Analysis

August 7, 2025

SMU Survey: Mills maintain short lead times on sheet

Written by Brett Linton

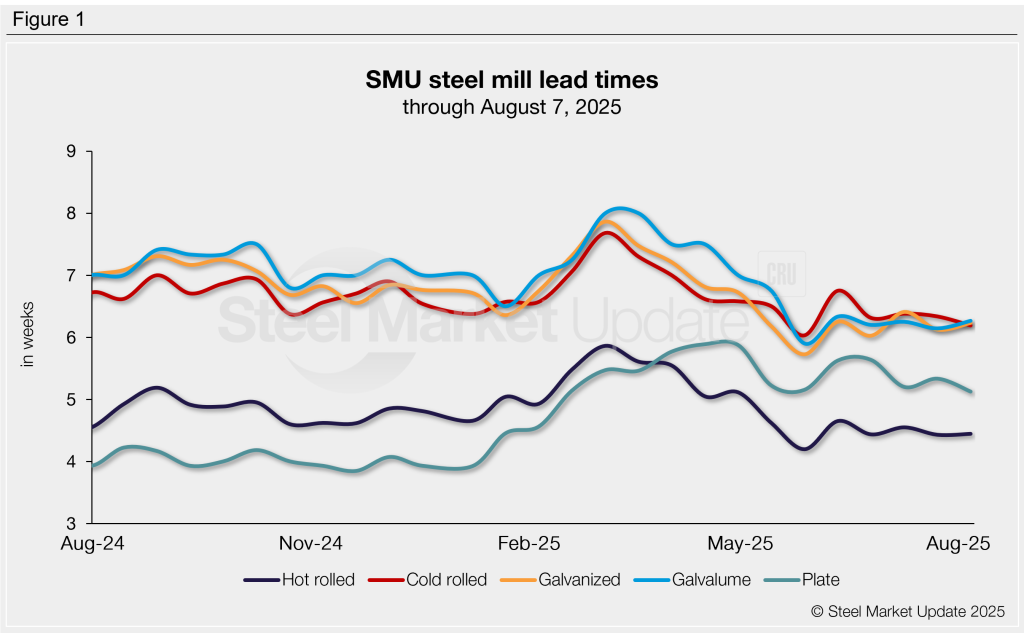

We saw little to no change in sheet and plate lead times this week, according to data from steel buyers across the country. Production times for sheet products are holding just above multi-year lows, while plate lead times remain elevated.

Sheet lead times have remained relatively stable since June, hovering within a few days of the two-and-a-half-year lows seen back in May. Plate lead times are approximately one week longer than the lower levels we saw this time last year through February 2025.

The average lead time for hot-rolled coil is now just under four and a half weeks. Cold-rolled and coated products are in the low six-week range. Plate is just over five weeks.

Table 1 summarizes current lead times and recent changes by product (click to expand).

Compared to our previous market check, three of our lead time ranges changed this week:

- The longest hot rolled lead time considered in our range extended from six weeks to seven.

- The longest Galvalume lead time considered in our range increased from seven weeks to eight.

- The shortest plate lead time considered in our range increased from three weeks to four, while the longest declined from eight weeks to seven.

Buyers foresee stability

Most buyers (71%) believe lead times will hold steady over the next two months, down from 79% in late July. Among the rest, 21% expect lead times to lengthen (up from 19%), and the remaining 7% anticipate further contractions (up from 2%).

Here are some of the comments we collected:

“They will maintain a slow pace. Much credit to mills for curtailing production and not overflooding the market.”

“If you look closely, you’re already seeing some lead times come back in. The newer mills/capacity are all hungry (and need to be fed).”

“Increased lead times as a result of tariffs. In time, many sideline buyers will have to order, which will, in my opinion, lead to longer lead times.”

“Potentially extending as restocking may happen when mixed with seasonal outages.”

“Extending due to normalization(?) after the shock of tariffs wears out and demand normalizes/picks up a bit too.”

“Slightly extending on plate”

“Contracting, we should be past most mill outages and mill capacity will be at full strength.”

Trends

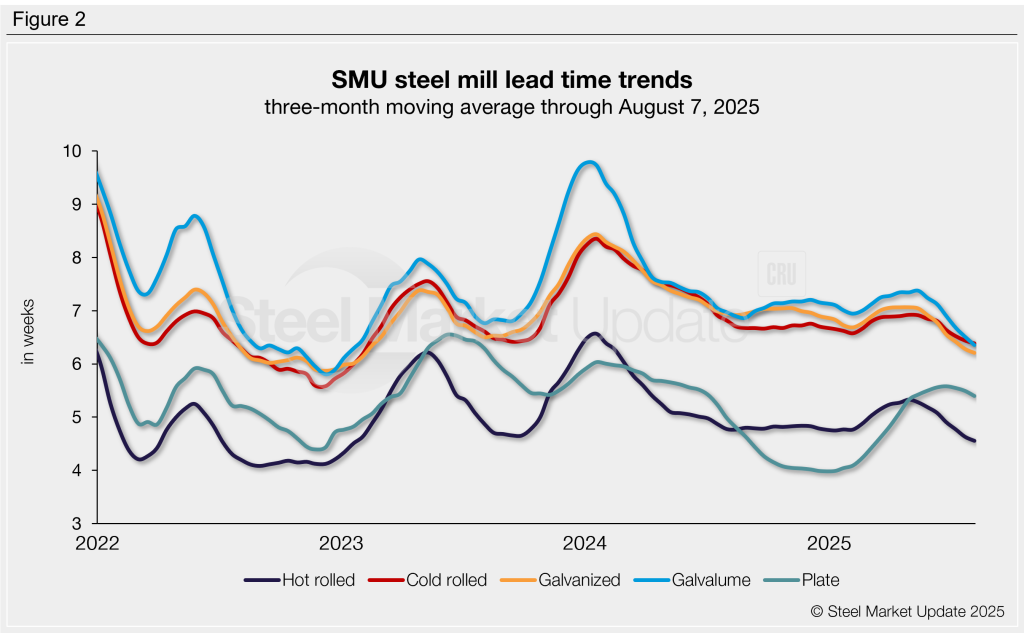

To highlight broader trends, lead times can be calculated on a three-month moving average (3MMA) basis (Figure 2). All sheet product 3MMAs declined for the seventh survey in a row, and plate declined for the third. Most sheet products are now in territory last seen in early 2023.

Average lead times by product across the last three months were: hot rolled at 4.6 weeks, cold rolled at 6.4 weeks, galvanized at 6.2 weeks, Galvalume at 6.4 weeks, and plate at 5.4 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Consult your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.