Our price momentum indicator for HR remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-7 weeks, averaging 5.0 weeks as of our May 22 market survey.

Cold-rolled coil

The SMU price range is $970–1,080/st, averaging $1,025/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is $20/st lower. Our overall average is down $10/st w/w. Our price momentum indicator for CR remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 4-10 weeks, averaging 6.7 weeks through our latest survey.

Galvanized coil

The SMU price range is $940–1,060/st, averaging $1,000/st FOB mill, east of the Rockies. The lower end of our range is down $40/st w/w, while the top end is down $30/st. Our overall average is down $35/st w/w. Our price momentum indicator for galvanized remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,037–1,157/st, averaging $1,097/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $960–1,060/st, averaging $1,010/st FOB mill, east of the Rockies. Both the lower and the top ends of our range are down $20/st w/w. Our overall average is also down $20/st w/w. Our price momentum indicator for Galvalume remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,254–1,354/st, averaging $1,304/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-7 weeks, averaging 6.3 weeks through our latest survey.

Plate

The SMU price range is $1,070–1,200/st, averaging $1,135/st FOB mill. The lower end of our range is $10/st lower w/w, while the top end is unchanged. Our overall average is down $5/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 4-7 weeks, averaging 5.5 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert