Analysis

August 18, 2024

Final thoughts

Written by Michael Cowden

More than 1,400 of you are now signed to attend Steel Summit – which kicks off next week at the Georgia International Convention Center (GICC) in Atlanta.

We are very close to beating last year’s record attendance. So, if you’re on the fence, help us be part of steel history again – register here!

Steel Summit 101

If you’re new to the event – which will be held Aug. 26-28 – you might not know that this is not only one of the biggest steel conferences in North America but also one of the easiest to attend too.

The GICC is connected to Hartsfield-Jackson airport by a tram. You can grab your bags, hop on the tram, and be at Summit in a matter of minutes – no rideshare, taxi, or subway required.

We typically start with a bang. This year will be no different. We’ll also seek the wisdom of the opening-day crowd with a few live poll questions. Over the course of the conference, we’ll talk about everything from steel price forecasts and demand trends to trade policy and the state of the economy.

And of course it’s an election year. That means we’re going to be talking about who might win in November and what the outcome could mean for steel. As the negative ads ramp up (especially in “battleground” states), feelings can run high.

Be nice, please

Here’s my ask: We might not agree on everything. But let’s keep it civil. Summit is about the industry we love, that supports us and our families, and about bringing people together.

To that end, I think you’ll really enjoy the opening keynote from Sirius XM radio host and CNN contributor Michael Smerconish. He’ll be talking about his latest creation – “The Mingle Project”.

Smerconish is a great speaker, as those of you who have attended past Summits already know. And I hope his words will set the tone for the rest of the conference. We want you to learn a lot, network a lot, and maybe make a few new friends along the way – even better if they’re ones from outside your usual social bubble.

Survey says

My colleague David Schollaert has a good summary of of SMU’s latest steel market survey here. Those results were released to our premium subscribers on Friday. (If you’re interested in upgrading to a premium account, please contact my colleague Luis Corona at Luis Corona Luis.Corona@crugroup.com.)

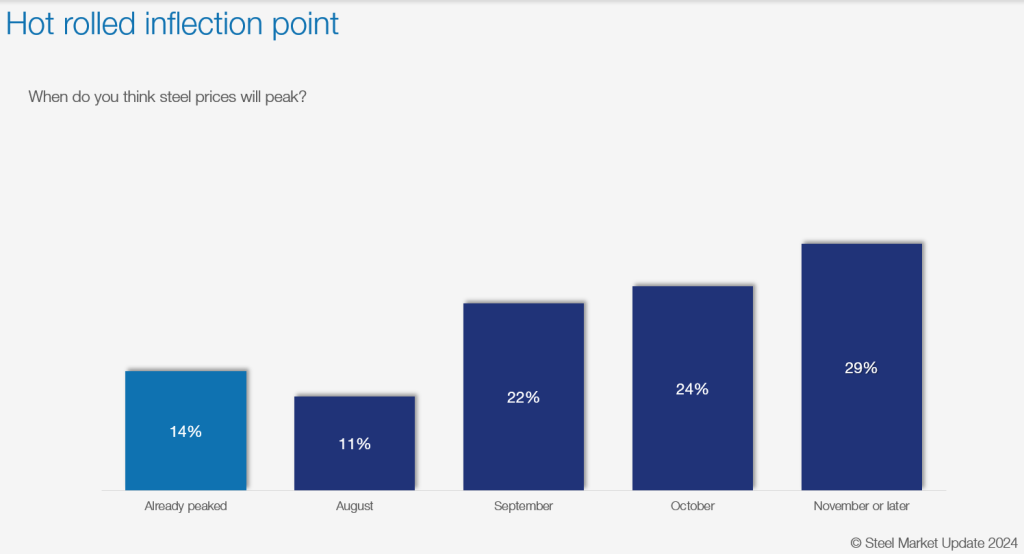

Below are a few survey findings that caught my attention too. For starters, most people think sheet prices will continue rising into the autumn months (75%):

That’s what you’d expect following mill price-increase announcements in late July and early August.

But a solid minority (25%) think prices have already peaked or will by the end of this month. I didn’t expect that result. After all, the conventional wisdom (whether that still holds is another question) is that prices tend to rebound after the “summer doldrums”. It’s not often that they fall into the fall.

Here is a sampling of what survey respondents had to say about where and when prices might peak. I’ve divided the responses up into bulls, bears, and centrists.

