Market Segment

April 23, 2019

SDI Finishes Challenging First Quarter with Optimism

Written by Sandy Williams

“A somewhat challenging flat-rolled price environment” is how Steel Dynamics CEO Mark Millett described the first quarter of 2019.

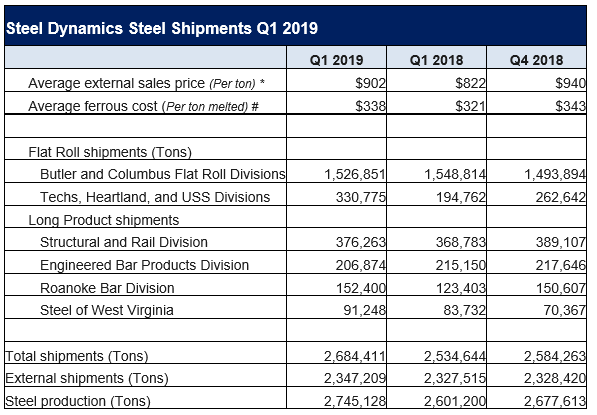

SDI posted net income of $204 million in the first quarter and sales of $2.8 billion. Lower steel prices impacted sales resulting in 3.0 percent decline sequentially. Operating income for the company’s steel operations fell 22 percent from the fourth quarter to $312 million resulting in metal spread compression. Average sales price for the quarter decreased $38 per ton to $901, while average scrap cost consumed decreased just $5 per ton.

“Flat-rolled steel prices began a downward trend in the second half of 2018, which continued through mid-first quarter reaching an inflection point in February,” said Millett. “As prices softened, buyers remain on the sideline, yet our teams were able to increase flat roll shipments to help offset some of the margin compression.”

“The continued stabilization and improvement in flat roll steel prices are having a positive impact, resulting in increased flat roll order activity and solid order backlogs. We are seeing continued strength in the automotive, energy and industrial sectors, and as evidenced by strong steel fabrication backlogs and strength in non-residential construction.”

Lead times for hot rolled coil are “very, very healthy,” said Millett, and lead times are 6-8 weeks for coated and pre-paint.

Flat rolled shipments rose 6.5 percent to 1.85 million tons and long product shipments increased 4.5 percent to 827,000 tons. Total shipments rose 5.9 percent to 2.68 million tons year-over-year. The breakdown by flat product for the first quarter was 854,000 tons of hot-rolled and pickled & oiled shipments, 137,000 tons of cold rolled, and 867,000 tons of coated shipments.

CFO Theresa Wagler reported that estimated annual shipping capacity is now over 13 million tons, comprised of 8.5 million tons of flat-rolled steel and 4.5 million tons of long products. The company also has 4.5 million tons of annual flat roll steel coating capability that will increase to 5 million tons once the third galvanizing line is running at Columbus in mid-2020.

SDI plans to invest another $90 million at Columbus to increase its range of complex grade capabilities. The upgrades will reduce shipments of non-coated flat rolled steel to the southern U.S. by about 400,000 tons by 2021—just in time for SDI’s new steel mill to begin operating in the Southwest to fill the void.

Steel Dynamics has narrowed the choice for its new flat rolled steel mill to either Texas or Louisiana. The $1.8 billion EAF mill will have an annual production capacity of 3 million tons and include a 450,000 ton galvanizing line and 250,000 ton paint line with Galvalume capability. (See related story in this issue).

Said Millett, “The mill will provide a significant freight cost savings and delivery time advantage to many customers in the U.S. and Mexican regions. This will provide a competitive supply chain allowing the new mill to effectively compete with imports flowing into Houston and the West Coast that have inherently long lead times and speculative price risk. Customers are excited and have already expressed interest in possibly locating facilities on or near our site.”

On the trade front, Millett says progress is being made in China and for the North American trade agreement. SDI expects the Section 232 tariffs on Mexico and Canada to be lifted and replaced with quotas based on historical levels of imports with a tariff for any additional amounts.

Section 301 measures on pre-fabricated imports are showing promise. Large projects that were expected to use Chinese steel are being rebid, said Millett. “I think that’s a very, very positive sign for our long products metal market in general,” he said.

When asked about scrap pricing, Russ Rinn, executive vice president of Metals Recycling, said a tepid export market is the reason why scrap has remained moderate despite higher steel prices and demand.

Scrap is staying on the coast making it a higher supply than it has been in a decade or so, said Rinn. “When there is excess scrap hanging around, it’s all chasing a smaller market because they like exports.”

Electrodes are contributing heavily to input costs compared to a year ago, increasing nearly $20 million quarter-over-quarter, said Wagler.