Analysis

August 8, 2024

US steel imports tumble in June

Written by Brett Linton

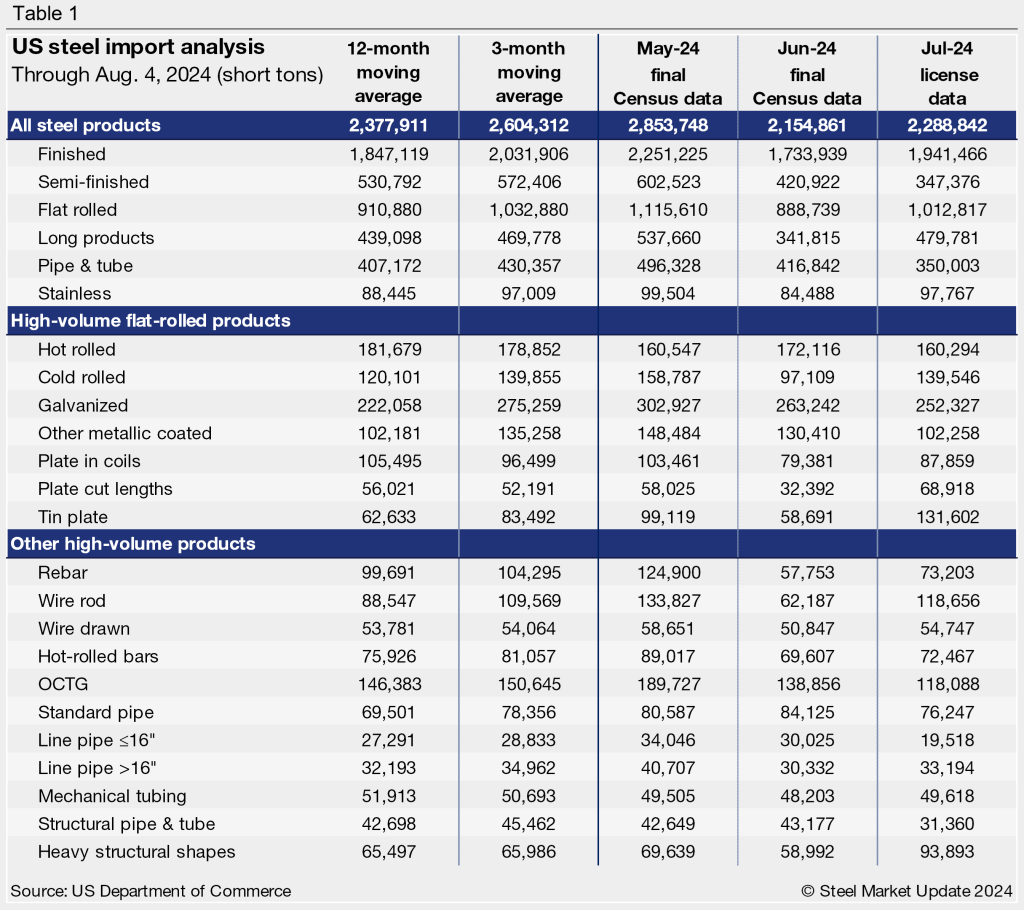

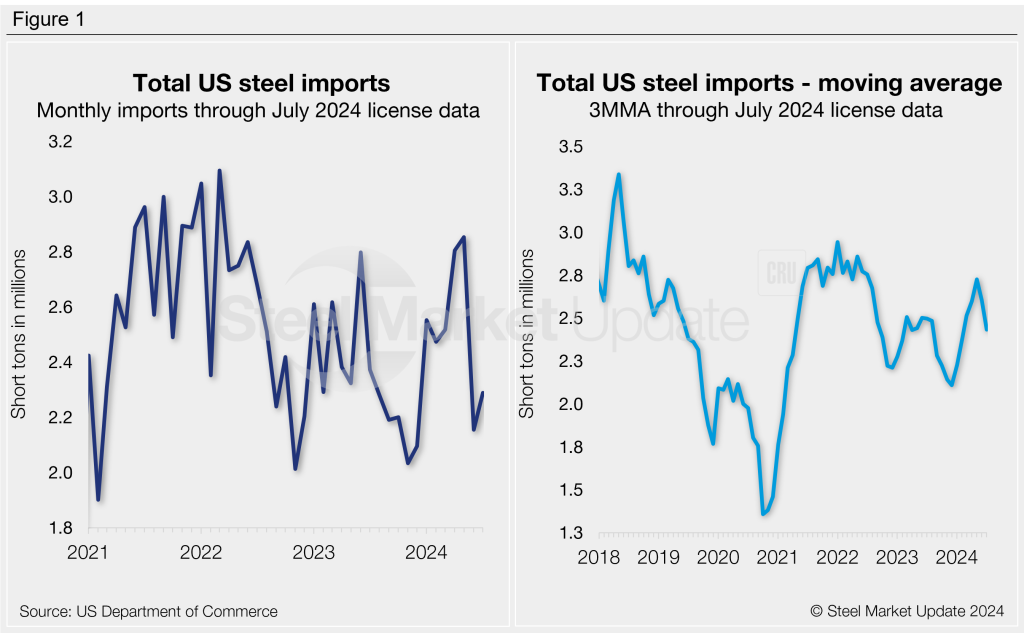

June steel import data was finalized at 2.15 million short tons (st) this week, down 24% from May according to the latest US Commerce Department release. June represents the lowest monthly import rate seen this year. July import licenses now tally up to 2.29 million st as of Aug. 4, potentially recovering 6% from June.

Smoothing out the data

Looking at imports on a three-month moving average (3MMA) basis can smooth out the variability seen month-to-month. On a 3MMA basis, imports through final June data are at 2.60 million st. Recall that we saw a 22-month high 3MMA of 2.73 million st the previous month. The 3MMA is lower for July, now at 2.43 million st.

