CRU

July 8, 2025

CRU: US rebar and wire rod prices rise alongside S232 increase

Written by Alexandra Anderson

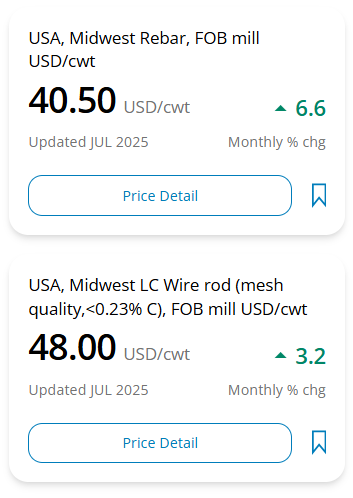

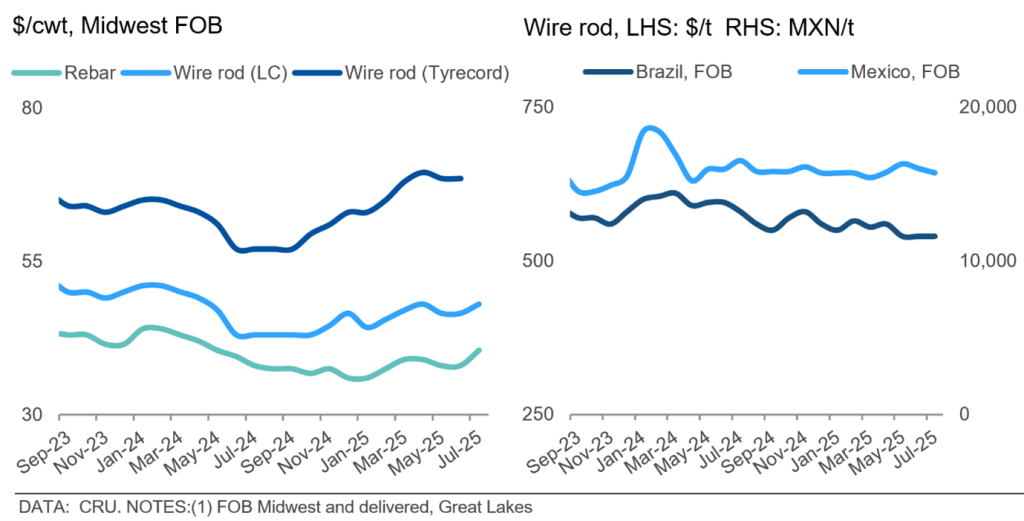

US rebar and wire rod prices rose m/m as mills raised prices on the back of Section 232 tariffs increasing to 50% in early June. Tyre cord prices rose again as well, due to the high US dependency on imports. For remaining long products, import interest has gradually declined in recent months because of the tariffs, although current import volumes remain high as previously committed orders make landfall. Domestic scrap prices were flat in June, though their influence on longs has waned as tariffs give import pricing more weight.

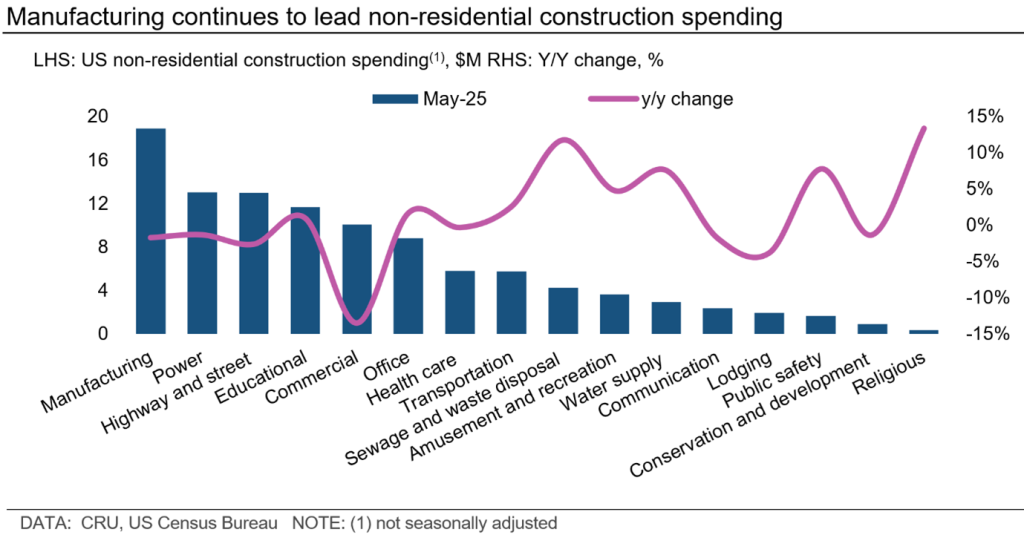

Prices for rebar rose $2.50/cwt ($50/short ton) m/m in response to higher Section 232 tariffs, while merchant bar and structurals were unchanged. Additionally, rebar producers filed an anti-dumping case against Algeria, Belarus, Egypt, and Vietnam, fueling bullish outlooks among market participants. According to the US Census Bureau, non-residential construction spending continued to support end-use demand, with the commercial and healthcare sectors being the primary areas of focus. Data centers remain a strong driver of private construction spending as well, up 34% y/y. Still, trade policy remains front of mind for buyers, and they are keeping purchases measured in anticipation of trade deals.

Demand for rebar imports has slowed as offers are at or near parity with domestic price levels. However, volumes are up m/m as material ordered in late Q1 starts to arrive. According to the US Department of Commerce, license data indicates ~80,000 metric tons of rebar imports for June, mostly from Egypt and Vietnam.

Wire rod prices also increased due to elevated Section 232 rates, with some products experiencing greater upward pressure than others. The US tyre cord market, for example, is heavily import-dependent, and therefore prices have surged due to tariff implications. While the US remains a net importer of wire rod, products like low-carbon and high-carbon wire rod have more material domestically available.

According to the US Department of Commerce, license data shows ~129,000 metric tons of wire rod imports for June, up 23% from May census data. Egypt, Vietnam, and India were the main origins of material, displacing shipments from more traditional sources, like Canada.

As with rebar, wire rod buyers are working hand-to-mouth as they expect trade deals with Canada and Mexico to ease supply constraints. Meanwhile, Liberty is still in the process of ramping up its production, which should be fully back online in July.

In Brazil, domestic longs prices decreased by 2% m/m as demand continues to be weaker while supply remains stable. High interest rates are putting pressure on the construction sector and are expected to remain high for the rest of this year. According to IABr, longs production decreased in May by 1.9% m/m with the year-to-date volume being 3.5% higher y/y. In terms of trade, imports decreased in May by 18% m/m, but the year-to-date volume is still higher by 7.9% y/y.

Editor’s Note

For more information on the rebar markets, check out this Insight piece we recently shared, also from CRU Senior Steel Analyst Alexandra Anderson, which discusses oversupply in the global rebar market and its potential impacts on US mill investments.

Also, on Wednesday, July 9, SMU will host CRU analysts Thais Terzian and Frank Nikolic on a Community Chat. Join us at 11 a.m. ET, when they will share the latest insights into the metallics, base metals, and battery materials markets. You can register here.

The analysis above was first published by CRU, the parent company of Steel Market Update. To learn about CRU’s global commodities research and analysis services, visit www.crugroup.com.