Market Data

March 27, 2014

Third Estimate of Q4 2013 Gross Domestic Product

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released their third estimate of real GDP today, (March 27th) for Q4 2013. The third is normally the final estimate though there sometimes are revisions further back in time. GDP rose in the fourth quarter by 2.6 percent at a seasonally adjusted annual rate, this was an upward revision from the second estimate of 2.4 percent, but still well below the advance estimate of 3.2 percent. For the year as a whole GDP rose by 2.59 percent to 15.942 trillion dollars (Chained 2009 dollars.)

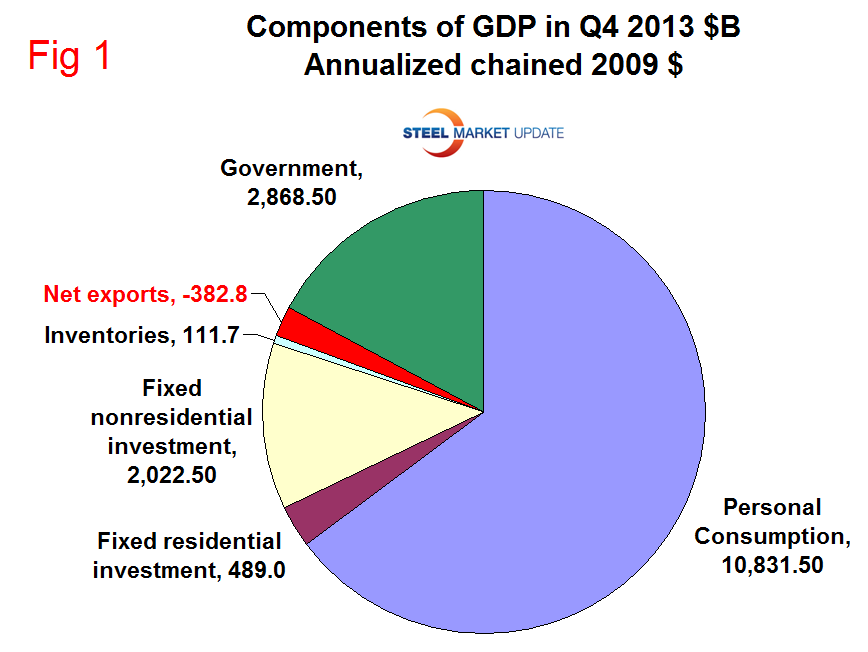

Personal consumption, the largest individual component of GDP rose by 2.22 percent, its best performance since Q4 2010. In Q4 personal consumption accounted for 67.94 percent of GDP (Figure 1). All other components contributed 0.38 percent meaning that they were more or less a wash. On the positive side next exports contributed 0.99 percent and government was the exact opposite with a negative contribution of 0.99 percent. Fixed residential, (housing) investment made a negative contribution of 0.26 percent, its first negative contribution since Q3 2010. Fixed nonresidential contributed 0.68 percent making 3 consecutive quarters of solid growth. Inventories which are the most volatile component of GDP broke even in the fourth quarter.

