Product

January 11, 2013

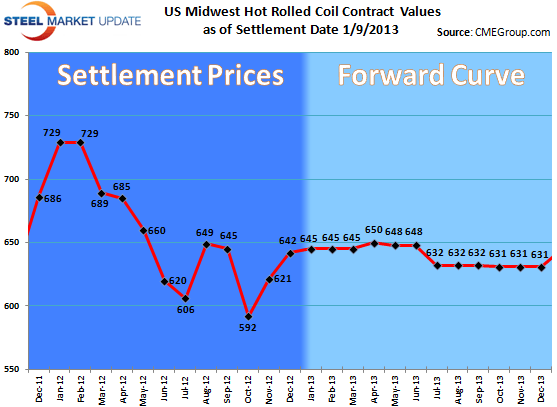

Hot Rolled Futures Begin To Buckle…

Written by Bradley Clark

Written by Brad Clark, Director of Steel Trading, Kataman Metals

Settlement prices retreated this week on the CME U.S. Midwest Hot Rolled futures contract as the expected New Year’s jubilation never materialized.

Volumes the past week surged as traders placed their bets for a breakout of the recent sideways trading range the market has experienced over the past couple of months. Over 20,000 tons of futures have traded focused mainly on the Q1. The trade levels ranged from 645-655 with the bulk of the volume going through at 650. While the majority of this volume took place at the beginning of the week as the days went by we are now seeing levels come down as it seems the bears have won this battle in the short term. With domestic scrap prices uncharacteristically flat in January and without the pent up demand many thought would materialize after the new year and resolution of the fiscal cliff, HRC futures are softening.

On a macro point China’s steel industry is on a mini tear as domestic prices in Asia are rising on the back of renewed hope that China’s economy is set to rebound in the coming year. Restocking of iron ore has been prevalent sending the raw material price through the roof over the past few weeks before taking a small breather this week. In the US — now that the fiscal cliff hysteria has subsided — all eyes have turned to the looming debt ceiling crisis, another psychological impediment preventing a ‘return to business as usual’ for many companies.

While volumes have picked up this past week, it appears some traders are taking risk off the table as open interest is down from last year’s average range of 11,000-13,000 lots.

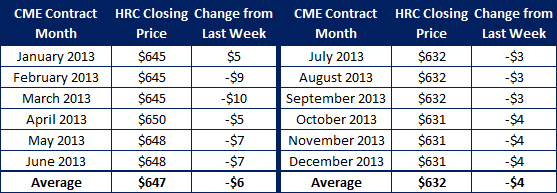

Below is a table with yesterday’s HRC futures settlement prices on the CME contract for each individual month through Q2 2013 as of 1/9/2013 close:

OPEN INTEREST: 9,513 lots (1 lot = 20 short tons)