Analysis

July 8, 2025

US steel imports recovered in May, fell again in June

Written by Brett Linton

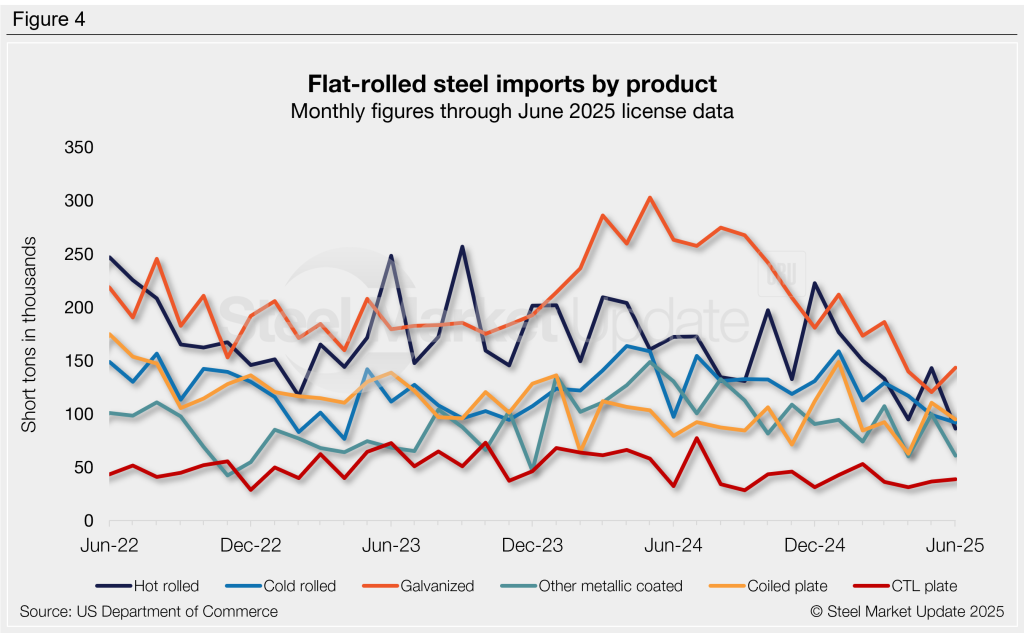

Following one of the lowest levels seen in more than two years, US steel imports rebounded 20% from April to 2.49 million short tons (st) in May, according to recently released US Commerce Department data. While up, trade remains low relative to recent years. Preliminary June license data suggests another decline, with licenses currently down 12% month over month (m/m).

Recall that imports spiked at the start of the year to 3.08 million st in January, the highest level since April 2022. Imports have generally trended lower since then. As of last week, June licenses totaled 2.19 million st, down 29% from January’s peak (Figure 1, left).

Almost half of the steel that entered the country in May came from five countries: Brazil (20%), Canada (13%), South Korea (12%), Vietnam (6%), and Taiwan (6%). Other major suppliers included Mexico, Germany, Egypt, Turkey, Japan, India, Romania, Austria, the Netherlands, and the UAE, each contributing 2-5% of the total. Combined, these 15 countries accounted for 87% of all May imports.

To explore steel import data by country, category, or specific product, visit the International Trade Administration’s Steel Import Monitor.

Import trends

Import data can be analyzed as a three-month moving average (3MMA) to better highlight trends by smoothing out monthly fluctuations (Figure 1, right). On this basis, 3MMA imports reached a ten-month high of 2.61 million st in March, a sharp rise from December’s one-year low of 2.20 million st. The 3MMA increased from Aprilto 2.36 million st in May, then declined in June to 2.25 million st. For comparison, imports averaged 2.41 million st per month in 2024 and 2.35 million st per month in 2023.