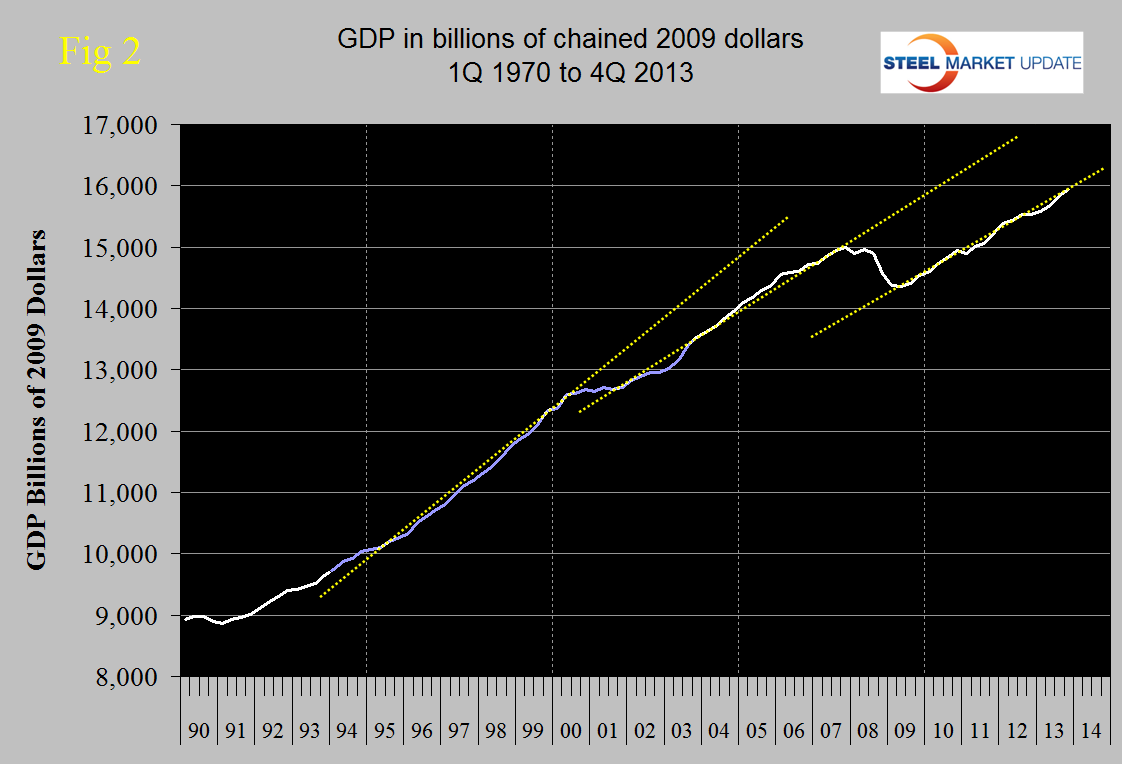

GDP is growing at about the same rate it did after the 2001 recession but slower than in the boom times of the late 1990s (Figure 2).

The first estimate of the first quarter of 2014’s economic growth will be released late next month. On March 24th the Associated Press reported: “The consensus of 48 economists surveyed by the National Association for Business Economics is that bad weather cut first-quarter growth to a weak annual rate of 1.9 percent, but that growth could exceed 3 percent by year’s end. NABE’s report, released Monday, covered a survey period from Feb. 19 through March 5. Its forecast for average US economic growth of 2.8 percent this year is better than the 2.5 percent rate they predicted in NABE’s December survey. Those surveyed expect consumer spending to increase 2.6 percent in 2014, not 2.4 percent, as hourly wage growth is forecast to rise faster than inflation. GDP is expected to grow an average of 3.1 percent in 2015. ‘‘Conditions in a variety of areas — including labor, consumer and housing markets — are expected to improve over the next two years, while inflation remains tame. The Fed has been buying bonds for the past several years with the aim of driving down long-term interest rates to stimulate spending and economic growth. Now that the economy is slowly but steadily improving, the Fed has been tapering off those purchases. At each of its last three policy meetings, including last week’s, the Fed cut bond purchases by $10 billion to the current pace of $55 billion a month. There are six meetings left in 2014. NABE president Jack Kleinhenz, said in a statement, “Given the stronger growth forecast, 57 percent of the economists surveyed believe the Federal Reserve will end its bond purchases in the fourth quarter, as the central bank has signaled it plans to do. Another quarter think it will happen before that, though 17 percent think the Fed will keep buying bonds into 2015. Fed chairwoman Janet Yellen said Wednesday that with the job market still weak, the central bank intends to keep short-term rates near zero for a ‘‘considerable’’ time and would raise them gradually. She also said the Fed wouldn’t be driven solely by the unemployment rate, which Yellen feels overstates the health of the job market and the economy. Yellen appeared to jolt investors last week when she tried to clarify the Fed’s timetable for raising the short-term rate. She suggested the Fed could start six months after it halts its monthly bond purchases. That would mean the rate could rise by mid-2015. A short-term rate increase would elevate borrowing costs and could hurt stock prices. Stocks fell after Yellen’s mention of six months.