Semi-finished vs. finished breakdown

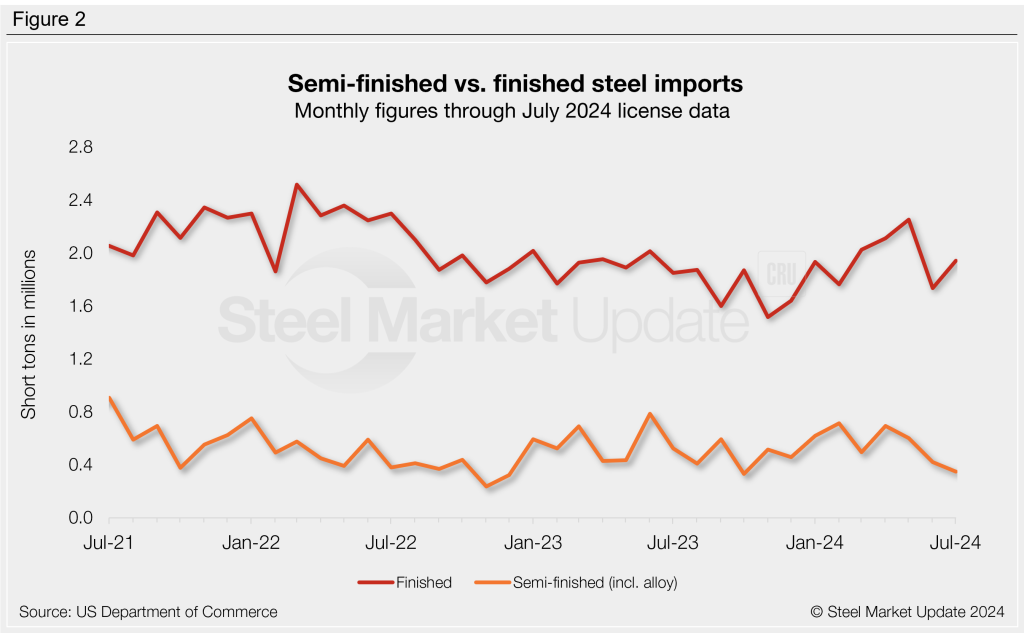

Imports of semi-finished steel fell 30% from May to June to an eight-month low of 421,000 st. July licenses currently total 347,000 st, down another 17% from June. For reference, semi-finished imports averaged 524,000 st per month last year. Thus far, 2024 has seen a monthly average of 555,000 st through July figures.

Meanwhile, June finished steel imports totaled 1.73 million st, a 23% decline from May’s 22-month high. The latest finished import tally through July has rebounded 12% to 1.94 million st. Finished imports averaged 1.83 million st per month in 2023, whereas the monthly average for the first seven months of 2024 now stands at 1.97 million st.