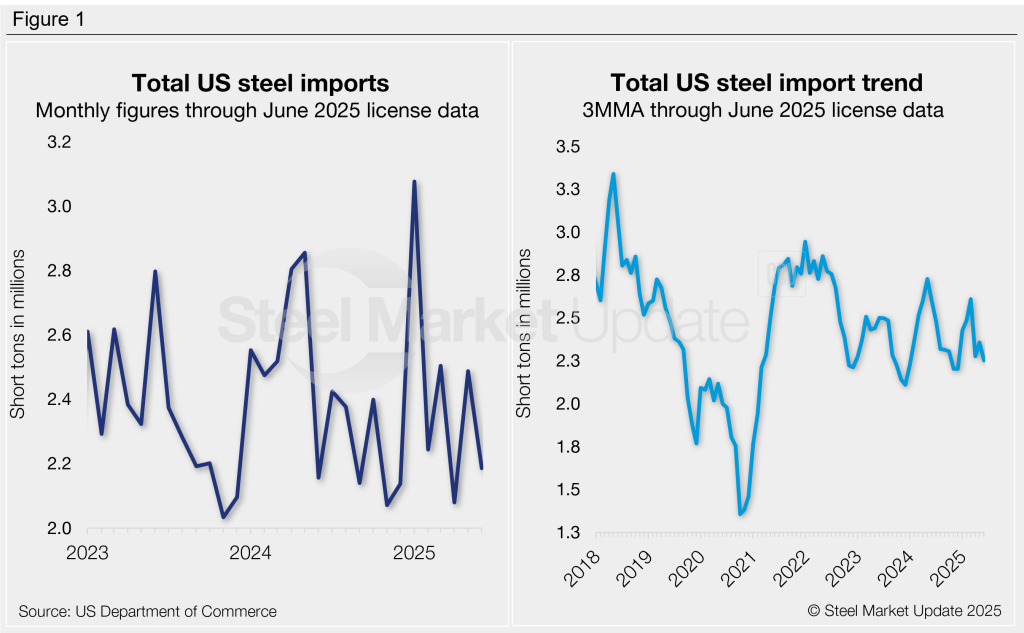

Imports by product

Table 1 highlights high-volume steel product imports (click to expand). Note that 3MMA and 12MMA figures are through final May data. For deeper analysis, visit our Steel Imports page.

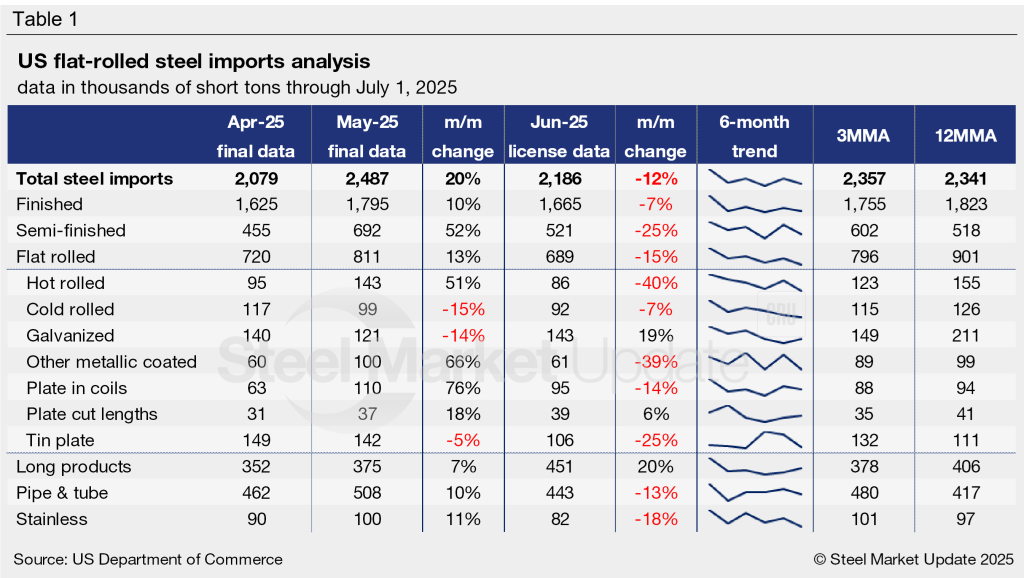

Finished vs. semi-finished imports

Finished steel products made up 72% of May imports, totaling 1.80 million st, in line with the prior six months (Figure 2). June finished licenses are currently down to 1.66 million st (76% of total imports). In 2024, imports of finished products averaged 1.89 million st per month, representing 79% of total imports.

Semi-finished imports (mostly slabs to be further processed by a mill) surged 52% m/m to 691,000 st in May, one of the highest rates seen in the last year. June licenses are currently down to 521,000 st. For reference, semi-finished imports averaged 515,000 st per month in 2024 and 524,000 st in 2023.

