Prices

May 11, 2014

OCTG, Cold Rolled & Galvalume Import Numbers Troubling

Written by John Packard

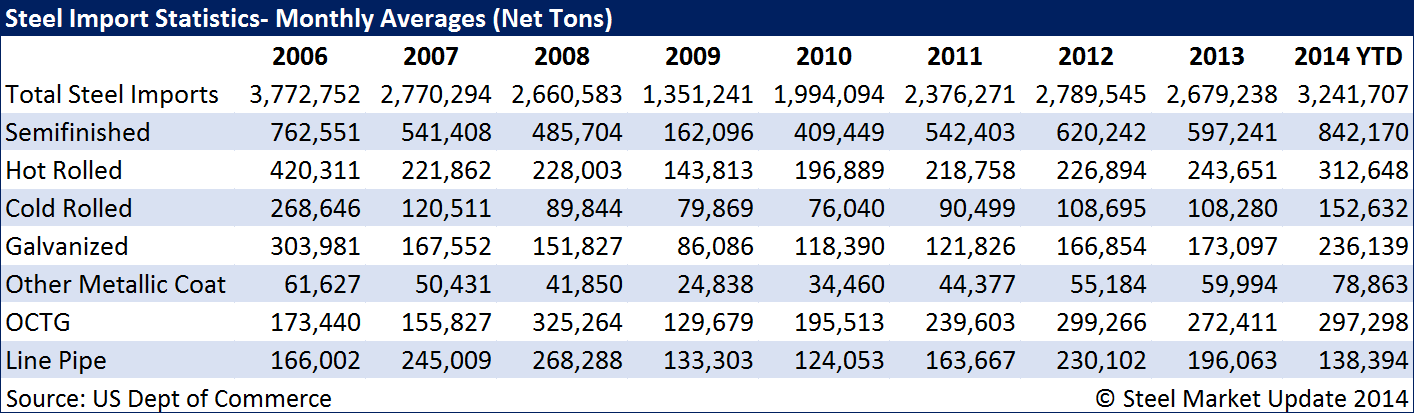

Steel Market Update watches foreign steel imports as closely as humanly possible as we look for trends to see how imported steel tonnages relate to past historical averages. We use a monthly average as opposed to a specific monthly number in order to smooth out the numbers and provide a clearer picture.

As you can see by the table below (2014 includes March final numbers but does not include April license data), semi-finished imports (which are mostly slabs) have exceeded 2006 levels and are 244,929 net tons higher this year than what we averaged during 2013. All numbers are shown as net tons (not metric tonnes).

We are seeing increases at high levels (2007-2013) on hot rolled, cold rolled, galvanized, other metallic and oil country tubular goods (OCTG). When compared to 2006 which was a strong year for the industry; slabs, other metallic (mostly Galvalume) and oil country tubular goods (OCTG) exceed the 2006 import levels.

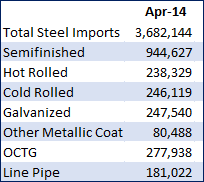

April 2014 tonnages – based on import license data (which can be suspect – but is useful as a tool until preliminary census data is released later this month) has slabs at even higher than the 2014 yearly average level.

Cold rolled is surging and getting close to the 2006 figure. The country causing the most recent surge is China which had been averaging 22,280 net tons per month over the past twelve months. During the month of April importers requested 101,750 net tons of Chinese CR licenses. The low $30’s delivered numbers we had seen being quoted over the past few months are now hitting the docks.

Also surging this year is “other metallic” most of which is Galvalume which continues to grow and is approaching 80,000 net tons of imports. The main exporting countries of note are: Taiwan with license requests of 24,000 net tons, South Korea with 18,700 net tons and China with 12,500 net tons.

The rhetoric is building at the domestic steel mills as they question foreign government subsidies as one of the main reasons for countries like China to be able to sell cold rolled into the United States at numbers approaching domestic hot rolled. Look for the mills to make a move and request relief from what they see as unfairly traded steel.