Product

February 20, 2013

U.S. Service Centers Improve Flat Rolled Inventories to 2.5 Months (SA)

Written by John Packard

U.S. service centers shipped 3,643,600 tons of steel products during the month of January, according to Metal Service Center Institute data released earlier today. Total shipments (all products) averaged 165,600 tons per day, down significantly from the 177,300 tons per day shipped during January 2012. Total tonnage shipped was down 2.1 percent on an actual basis but, when reviewed on a seasonally adjusted basis, the MSCI had it 6.9 percent lower than the prior year.

This is now the sixth consecutive month that year-over-year comparisons were less than the previous year (total tonnage shipped for the month vs. prior year).

Inventories stood at 8,736,200 tons (all products) an increase of 187,700 tons over December. Months on hand stood at 2.4 months on an unadjusted basis which is an improvement from the 3.4 months reported in December and on a seasonally adjusted basis 2.6 months vs. the revised December SA 2.7 months.

Carbon Flat Rolled

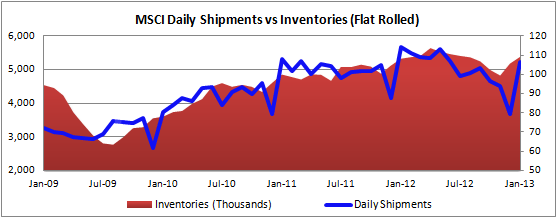

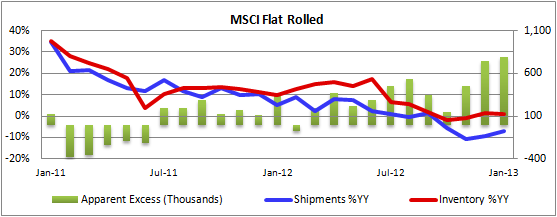

Flat rolled shipments totaled 2,336,400 tons, down 2.4 percent (actual) compared to one year ago on a daily shipment rate of 106,200 tons per day. This is down from 114,000 tons per day last January but well above the 79,300 tons per day shipped during the month of December.

Inventories stood at 5,380,800 tons an increase of 1 percent over January 2012. Months on hand stood at 2.3 months on a non-adjusted basis (down from 3.3 months in December) or 2.5 months on a seasonally adjusted basis (down from 2.6 months at the end of December SA).

Carbon Plate

Plate shipments totaled 379,200 tons or 17,200 tons per day. This is 2.8 percent lower than plate shipments during January 2012 (actual basis). The 17,200 tons per day is an improvement over the 13,300 tons reported for the month of December.

Inventories stood at 1,028,900 tons at the end of January which is actually lower than the 1,043,100 tons reported at the end of December. Inventories are up 1.9 percent compared to January 2012. Months on hand stood at 2.7 months on an unadjusted basis (an improvement over December’s 3.9) and 2.9 months on a seasonally adjusted basis (down from December’s 3.2 months).

Pipe & Tube

Pipe and tube shipments totaled 241,400 tons at 11,000 tons per day for the month of January. This is 600 tons per day less than January 2012 when the U.S. service centers shipped 11,600 tons per day.

Inventories stood at 707,700 tons which is down from 719,200 tons at the end of December. However, January inventories are 6.2 percent higher than January 2012 levels. Months on hand stood at 2.9 on an unadjusted basis (down from 4.1 months) and 3.2 months on a seasonally adjusted basis (down from 3.4 months).