Distributors/Service Centers

January 29, 2015

SMU Analysis of Service Center Inventories, Spot Steel Prices

Written by John Packard

As we listen to the domestic steel mills earnings conference calls, one of the items we focus on is their viewpoint regarding service center inventories. One year ago the domestic mills were touting the lack of inventory as being one of the drivers of orders which was keeping flat rolled steel prices high. That tune has recently changed although there does not seem to be a clear consensus of opinion at the steel mills.

With the historically high rates of foreign steel imports, coupled with no slowdown in domestic steel mill production rates, the result has been higher inventories at the domestic service centers based on Steel Market Update analysis.

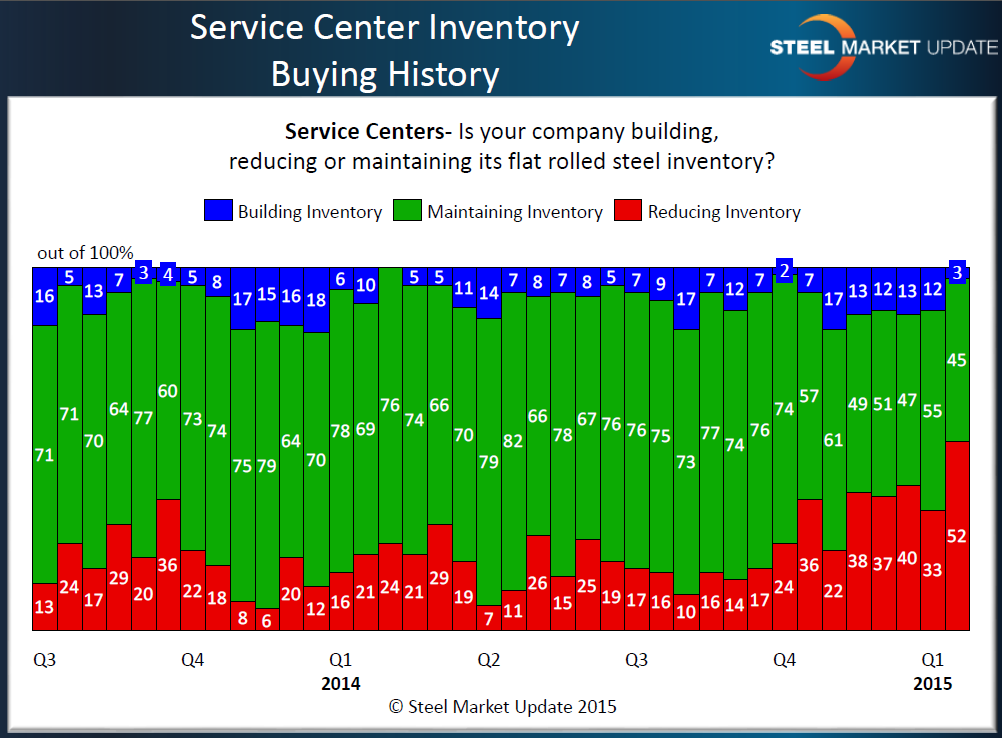

Last week Steel Market Update conducted one of our flat rolled steel market surveys. We asked both manufacturers and service centers whether they were reducing, building or maintaining inventory levels. What we discovered was the percentage of service centers moving into an inventory reduction mode had grown to 52 percent, up from 33 percent at the beginning of this month and well above the 24 percent recorded one year ago. Here is what that looks like on a historical basis (graphic taken from Power Point shared with our Premium level members):

