Analysis

August 7, 2025

SMU Survey: Most buyers say mills are willing to talk price

Written by Brett Linton

The bulk of steel buyers responding to this week’s market survey continue to report that mills are open to negotiating spot prices. Negotiation rates have remained high for most of the past three months.

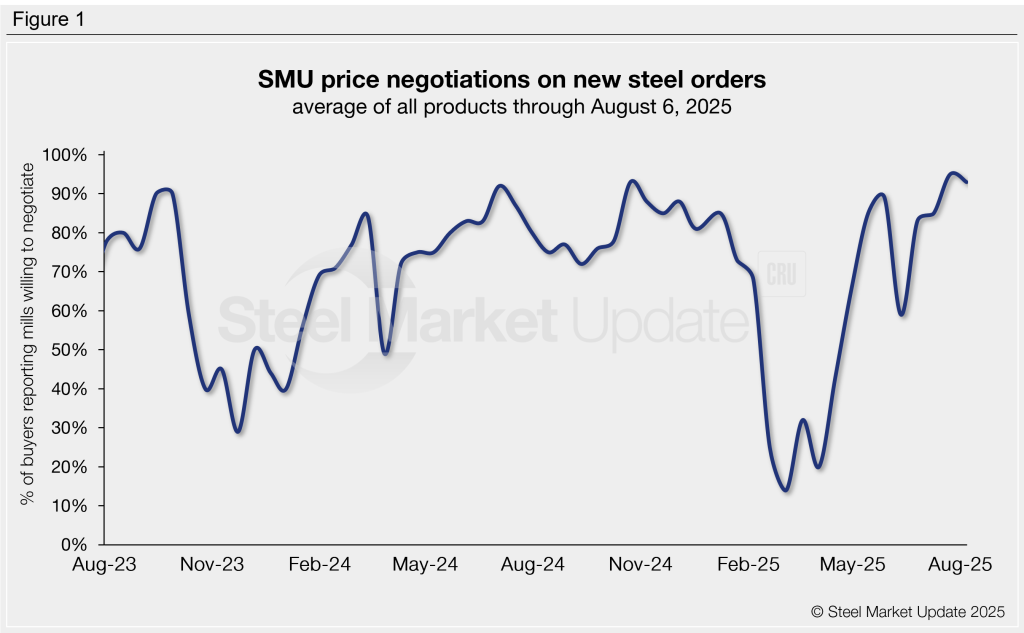

SMU polls thousands of buyers every other week, asking if domestic mills are willing to negotiate on new spot order pricing. This week, 93% of respondents said mills were willing to talk price to secure an order. While this rate is down two percentage points from our previous survey’s record high, it still represents one of the highest rates in our data history, dating back to 2010 (Figure 1).

Earlier this year, mills had held the upper hand as tariff news drove prices higher. Buyers regained leverage across April and have mostly held the power since.

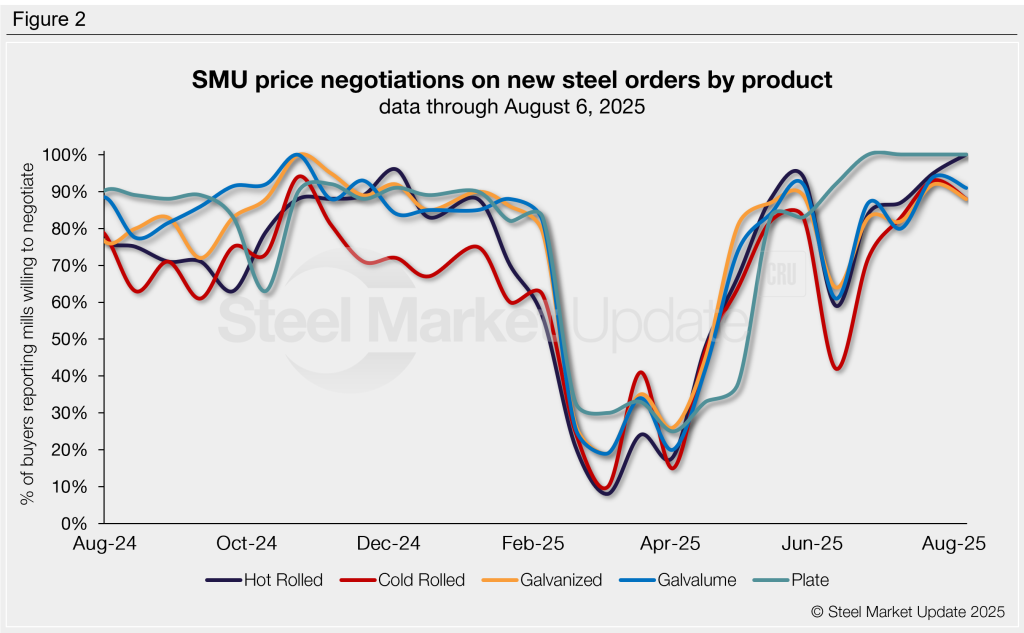

Negotiation rates high on all products

Negotiation rates remain high across all five of the sheet and plate products we track (Figure 2). Current rates are:

- Hot rolled: 100% of buyers said mills are negotiable on price, up five percentage points from two weeks ago to a three-and-a-half-year high.

- Cold rolled: 88%, down five points.

- Galvanized: 88%, down four points.

- Galvalume: 91%, down three points.

- Plate: holding at 100% for the fourth survey in a row.

Buyer remarks:

“If you have volume, they will play ball [on sheet].”

“Depending on mill, size of buy, larger [hot rolled] tons can get a better price.”

“Some mills are adjusting [on hot rolled] and looking to establish or shore up relationships.”

“Unfortunately, lowering plate numbers doesn’t create a buyer to buy. Removing instability and uncertainty drives the market, not lower prices.”

“Some more willing than others [on galvanized].”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.