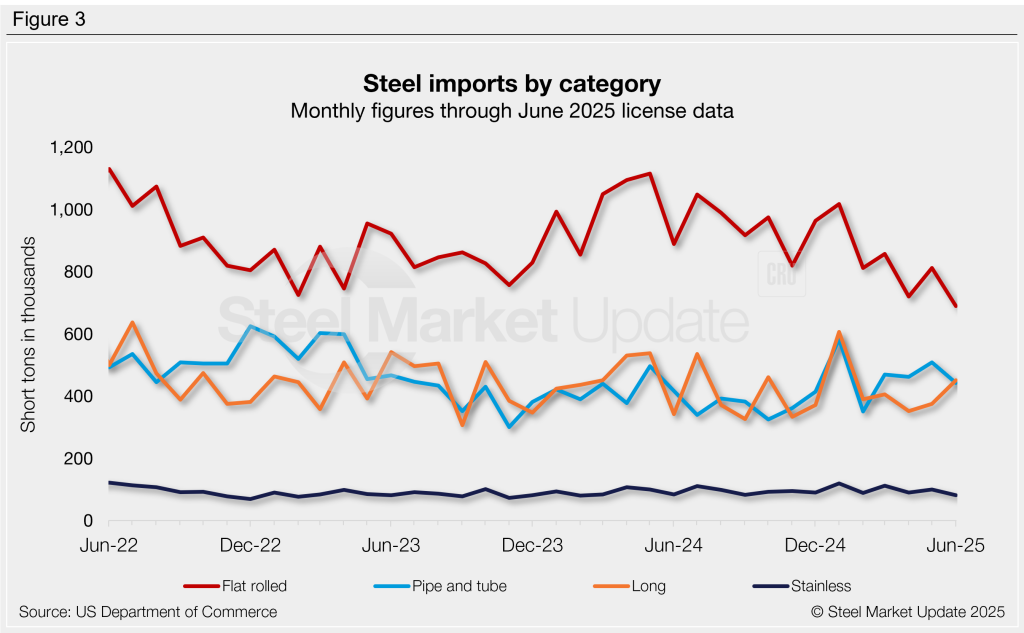

Imports by category

Figure 3 shows monthly imports by popular steel product categories. Notable shifts include:

- Flat-rolled imports rose 13% in May from April’s four-year low. June licenses retreated 15% to potentially the lowest since January 2021.

- Long products increased 7% in May and another 20% in June, possibly hitting a five-month high.

- Pipe and tube climbed 10% in May to the second-highest level seen in two years, then fell 13% in June.

- Stainless rose 11% in May, then declined 18% in June to a potential 16-month low.

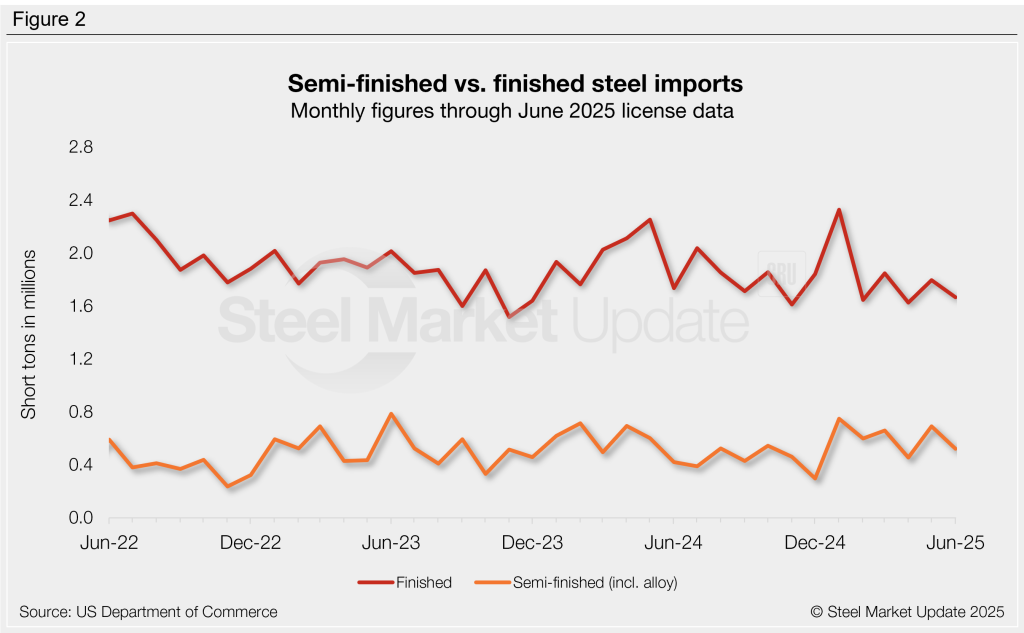

Flat-rolled imports

Figure 4 tracks flat-rolled imports for six popular sheet products. Most increased from April to May, while all but two declined in June. Many are at or near multi-year lows. Key highlights:

- Hot-rolled coil imports surged 51% m/m in May from April’s 15-year low. June licenses fell 40%, possibly back down to 2009 lows.

- Cold-rolled coil fell 15% in May and another 7% in June to a two-year low.

- Galvanized declined 14% in May to a 12-year low, then rebounded 19% in June.

- Other-metallic coated jumped 66% in May after April’s 16-month low. June licenses are back down 39%.

- Coiled plate surged 76% in May (from April’s four-year low), then slipped 14% in June.

- CTL plate increased 18% in May and is another 6% in June, potentially at a four-month high.