Market Data

April 29, 2014

Consumer Confidence April 2014

Written by Peter Wright

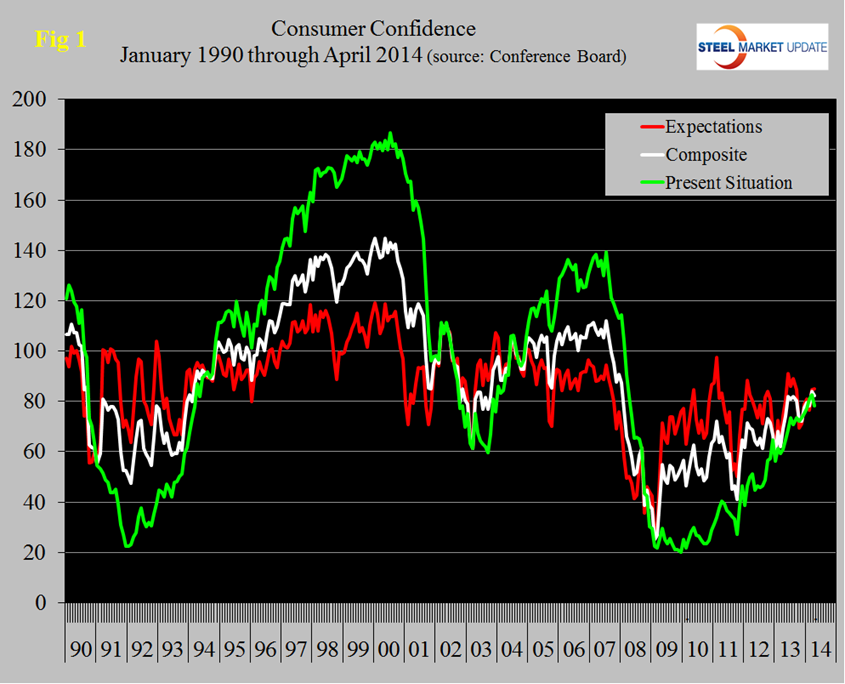

The consumer confidence index decreased by 1.6 in April driven by a decline of 4.2 in the present situation component and an increase of 0.1 in expectations. Job availability was the main drag, a surprising result since economists expect the April net job creation report to be strong when reported by the Bureau of Labor Statistics on Friday this week. The gradual improvement in consumer confidence has been a bumpy ride since mid-2009 and the three month moving average (3MMA) of both the present view and expectations components increased in April which caused the 3MMA of the composite to rise by 1.0 to 81.5 (Figure 1).

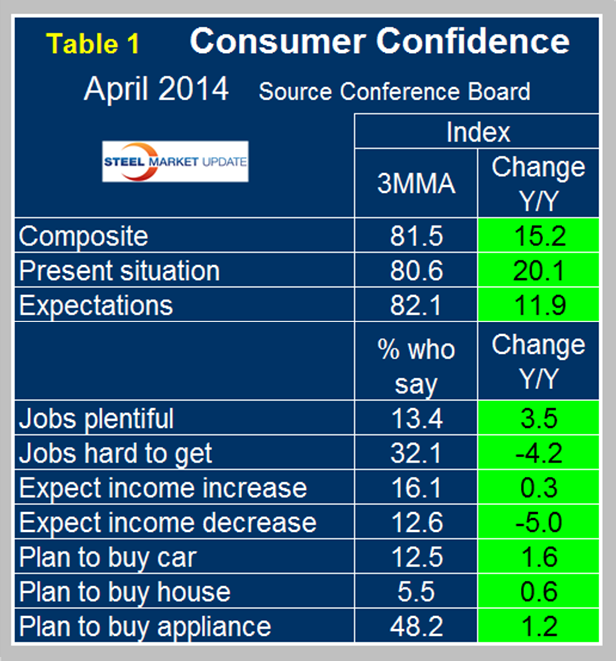

On a year over year basis using a 3MMA the composite is up by 15.2 led by consumers’ view of the present situation which is up by 20.1, (Table 1). All the sub-components in Table 1 are green. Year over year the consumers view of job opportunities is improving as are income expectations. Intentions for auto purchase are up year over year and the recent reported weakness in the housing market is not reflected in the Conference Board report for which the housing component has been more or less flat since August 2012. Table 1 shows a 0.6 percent increase in housing y/y but this is because the result for February last year was an outlier at 3.7 percent.

The official statement from the Conference Board read as follows:

The Conference Board Consumer Confidence Index Falls Slightly in April

The Conference Board Consumer Confidence Index, which had increased in March, declined slightly in April. The Index now stands at 82.3 (1985=100), down from 83.9 in March. The Present Situation Index decreased to 78.3 from 82.5, while the Expectations Index was virtually unchanged at 84.9 versus 84.8 in March.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was April 17.

“Consumer confidence declined slightly in April, as consumer’s assessed current business and labor market conditions less favorably than in March,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “However, their expectations regarding the short-term outlook for the economy and labor market held steady. Thus, while sentiment regarding current conditions may have slipped a bit, consumers do not foresee the economy, or the labor market, losing the momentum that has been building up over the past several months.”

Consumers’ appraisal of current conditions pulled back moderately in April. Those claiming business conditions are “good” edged down to 21.8 percent from 22.6 percent, while those claiming business conditions are “bad” rose to 24.4 percent from 23.5 percent. Consumers’ assessment of the labor market was also slightly more negative. Those stating jobs are “plentiful” declined to 12.9 percent from 13.8 percent, while those saying jobs are “hard to get” increased to 32.5 percent from 31.4 percent.

Consumers’ expectations held steady in April. The percentage of consumers expecting business conditions to improve over the next six months was unchanged at 17.4 percent, while those anticipating business conditions to worsen increased marginally to 10.3 percent from 10.1 percent. Consumers were slightly more optimistic about the outlook for the labor market. Those expecting more jobs in the months ahead increased to 15.0 percent from 14.1 percent, while those expecting fewer jobs edged up to 17.9 percent from 17.5 percent. The proportion of consumers anticipating their incomes to grow increased to 17.1 percent from 15.3 percent, but those expecting a drop in their incomes also increased, to 12.9 percent from 11.5 percent.

SMU Comment: Not for the first time we have a contrarian view of a nationally respected data set. The use of a 3MMA often gives an opposite view of a monthly data stream and this is one such case. Consumer confidence drives consumer spending which is the largest component of GDP. Steel consumption is a function of GDP though the steel component is much more volatile than the headline number. The first estimate of GDP growth for Q1 2014 will be released tomorrow, (Wednesday) and will be analyzed and reported in the Steel Market Update on Thursday. (Source: the Conference Board)