Analysis

February 14, 2025

CRU: Scrap prices surge in the US, stay rangebound elsewhere

Written by Puneet Paliwal

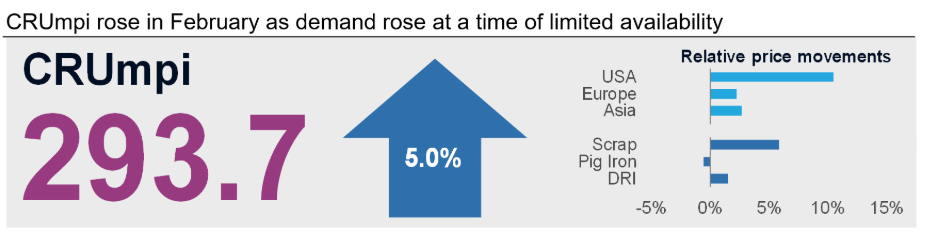

The CRU Metallics Price Indicator (CRUmpi) rose by 5.0% m/m in February to 293.7, a five-month high. Scrap prices increased in different degrees this month, reflecting the confidence level in the steel market across different regions. While US scrap prices rose sharply m/m due to limited availability, those in Europe and Asia had only small gains on the back of modest improvement in demand.

In the US, scrap prices rose by more than 12% m/m across the various regional markets as supply was squeezed while demand remained steady. Inbound traffic to scrap yards was hindered by reduced collection rates during acute weather conditions while dealers were still completing January orders. Moreover, scrap prices in this round of negotiations were influenced by uncertainties bought in by speculations around tariffs on steel imports, which became clearer this week.

CRU market contacts suggest that most scrap dealers opted to offer more material domestically than to the export market, which caused export prices to edge higher at the start of February as well. While scrap prices rose, those of pig iron fell m/m as Brazilian suppliers reduced offer prices (i.e., despite already weak margins) to boost buying interest amongst US buyers, who had been buying more from alternative markets such as Ukraine and India.

In Europe, on the other hand, scrap prices increased marginally m/m following a slight improvement in demand. Scrap inventory at mills had gradually reduced over the winter period, so some buyers returned to the market this month. Nevertheless, steelmakers in the region, particularly those in Germany, have been grappling with high energy costs. Thus, they did not entertain high-price offers for scrap and continued to bid lower to protect their profit margins. Outside of the EU, Turkish scrap prices rose in early February on the back of improvements in domestic demand and prices for long products, which allowed mills to raise operating rates and consume more scrap. The absence of Chinese-origin billet offers during the Chinese New Year holiday period also supported scrap demand and prices.

Meanwhile, Asian scrap prices were a mixed bag in February as East Asian prices rose m/m, while those in China and South Asia declined. Generally, weak demand and cautious buying continued to weigh on scrap prices in the region. Chinese domestic demand weakened during the New Year holiday period, and post-holiday restocking was not too encouraging, which kept scrap prices low. Scrap import prices in Bangladesh also fell m/m as mills deferred fresh purchases due to bleak steel market confidence. Construction demand is muted in the country due to low government spending, while the dollar shortage and currency depreciation also affected trade across commodities.

In East Asia, however, scrap prices increased as demand improved alongside that of steel. Vietnamese scrap procurement rose after the holidays as mills restocked, although they resisted high-priced scrap offers. Meanwhile, Japanese export offers attracted buying interest from other Asian markets, which eased local oversupply to some extent.

This article was first published by CRU. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.