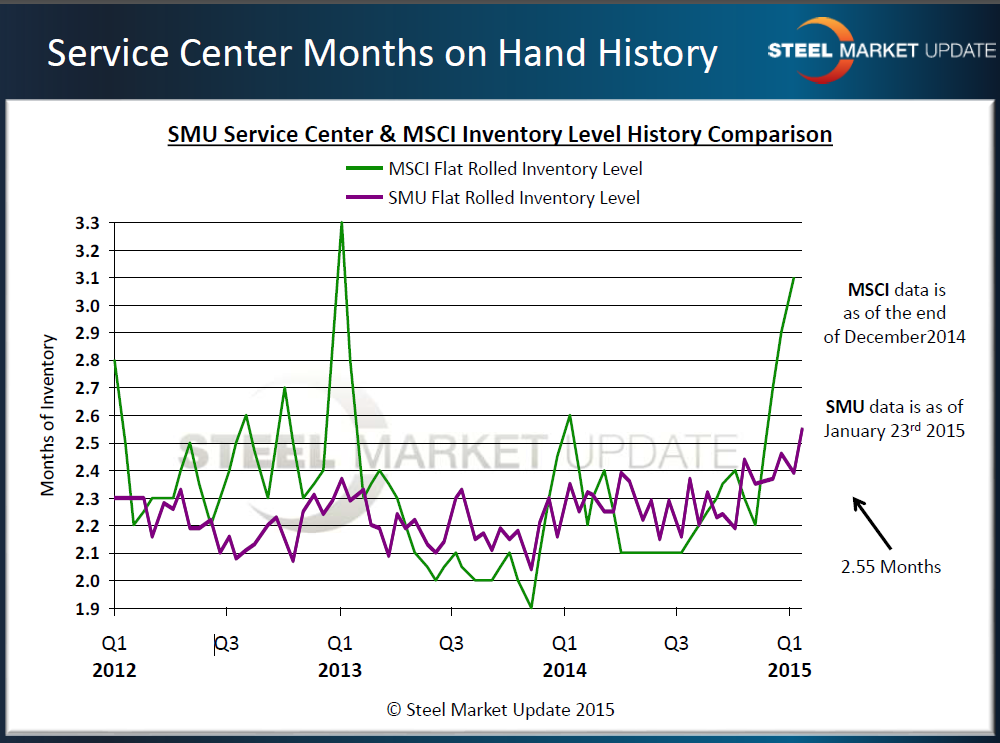

We also conducted an analysis of service center inventories based on the number of month’s supply on the service center floors. We saw a jump in our not seasonally adjusted number which went to 2.55 months, which is the highest level we have seen in our survey since we began asking the question of the distributors participating in our survey.

We would expect to see a similar jump in the MSCI numbers when they are released in mid-February.

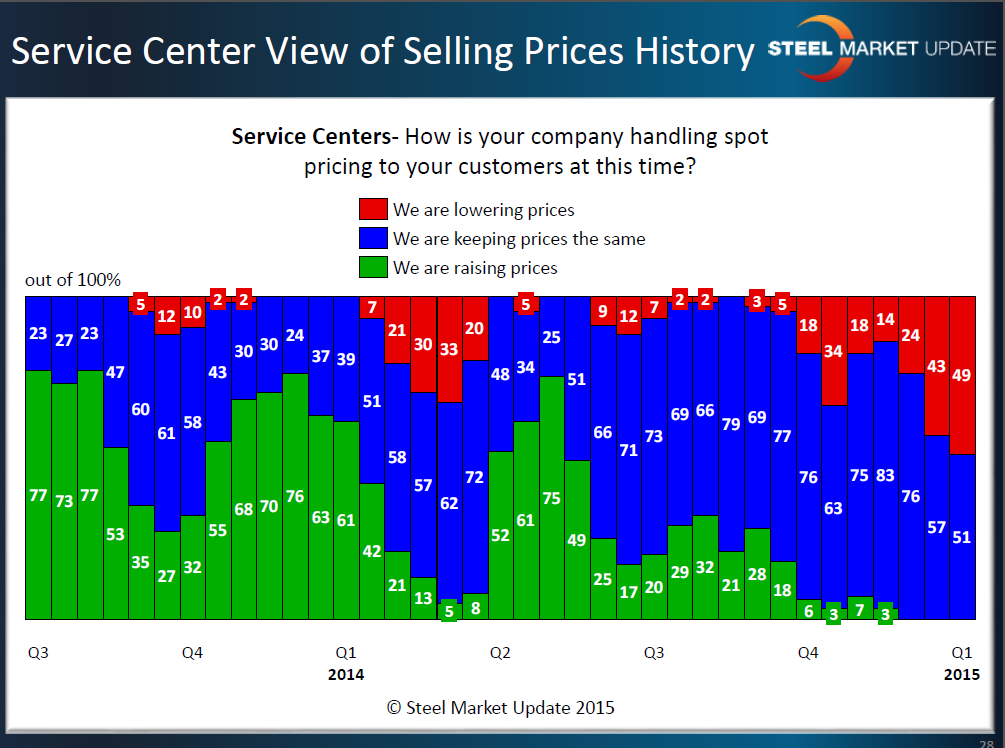

The net result of all of this is service centers are actively moving inventory at whatever price they believe is reasonable under the current market conditions. We have written a great deal on this topic in the past. SMU is of the opinion that the distributors are assisting in pushing prices lower but, they will reach a point of “capitulation” when virtually every service center is dumping their spot inventories. At the point when approximately 75 percent of the service centers are resigned to selling inventories at price levels that move lower on almost a daily basis, at that point the distributors will begin to accept the possibility of price increases (possibly resulting in price stability) out of the domestic mills.

A number of the steel mills spoke of prices nearing the bottom of the market as the spread between foreign and domestic pricing shrinks, making domestic steel more attractive. As the inventory over-hang is addressed (which was exacerbated by the unexpected crash of the energy markets) we should see service centers return to the domestic steel mills in order to replace steel which is currently being pushed onto the spot markets. SMU expects this to take another month to two months and could take longer if February and March import levels continue to be at the historical monthly highs we have seen in December and now, again, in January 2015.

SMU is watching our survey results very carefully. We will conduct our next flat rolled market analysis next week beginning on Monday morning when our invitations are released. If you are an active buyer of prime flat rolled steel and would like to participate in our survey please send us an email with your contact information, position and what kind of steels are purchased by your company. You can reach us at: info@SteelMarketUpdate.com.

The Power Point slides shown above are part of the survey results we share with our Premium Level members after each of our surveys are completed. If you would like information about upgrading to a Premium level membership please contact our office at: 800-432-3475 or by email: info@SteelMarketUpdate.com.