Bulls:

“Demand is picking up in heavy steel coil, and interest rates are starting to move down.”

“Demand will start to pick in late Q3 – similar to pre-Covid years. And mills will take advantage of the opportunity to push pricing as high as possible.”

“Customers seem to have overreacted in reducing inventory. As the market begins to turn, the domestic mills will push hard and create more upward movement than would have been the case based on fundamentals. Contract season will start soon, and the total focus will be on getting prices up.”

“We won’t see a true peak until late Q1/early Q2 of 2025.”

Bears:

“I do not agree that they are trending up. It’s a glitch to stop the decline.”

“We have definitely set a floor. But we are thinking it’ll be a mostly temporary one and that pricing will level and dip back a bit. Demand is still too slow.”

“This rally seems pretty weak.”

“Dead-cat bounce.”

Centrists:

“This next cycle will be more moderate than previous cycles. There is not enough economic activity to support a big ramp up. The market will be one where moderate returns will be the norm – neither good nor bad.”

“It will remain flat for a while. Then import positions/options change, and mill outages in back half of 2024 play a role.”

“The market will stay flat until elections are over.”

While not everyone agrees on when prices will peak, there is broad consensus that recent mill price increases have at least stopped the bleeding downstream.

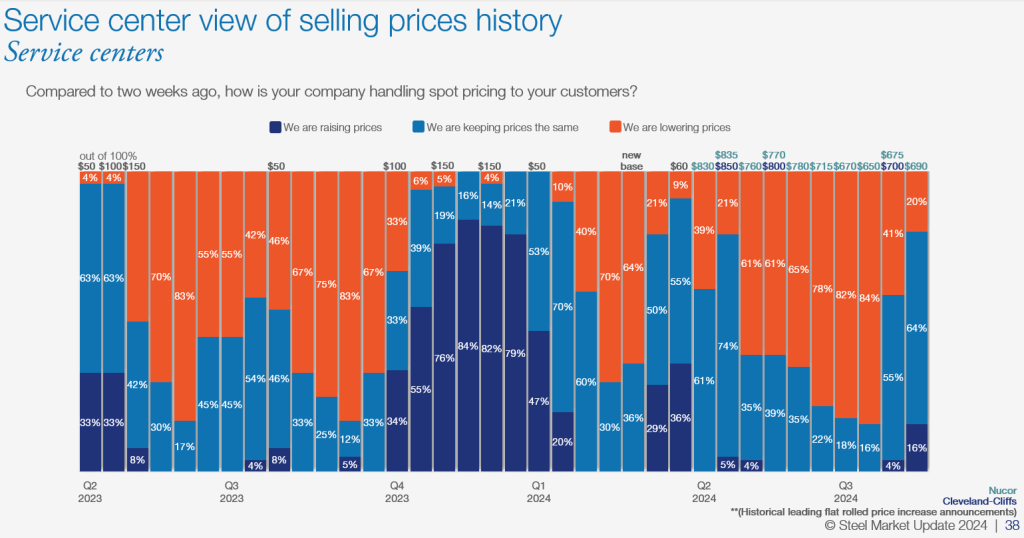

Take a look at the chart below:

Among service center respondents, 64% said they were holding prices, 16% said they were increasing them, and only 20% said they continued to lower prices.

That’s a huge change from a month ago. Back then, 84% reported lowering prices, none said they were increasing them, and only 16% said they were holding the line.

