Drill rig activity stabilizes in US and Canada

Oil and gas drill rig activity in the US inched lower last week while holding steady in Canada, according to the latest report from oilfield services provider Baker Hughes.

Oil and gas drill rig activity in the US inched lower last week while holding steady in Canada, according to the latest report from oilfield services provider Baker Hughes.

Chinese steel export prices decreased for the eleventh week in a row, with all steel products recording losses of 2-3.7% compared to the previous week.

The front end of CME hot-rolled (HR) coil steel futures contracts had drifted lower when this article was filed on Thursday afternoon. And the back end of 2024 had also come under pressure. Despite staging a late-month rally at the end of July back into the low $700s per short ton (st) range, the lead […]

Three out of four of our market survey respondents report that steel mills are open to negotiating new order prices this week, a slight decline compared to our previous market check.

Steel buyers continue to report short mill lead times for both sheet and plate products, according to SMU's latest canvass of the market. Lead times for hot-rolled and plate products marginally increased from our late July survey, likely due to limited restocking in anticipation of upcoming mill outages for scheduled maintenance.

This Premium analysis covers North American oil and natural gas prices, drilling rig activity, and crude oil stock levels. Trends in energy prices and rig counts are an advanced indicator of demand for oil country tubular goods (OCTG), line pipe, and other steel products.

New York state’s manufacturing activity improved in August but remained in contraction territory, according to the latest Empire State Manufacturing Survey from the Federal Reserve Bank of New York.

North American auto assemblies slumped by more than 14% from June, falling to a 20-month low in July. Assemblies were also down 1.5% year on year (y/y), according to LMC Automotive data.

US light-vehicle (LV) sales slipped to an unadjusted 1.273 million units in July, down 2% vs. a year-ago, the US Bureau of Economic Analysis (BEA) reported. The year-on-year (y/y) decline in domestic LV sales came despite a 4.2% month-on-month (m/m) rise.

Italian mill equipment provider Danieli announced a Mexican company has ordered two electric-resistance welded (ERW) tube mills from Danieli Centro Tubes.

Altos Hornos de México (AHMSA) announced it is entering the third stage of bankruptcy.

Canada’s steel and aluminum industries joined forces to call on the government for the imposition of tariffs on steel, aluminum, and electric vehicles.

I asked in a prior Final Thoughts where some of you thought Nucor’s weekly spot HR price would land. One opinion: $720 per short ton (st). That would allow the Charlotte, N.C.-based steelmaker to one up competitor Cleveland-Cliffs and to re-establish its position as a market leader.

Total US steel exports declined again in June, down 2% month-on-month (m/m) to 773,000 short tons (st) according to the latest US Department of Commerce data.

CRU Principal Analyst Henry Hao discusses China's recently reconfigured policy agenda, which could have significant implications for the global commodity markets.

US drill rig activity recovered last week after slipping the prior week, according to the latest data from Baker Hughes. But Canada’s counts edged down following a five-week run-up. Despite the decline, Canada’s rig count remains near a five-month high. US rigs In the week ended Aug. 9, the number of active drilling rigs in […]

Another month for hot-rolled (HR) coil, and another disappointing one for the bulls. They are still holding onto hope that the bottom is here and still pointing to an imminent uptick in HR prices.

The company is in the process of being acquired by Cleveland-Cliffs in a deal valued at USD$2.5 billion.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

The construction sector added 25,000 jobs in July, driven by improved wage gains according to the Associated General Contractors of America (AGC).

Following an uptick in mid-July, SMU’s Steel Buyers’ Sentiment Indices both eased this week. Current Buyers Sentiment has been see-sawing for the past few months, now back down to one of the lowest readings recorded since August 2020.

US drill rig activity resumed its downward trend last week according to the latest data from Baker Hughes. Meanwhile Canadian counts ticked higher for the fifth consecutive week. They now stand near a five-month high.

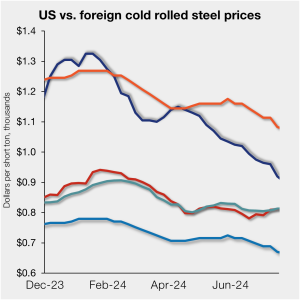

The price gap between US cold-rolled (CR) coil and imported CR tightened marginally after falling to a 10-month low in late July.

Long seen as being dominated by iron ore operations in Western Australia, diversified miner Rio Tinto is at an inflection point in its growth, according to CEO Jakob Stausholm, who referred to a step change from its aluminium business and consistent iron ore production at Pilbara. “We have considerable growth in cash flow from the […]

A roundup of CRU aluminum news from the past week.

Cleveland-Cliffs and Nucor each raised their respective hot-rolled coil (HRC) prices this week. Since last Wednesday’s settlement, the Midwest HRC futures curve has rallied as much as $63 in the September future.

ArcelorMittal’s earnings fell precipitously from a year earlier as the company said current market conditions are unsustainable.

Buyers continue to report very short mill lead times on sheet and plate products, according to our latest market canvass of steel service center and manufacturer executives

Steel buyers of sheet products say mills are still flexible on spot pricing this week, though less so than two weeks prior, according to our most recent survey data.

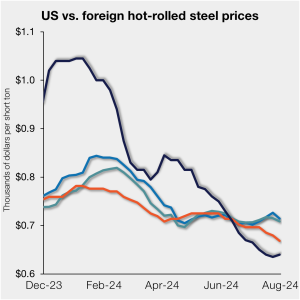

The premium between US hot-rolled (HR) coil and offshore hot band prices narrowed this week as it appears domestic tags might have reached a bottom.