Analysis

January 13, 2025

Apparent steel supply shrinks to 45-month low in November

Written by Brett Linton

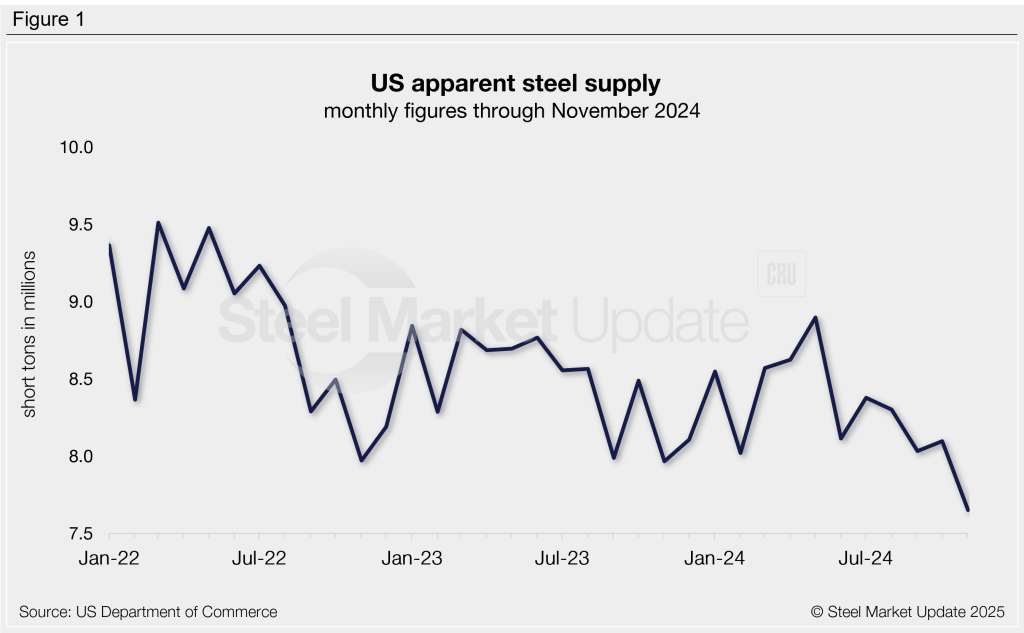

The amount of finished steel that entered the US market fell to a multi-month low in November, according to our analysis of Department of Commerce and the American Iron and Steel Institute (AISI) data. Referred to as ‘apparent steel supply’, we calculate this volume by combining domestic steel mill shipments with finished US steel imports and deducting total US steel exports.

Total apparent supply for November was 7.65 million short tons (st), a 6% decline from the prior month. This marks the smallest monthly supply rate recorded since February 2021.

Prior to November, monthly supply had consistently remained within the 8-9 million st range for over two years. Recall that earlier in 2024, supply reached a 21-month high in May (8.90 million st).

