Sheet

October 24, 2024

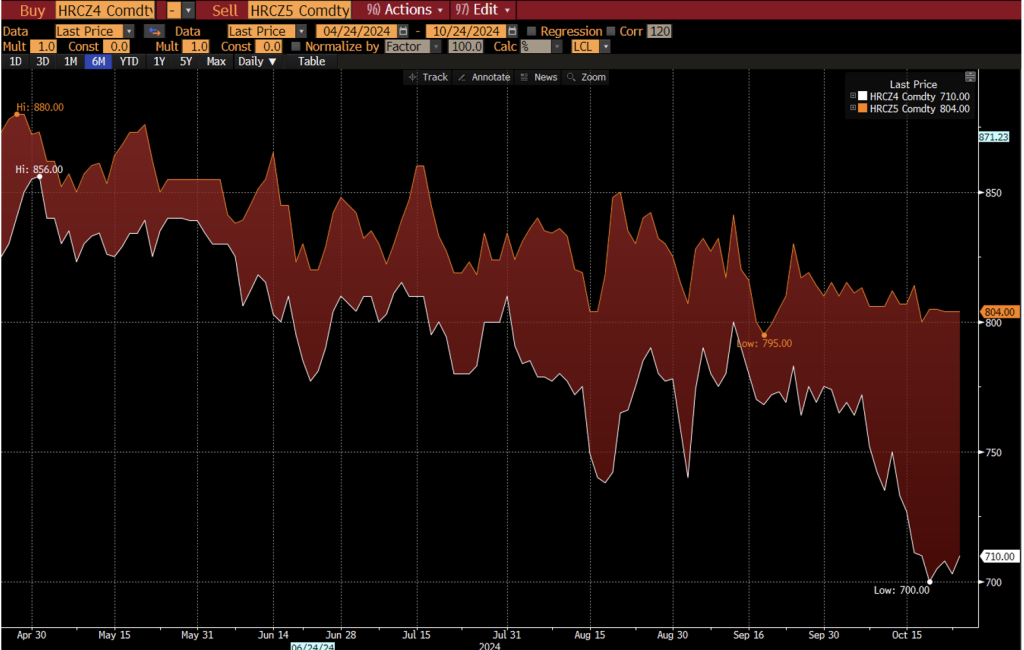

HR futures drift lower as open interest grows

Written by Mark Novakovich

Despite a higher settle on Thursday on CME hot-rolled coil (HRC) futures, the pattern over the past four weeks has seen nearby steel futures prices drift lower, while the back of the 2025 curve has remained supported.

Market chatter about U.S. Steel raising prices, as well as various buy-side inquiries in 2025, lent some support for Thursday’s session. However, flat prices remain down from month-ago levels as various indices confirm lower physical prices.

CME HRC futures

The ongoing softness in the underlying physical market has been well-reported and is well-known. It stems from relatively short lead times, adequative service center inventories, and lackluster end-user demand. All of these have consequently weighed on futures values. The lower levels, however, have attracted some buying interest, particularly in the forward positions, such as calendar-year (CY) 2025 and CY2026.

Much of the recent focus has been the December 2024 HRC contract, which has fallen by $65 per short ton (st) since I wrote my last column at the end of September. It went from $775/st to $710/st, as of Thursday’s provisional close. Fund positioning, and rolling from November ’24 to December ’24, has been the main catalyst in the prompt portion of the futures complex. The December 2024 position now makes up more than 30% of open interest for the HRC contract, or roughly 157,000 st of the 505,000-st total open volume.

Notably, the contango structure has widened as December ’24 HRC has fallen, while the December ’25 contract is down only $10/st since the end of September. That puts the December-to-December carry at $94/st. Uncertainty surrounding the upcoming election and implications of potentially more tariffs, combined with the coated trade case, have kept 2025 levels firm relative to the physical dynamics weighing on the front of the curve.

CME BUS futures

Surprisingly, the CME busheling (BUS) contract came to life today, after months of negligible activity. On Thursday, 740 gross tons (gt) of CY2025 traded in the CME block market, as several traders felt the structure through next year was roughly flat to spot and traded it. We’ve heard the CME remains committed to launching a Chicago-indexed busheling contract, and may provide an official market notice on its plans early next month.