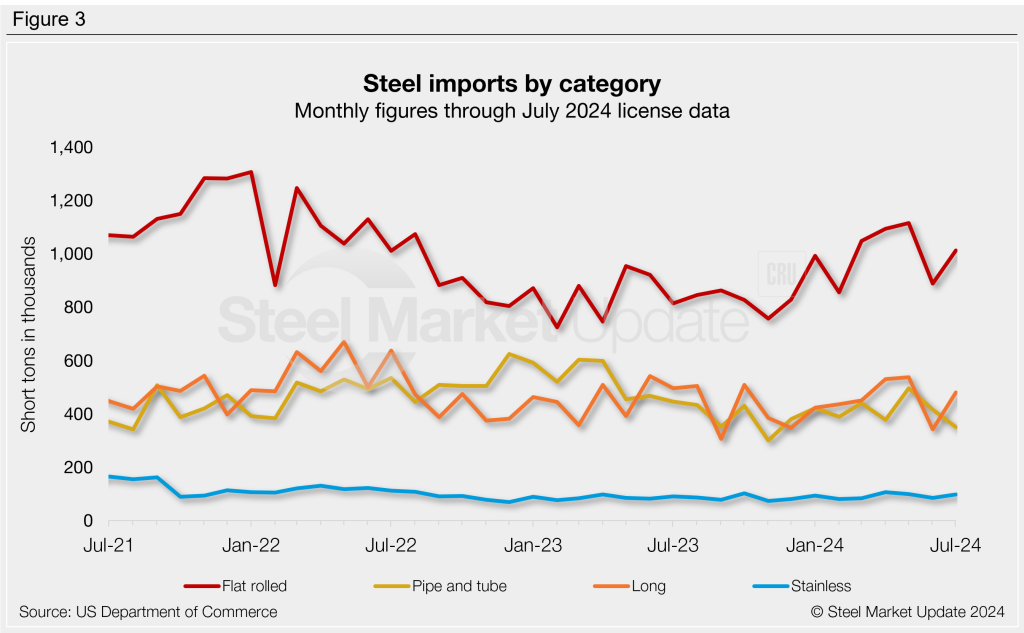

Imports by category

Figure 3 graphs monthly imports by product category. June flat-rolled steel imports are down 20% from May’s 23-month high to 888,000 st. July license data shows a potential recovery of 14%.

Imports of long products tumbled 36% in June to a 9-month low of 342,000 st. (This follows an 11-month high seen one month prior.) July licenses currently show a complete reversal, rising 40% to 480,000 st.

Pipe and tube imports fell 16% in June to 417,000 st. Licenses are down another 17% in July, potentially an eight-month low.

Stainless imports fell 15% from May to June to 84,000 st, easing further from the 20-month high seen in April. July stainless projections are currently 16% higher than June at 98,000 st.

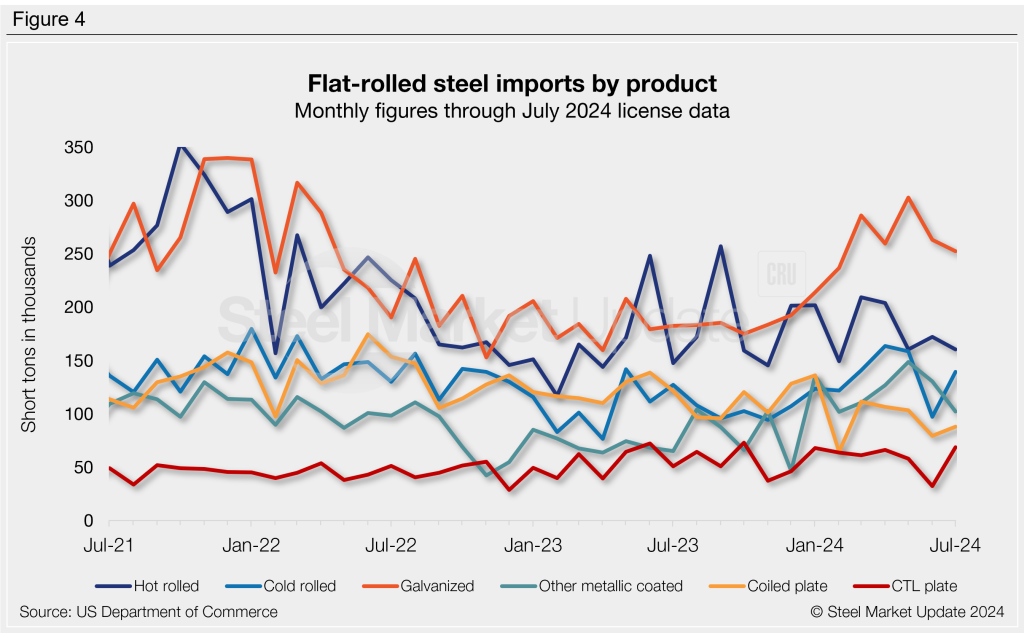

Flat-rolled imports

Figure 4 shows flat rolled imports by popular products. Imports eased for all but one material from May to June. The largest monthly decline was seen in cut-to-length plate (-44%), followed by tin plate (-41%), cold rolled (-39%), plate in coils (-23%), and galvanized (-13%).

July licenses are mixed across the products we track; current data indicates significant swings in tin plate (+124%), cut-to-length plate (+112%), and Galvalume (-21%).

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products. Explore this steel trade data deeper on the Steel Imports page of our website.