Apparent steel supply remains strong through September

Apparent steel supply rose to 8.64 million short tons in September, driven primarily by higher domestic mill shipments despite a sharp drop in finished imports.

Apparent steel supply rose to 8.64 million short tons in September, driven primarily by higher domestic mill shipments despite a sharp drop in finished imports.

Sheet prices mostly ticked higher again this week. And the reasons shouldn’t come as a big surprise to anyone who has been reading SMU lately.

In this Premium analysis we examine North American oil and natural gas prices, drill rig activity, and crude oil stock levels through December

Following last week’s pause, SMU’s price indices were overall steady to higher this week, holding at or near multi-month highs.

US shipments of heating and cooling equipment fell 11% in October from September to the lowest monthly rate of the year, and an eight-year low, according to AHRI.

There are few firm predictions about the January scrap market in North America at mid-month except to say it will be stronger. The question is by how much?

Following August’s modest 4% uptick, the volume of steel shipped outside of the country slipped 8% in September to 594,000 short tons, according to recently released data from the US Department of Commerce.

Register for Steel 101, space is limited. Don’t miss it! Did you know one of Hollywood’s favorite set locations is also the site of SMU’s next Steel 101 workshop? The workshop is an excellent way to build a solid foundation of steel knowledge or sharpen your existing understanding. Join us on location at the Nucor CSI facility in Ontario, California, on Jan. 13-14, 2026. Attendees […]

Flat rolled = 50.6 shipping days of supply Plate = 52.8 shipping days of supply Flat rolled US service centers’ flat-rolled steel supply declined for the fourth straight month, reaching 50.6 shipping days of supply on an adjusted basis at the end of November, according to SMU data. Flat roll supply is at its lowest […]

Canadian steelmaker Algoma's plans to bring forward the scheduled full transition to electric-arc furnace (EAF) steel production by one year merits a revisit. Why? Because of its potential impact on ferrous scrap flows between the US and Canada.

In our opinion, it is striking that for all the bold talk about establishing a "common external tariff" — or "Fortress North America" — the solutions being proposed fail to live up to their promises. As we have commented recently, USMCA certainly needs a rethink. But we have serious concerns about Canadian and Mexican proposals that suggest common trade policies that are, as we see it, more illusory than effective.

According to recently finalized US Commerce Department data, US steel imports tumbled to a near five-year low in September

US plate market participants hope the new year will bring favorable market conditions. But they remain leery of making big purchases because of lingering uncertainty.

The latest SMU’s Steel Buyers’ Sentiment Indices showed mixed results.

A cluster of Airbus announcements reveals how quickly the OEM is tightening and rebalancing its US supply chain.

US longs prices diverged in early December, with rebar and structurals prices rising on data center demand while wire rod remained flat, as domestic mills balanced the market. Import volumes, in November, declined sharply across all longs.

SMU’s latest steel buyers market survey results are now available on our website to all premium members.

There was a palpable sense of optimism among folks at the HARDI conference about demand from data centers. In other words, around the physical infrastructure – which also includes energy transmission - needed to feed the AI boom. The big question: Could demand from data and AI be far stronger than the market yet realizes?

After another eventful week in the steel market comes to a close, one of the most interesting developments has been timing.

Steel mill lead times held relatively steady this week on both sheet and plate products, according to responses from SMU’s latest market survey.

Participants in the domestic coil market hope producer price increases indicate strong market conditions entering the new year.

Less than half of the steel buyers who responded to our market survey this week reported that domestic mills are willing to talk price on new spot orders

The pig iron market in Brazil has moved up since our last report for US-bound cargoes.

Members of Mexico’s lower house have approved a plan to impose levies of between 5% and 50% on imports of 1,463 categories of goods from countries lacking a trade agreement with Mexico.

The price spread between hot-rolled coil and prime scrap has widened for the third consecutive month in December, based on SMU’s most recent pricing data.

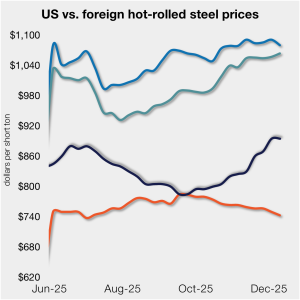

The price gap between stateside hot band and landed offshore product continues to narrow toward parity, now at its lowest level in five months.

Let's take a look inside the last SMU Scrap Survey of 2025.

SMU’s sheet and plate prices took a breather this week, holding relatively steady at multi-month highs.

SMU’s Current and Future Sentiment Indices for scrap increased this month, according to the latest data from our ferrous scrap survey.

SMU’s December ferrous scrap market survey results are now available on our website to all premium members.