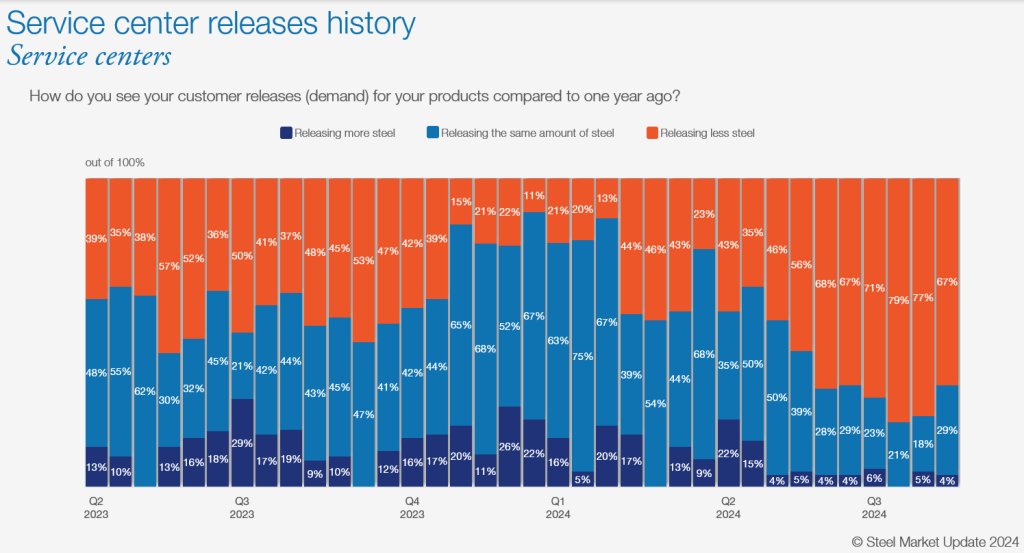

If there is a fly in the ointment, it might be the data in this chart:

About two-thirds of service centers tell us that they’re releasing less steel now than they were a year ago. That’s a little better than 75-80% readings we saw earlier this summer – but not by much.

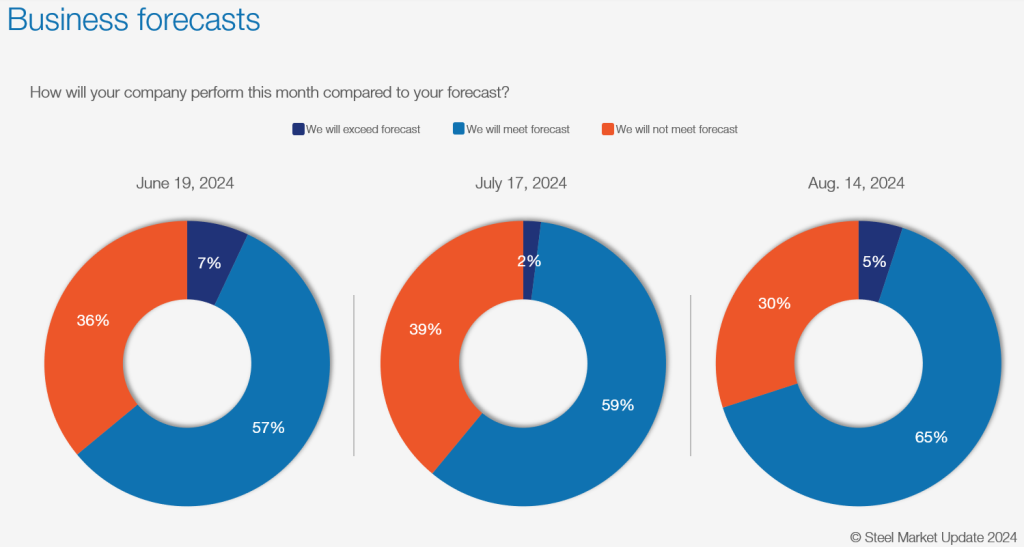

And that result might explain why 30% of respondents to our survey report that they’re not meeting forecast while only 5% say they’re exceeding it.

The good news is that most (65%) continue to meet forecast.

Here is what respondents had to say about their forecasts and what’s impacting them:

“Customers are down across the board. Ag layoffs, parts/productions moving to Mexico, high interest rates hurting automotive and home buying/upgrades is having a major impact.”

“As an OEM, we’re OK. But a lot of our peers certainly seem slow with demand off and internal layoffs are pretty abundant.”

“We will barely meet forecast. But expectations are for a strong September.”

“Yes. But after adjusting down.”

Download the Summit app!

Your feedback helps us make sense of the steel market. And we’ll be asking you a few questions to kick off Summit – just as we have in past years. What will hot-rolled (HR) coil prices be a year from now? How is demand? Who will win the election?

Is there anything else that you’d like us to ask 1,400 or so folks in the steel business? Let us know at info@steelmarketupdate.com. We might include any good suggestions in our live polls at Summit.

Fwiw, you’ll need to the Steel Summit 2024 app to participate in those polls. If you haven’t already, go to either the Apple or Android app stores and download it today.

PS – Thanks again for you continued support. And we can’t wait to see you on Aug. 26 in Atlanta!