Market Data

April 15, 2025

March service center shipments and inventories report

Written by Estelle Tran

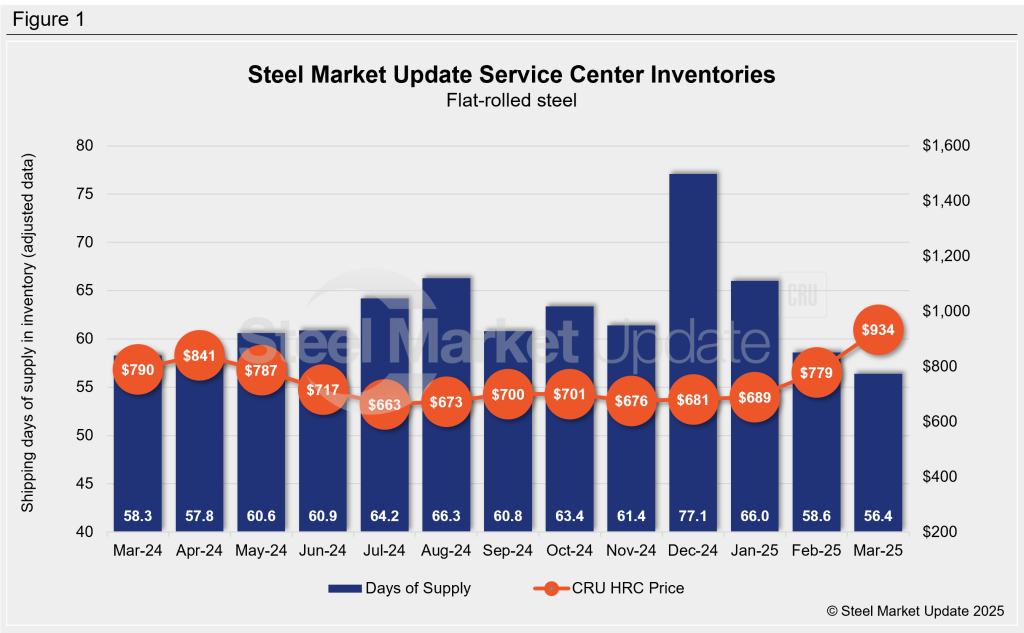

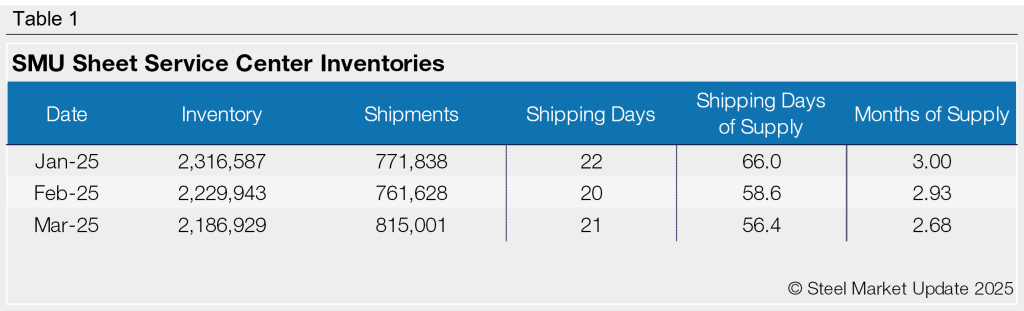

Flat rolled = 56.4 shipping days of supply

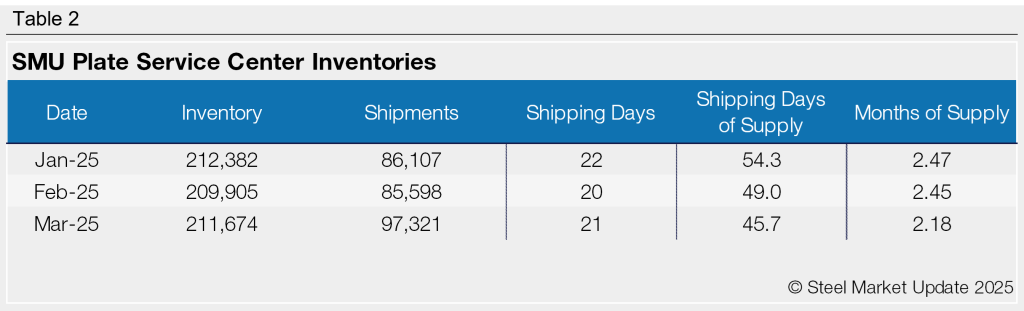

Plate = 45.7 shipping days of supply

Flat rolled

US service centers’ flat-rolled steel supply declined in March with strong shipments, as buyers sought to get ahead of price increases. At the end of March, service centers carried 56.4 shipping days of flat-rolled steel supply, according to adjusted SMU data. This is down from 58.6 shipping days of supply in February and 58.3 shipping days in March 2024. Inventories represented 2.68 months of supply in March, down from 2.93 in February and 2.78 in March 2024.

March had 21 shipping days, compared to February’s 20. The daily shipping rate in March was the highest it has been in years and is reminiscent of early 2021 levels. Market contacts have reported robust demand from manufacturing customers pulling forward demand ahead of tariff-fuelled price increases. The rapid price hikes also boosted sales to other service centers.

Mill lead times have edged down recently with hot-rolled coil lead times at 5.55 weeks, according to the latest SMU survey on April 2. Lead times were at 5.86 weeks in early March.

The amount of flat-rolled steel on order slipped in March. However, stronger demand in March of this year means that material on order translated to fewer days of supply.

With healthy April shipping levels and declining material on order, we expect inventories to drop again in April. The question is: How long will shipments remain strong? We are starting to see manufacturers looking to reduce inventory. In the latest SMU survey, 33% of manufacturers said they were reducing inventory and 59% said they were maintaining inventory. One month prior, in the March 7 survey, 13% of manufacturers said they were reducing inventory and 61% said they were maintaining inventory.

Plate

US service center plate supply also declined in March on the back of robust shipments. At the end of March, service centers held 45.7 shipping days of plate supply. This is down from the 49 shipping days of plate supply in February, on an adjusted basis. Plate inventories represented 2.18 months of supply, down from 2.45 months in February.

The daily shipping rate for plate in March was up 18% year over year (y/y). The spike in shipments in March caused plate supply to fall to the lowest level seen since March 2023, when service centers carried 41 shipping days of supply.