Product

January 16, 2013

SMU Price Ranges & Indices: Top End of Our Range Erosion

Written by John Packard

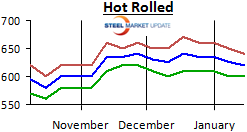

Flat rolled steel prices continued to drift slightly lower as buyers reported a tighter range than what we had seen one week ago. The top end of the range for all of the items declined between $10 and $20 per ton this past week. The net result being our averages adjusted lower by $5 to $10 per ton depending on the product.

Hot Rolled Coil: SMU Range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average has adjusted lower by $5 per ton compared to one week ago. The trend for HR continues to be “Neutral” which essentially means there is no clear cut direction associated with this market. The market is close to making a move below $600 per ton which could change the psychology of the market and push prices lower. Before that happens, the domestic mills may attempt to raise prices in order to prevent a wholesale decline from here. We discuss our reasons for keeping SMU Price Momentum at Neutral as opposed to moving it to Lower in the article below.

Hot Rolled Coil: SMU Range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average has adjusted lower by $5 per ton compared to one week ago. The trend for HR continues to be “Neutral” which essentially means there is no clear cut direction associated with this market. The market is close to making a move below $600 per ton which could change the psychology of the market and push prices lower. Before that happens, the domestic mills may attempt to raise prices in order to prevent a wholesale decline from here. We discuss our reasons for keeping SMU Price Momentum at Neutral as opposed to moving it to Lower in the article below.

Hot Rolled Lead Times: 3-5 weeks

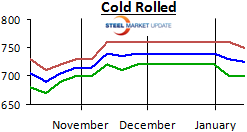

Cold Rolled Coil: SMU Range is $700-$750 per ton ($35.00/cwt-$37.50/cwt) with an average of $725 per ton ($36.25/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average adjusted lower by $5 per ton. The trend for CR is Neutral as the market searches for direction (see HR discussion above).

Cold Rolled Coil: SMU Range is $700-$750 per ton ($35.00/cwt-$37.50/cwt) with an average of $725 per ton ($36.25/cwt) fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $10 per ton compared to one week ago. Our average adjusted lower by $5 per ton. The trend for CR is Neutral as the market searches for direction (see HR discussion above).

Cold Rolled Lead Times: 4-7 weeks

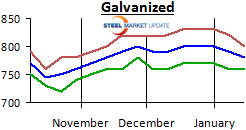

Galvanized Coil: MU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $20 per ton compared to one week ago. Our average is now $10 per ton less than one week ago. The trend is Neutral for galvanized which, like hot rolled and cold rolled, searches for market direction from here.

Galvanized Coil: MU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $20 per ton compared to one week ago. Our average is now $10 per ton less than one week ago. The trend is Neutral for galvanized which, like hot rolled and cold rolled, searches for market direction from here.

Galvanized .060” G90 Benchmark: SMU Range is $760-$8.0 with an average of $780 per ton.

Galvanized Lead Times: 4-7 weeks

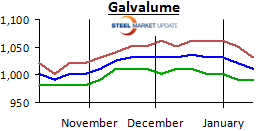

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $20 per ton compared to one week ago. Our Galvalume average is now $10 per ton less than at this time one week ago. The trend is Neutral for Galvalume much like all the other flat rolled products as the market searches for direction from here.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt with an average of $36.00/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained intact while the upper end of our range moved lower by $20 per ton compared to one week ago. Our Galvalume average is now $10 per ton less than at this time one week ago. The trend is Neutral for Galvalume much like all the other flat rolled products as the market searches for direction from here.

Galvalume .0142” AZ50 Grade 80 Benchmark: SMU Range is $991-$1031 per ton with an average of $1011 per ton.

Galvalume Lead Times: 4-7 weeks.