Trends

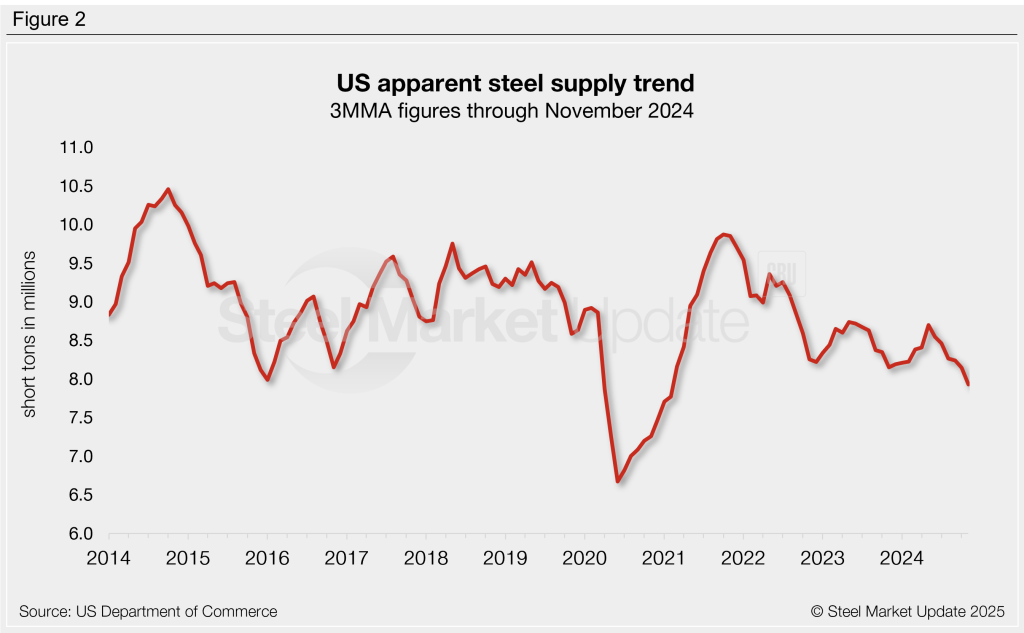

To smooth out monthly fluctuations and better highlight trends, monthly supply levels can be recalculated as a three-month moving average (3MMA), as shown in Figure 2.

Supply on a 3MMA basis has trended lower since the late 2021 peak of 9.87 million st. The November 3MMA is down to a near-four-year low of 7.93 million st. One year prior it was 8.15 million st. Two years ago it was 8.25 million st.

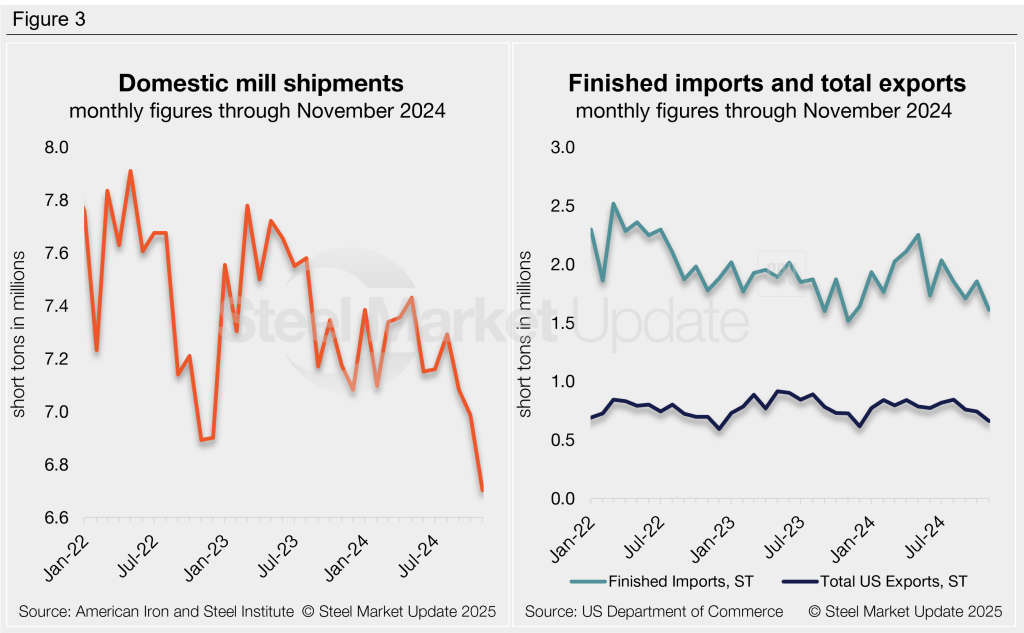

Figure 3 shows the individual inputs for apparent supply and clearly shows what factors are contributing to the reduced volumes seen through November. Domestic mill shipments have declined each month since August, falling 590,000 st or 8.1% in three months’ time. While changes in finished imports and total exports have a less substantial impact on supply, both have also trended lower across the second half of 2024.

To see an interactive graphic of our apparent steel supply history, click here. If you need any assistance logging into or navigating the website, contact us at info@steelmarketupdate.com.