SMU survey: Steel buyers' optimism waning

SMU’s Steel Buyers’ Sentiment Indices moved in differing directions this week. Both indices have generally trended downward across 2024, but continue to indicate optimism among steel buyers.

SMU’s Steel Buyers’ Sentiment Indices moved in differing directions this week. Both indices have generally trended downward across 2024, but continue to indicate optimism among steel buyers.

Here’s a roundup of some of the news making headlines in the aluminum industry this week from CRU’s Aluminum Analyst Marziyeh Horeh.

SMU's latest steel buyers market survey results are now available on our website. Here are some key points that we think are worth your time.

Oil and gas drill rig activity in the US inched lower last week while holding steady in Canada, according to the latest report from oilfield services provider Baker Hughes.

Chinese steel export prices decreased for the eleventh week in a row, with all steel products recording losses of 2-3.7% compared to the previous week.

Lead times for hot-rolled coil and plate have moved out a little, according to our latest survey data. Brett Linton has the details here. I think that might reflect some restocking and a host of fall maintenance outages – many of which are happening in September/October. But lead times aren't galloping away like some of the more bullish corners of the market might have hoped. And those for cold-rolled and coated products are largely unchanged.

Three out of four of our market survey respondents report that steel mills are open to negotiating new order prices this week, a slight decline compared to our previous market check.

Steel buyers continue to report short mill lead times for both sheet and plate products, according to SMU's latest canvass of the market. Lead times for hot-rolled and plate products marginally increased from our late July survey, likely due to limited restocking in anticipation of upcoming mill outages for scheduled maintenance.

This Premium analysis covers North American oil and natural gas prices, drilling rig activity, and crude oil stock levels. Trends in energy prices and rig counts are an advanced indicator of demand for oil country tubular goods (OCTG), line pipe, and other steel products.

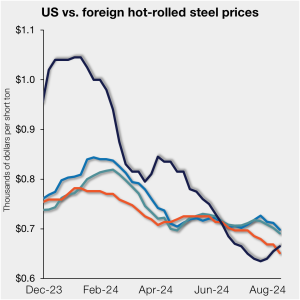

US hot-rolled (HR) coil prices are nearly even with prices for offshore material on a landed basis as domestic tags continue to inch up.

The Trade Remedies Authority (TRA) in the UK has proposed raising the tariff rate quota (TRQ) for imports of hot rolled sheet steel because of blast furnace closures at the Port Talbot works in south Wales. Tata Steel shut down one BF in July with the second to follow in September ahead of a switch […]

Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact info@steelmarketupdate.com. Flat rolled = 64.2 shipping days of supply Plate = 60.9 shipping days of supply Flat rolled Flat-rolled steel supply at US service centers grew in July with restocking as […]

SMU’s sheet prices increased across the board this week, marking the third consecutive week of rising prices, while plate prices held stable.

The countdown is on! In less than two weeks, we’ll kick off the 2024 SMU Steel Summit. This year is poised to be the best attended yet. More than 1,350 delegates have already registered – so we’re within sight of last year’s record number of nearly 1,450. I’m looking forward to learning from executives across […]

Specialty steel maker Metallus, formerly known as TimkenSteel, has officially begun work on a bloom reheating furnace at its Faircrest plant in Ohio.

Canada’s steel and aluminum industries joined forces to call on the government for the imposition of tariffs on steel, aluminum, and electric vehicles.

Nucor’s weekly consumer spot price (CSP) for hot-rolled (HR) coil is unchanged from last week at $690/ton.

I asked in a prior Final Thoughts where some of you thought Nucor’s weekly spot HR price would land. One opinion: $720 per short ton (st). That would allow the Charlotte, N.C.-based steelmaker to one up competitor Cleveland-Cliffs and to re-establish its position as a market leader.

After nearing a two-year high in May, the volume of finished steel entering the US market (referred to as ‘apparent steel supply’) receded in June, according to SMU’s latest analysis of data from the Department of Commerce and the American Iron and Steel Institute (AISI).

Total US steel exports declined again in June, down 2% month-on-month (m/m) to 773,000 short tons (st) according to the latest US Department of Commerce data.

CRU Principal Analyst Henry Hao discusses China's recently reconfigured policy agenda, which could have significant implications for the global commodity markets.

CRU Aluminum Analyst Marziyeh Horeh shares a roundup of this week's news from the aluminum industry.

June steel import data was finalized at 2.15 million short tons (st) this week, down 24% from May according to the latest US Commerce Department release. June represents the lowest monthly import rate seen this year. July import licenses now tally up to 2.29 million st as of Aug. 4, potentially recovering 6% from June. […]

It’s buy week again for ferrous scrap. US steelmakers are expected to offer their prices for August shipment this week. Most of the dealers and brokers RMU has quizzed believe the market has enough traction to hold sideways and even go up.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

The US sheet market appears to have reached a bottom following consistent weekly declines since April. However, other markets remain weak due to limited demand. Trading in Europe has been slow due to summer holidays. While European mills are also undergoing maintenance outages, these have not been enough to offset ongoing price falls, with weak […]

SMU has adjusted its sheet momentum indicator from neutral to higher for the first time since early April. The shift comes on the back of price hikes for leading sheet mills Nucor and Cleveland-Cliffs.

SMU’s sheet prices rose by an average of $10 per short ton (st) this week on most products, the second consecutive week of recovering prices. Aside from the marginal uptick seen last week, this is the first instance of increasing sheet prices since the first week of April.

The United Steelworkers (USW) union has praised Vice President Kamala Harris’ choice of Minnesota Gov. Tim Walz (D) as her running mate.

Nucor intends to keep plate prices unchanged with the opening of its September order book, according to a letter to customers dated Tuesday, Aug. 6.