Last week the Manufacturers Alliance for Productivity and Innovation (MAPI) released their latest quarterly economic forecast. Consumer spending and business investment should help increase U.S. economic growth in 2014 and 2015.

MAPI increased its forecast for U.S. gross domestic product (GDP) growth to 2.8 percent in 2014, up from its December 2013 prediction of 2.6 percent. The research organization maintained its GDP forecast of 3.2 percent for 2015. Manufacturing will grow faster than the overall U.S. economy, with increase 3.2 percent in 2014 and 4.0 percent in 2015. “The economic environment we expect for the next two years is for decently strong employment growth, a falling unemployment rate and relatively low inflation,” said MAPI Chief Economist Daniel J. Meckstroth. “The fastest growth in manufacturing will come from the rebound in the housing market. The fastest growth in the manufacturing sector will be among high-tech companies. High-tech manufacturing production, which accounts for about 5 percent of all manufacturing, is expected to grow 6.8 percent in 2014 and 7.2 percent in 2015. Production in non-high-tech manufacturing industries should increase by 2.9 percent in 2014 and 3.8 percent in 2015. Industrial equipment expenditures will advance 8.4 percent in 2014 and 10.9 percent in 2015. The outlook for spending on transportation equipment is for growth of 5.6 percent in 2014 and 4.1 percent in 2015. Spending on nonresidential structures is anticipated to improve by 3.5 percent in 2014 and 3.9 percent in 2015. Residential fixed investment is forecast to increase by double digits in both years, by 12.5 percent this year and an even more robust 18.8 percent in 2015.

MAPI expects manufacturers to add 356,000 jobs in 2014, or an average of nearly 30,000 a month. That is a substantial increase from the December forecast of 252,000 manufacturing jobs. However, MAPI now expects manufacturing to add 197,000 jobs in 2015, a decline from 256,000 jobs in the previous report.

Highlights from today’s BEA report read as follows:

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 2.6 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the “third” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 4.1 percent. The GDP estimate released today is based on more complete source data than were available for the “second” estimate issued last month. In the second estimate, the increase in real GDP was 2.4 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) was larger than previously estimated, while private investment in inventories and in intellectual property products were smaller than previously estimated.

The increase in real GDP in the fourth quarter primarily reflected positive contributions from PCE, exports, and nonresidential fixed investment that were partly offset by negative contributions from federal government spending and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. The deceleration in real GDP growth in the fourth quarter reflected a downturn in private inventory investment, a larger decrease in federal government spending, a downturn in residential fixed investment, and a deceleration in state and local government spending that were partly offset by accelerations in PCE and in exports, a deceleration in imports, and an acceleration in nonresidential fixed investment.

Real personal consumption expenditures increased 3.3 percent in the fourth quarter, compared with an increase of 2.0 percent in the third. Durable goods increased 2.8 percent, compared with an increase of 7.9 percent. Nondurable goods increased 2.9 percent, the same increase as in the third quarter. Services increased 3.5 percent in the fourth quarter, compared with an increase of 0.7 percent in the third.

Real nonresidential fixed investment increased 5.7 percent in the fourth quarter, compared with an increase of 4.8 percent in the third.

Real residential fixed investment decreased 7.9 percent, in contrast to an increase of 10.3 percent.

Real exports of goods and services increased 9.5 percent in the fourth quarter, compared with an increase of 3.9 percent in the third. Real imports of goods and services increased 1.5 percent, compared with an increase of 2.4 percent.

Real federal government consumption expenditures and gross investment decreased 12.8 percent in the fourth quarter, compared with a decrease of 1.5 percent in the third.

Quarterly GDP by Industry and State: The Bureau of Economic Analysis will be reporting U.S. quarterly GDP by industry beginning April 25. The release is due out at 8:30 a.m. EST. These reports will include data from the first quarter of 2005 to the fourth quarter of 2013. On August 20 at 8:30 a.m. EST, the BEA will release state-level GDP data on a quarterly basis for the first time. The release will cover the period from the first quarter of 2007 to the fourth quarter of 2013. Previously, these two reports were available only annually. The greater frequency means more timely data on each industry’s performance and contribution to U.S. growth. The data will be included in the Moody’s Analytics historical databases and be incorporated in forecasts.