Market Data

September 5, 2013

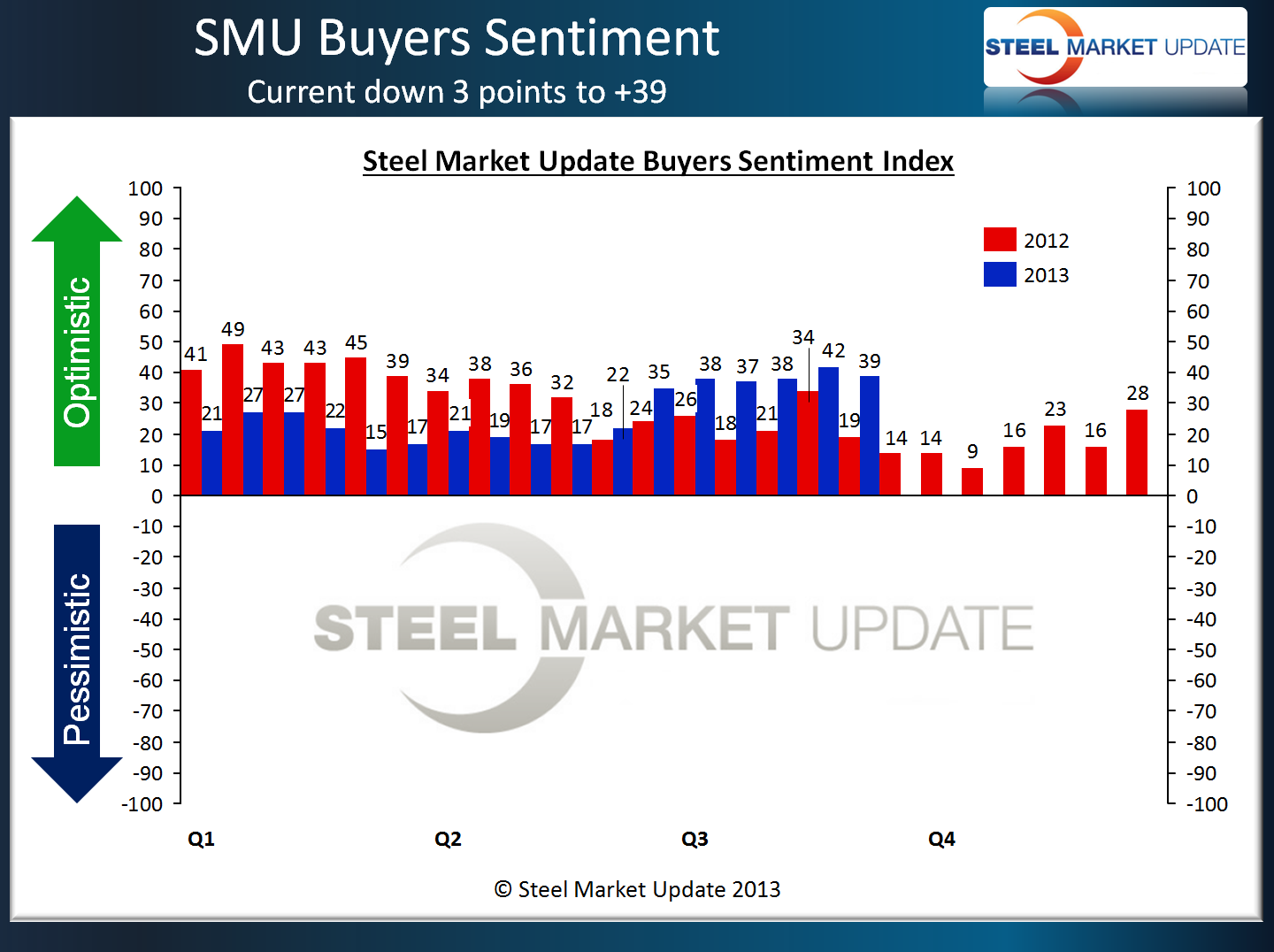

SMU Steel Buyers Sentiment Index at +39

Written by John Packard

Sentiment Continues to Trend Higher (more optimistic)

Steel Market Update (SMU) Steel Buyers Sentiment Index was measured earlier today at +40, down 3 points from the middle of August and well within the optimistic range for the index. Compared to one year ago buyers and sellers of flat rolled steel are feeling much better about their company’s ability to be successful in today’s market. Last September the SMU Steel Buyers Sentiment Index was measured at +19 and then dropped to a low point of +9 during the middle of October 2012. Since the end of May 2013, Sentiment has been trending higher indicating steel buyers and sellers continue to grow even more optimistic about their company’s ability to be successful in the current market environment.

The three month moving average (3MMA) is now +38.17 an improvement of +7 points when compared to the 3MMA recorded at the beginning of August. The new 3MMA is the highest we have recorded this year and the highest average since May 2012 when our 3MMA was +39.17 (and dropping).

Steel Market Update believes the rising trend in Sentiment is based on stable (at higher levels than earlier this year) flat rolled steel prices, rising spot prices increases the value of inventories bought prior to the increases, no flood of imports to date and stable to slightly higher demand levels across most industries.

SMU began measuring “Sentiment” in November 2008. Since that time the most pessimistic reading recorded was -85 in March 2009. The most optimistic was +49 in the middle of January 2012. During 2013, Sentiment was modest as we had readings in the high teens to +27 until the breakout which occurred in mid-June 2013 when we jumped to +35 and we have been trending higher ever since.

SMU Future Steel Buyers Sentiment Index Down 4 Points

During the SMU steel market survey process, where we invite more than 600 companies to participate and provide their input regarding pricing and market trends in the flat rolled steel markets, SMU Future Sentiment was measured at +45, down 4 points from two weeks ago but well above the +30 of one year ago. SMU Future Steel Buyers Sentiment Index records buyers and sellers of flat rolled steel opinions regarding their company’s ability to be successful three to six months into the future.

Comments Made During Survey Process

“USA is good but Canada is slower.” Manufacturing company.

“Margins are being crushed.” Service Center.

“We are developing new contractual agreements in light of the push away from CRU-based discounts that we think will allow us to be even more competitive in CY14.” Service Center.

“We are feeling a surge in the marketplace. Strong Ag, still waiting for recovery in commercial / industrial work.” Metal Building Company.

“Our business is down by 20% from 2012 on an annualized basis.” Manufacturing company.

“We will be entering into our busy season in the next 3-6 months,” Manufacturing company.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from + 10 to + 100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently we send invitations to slightly less than 660 North American companies to participate in our survey. Our normal response rate is approximately 120-170 companies. Of those responding to this week’s survey 52 percent were manufacturing companies (up from the previous survey’s 50 percent), 35 percent were service centers/distributors (down from 37 percent at the middle of August) and the balance was made up of steel mills, trading companies, toll processors and suppliers to the industry (such as paint companies).

Steel Market Update does canvass those being invited to participate in order to confirm their active participation in the flat rolled steel business. Our list is updated at least once per month and we are adding new companies on a continuous basis.